Yield Curve Flattening Means Sell Utilities & Buy Energy

Yield Curve Flattening

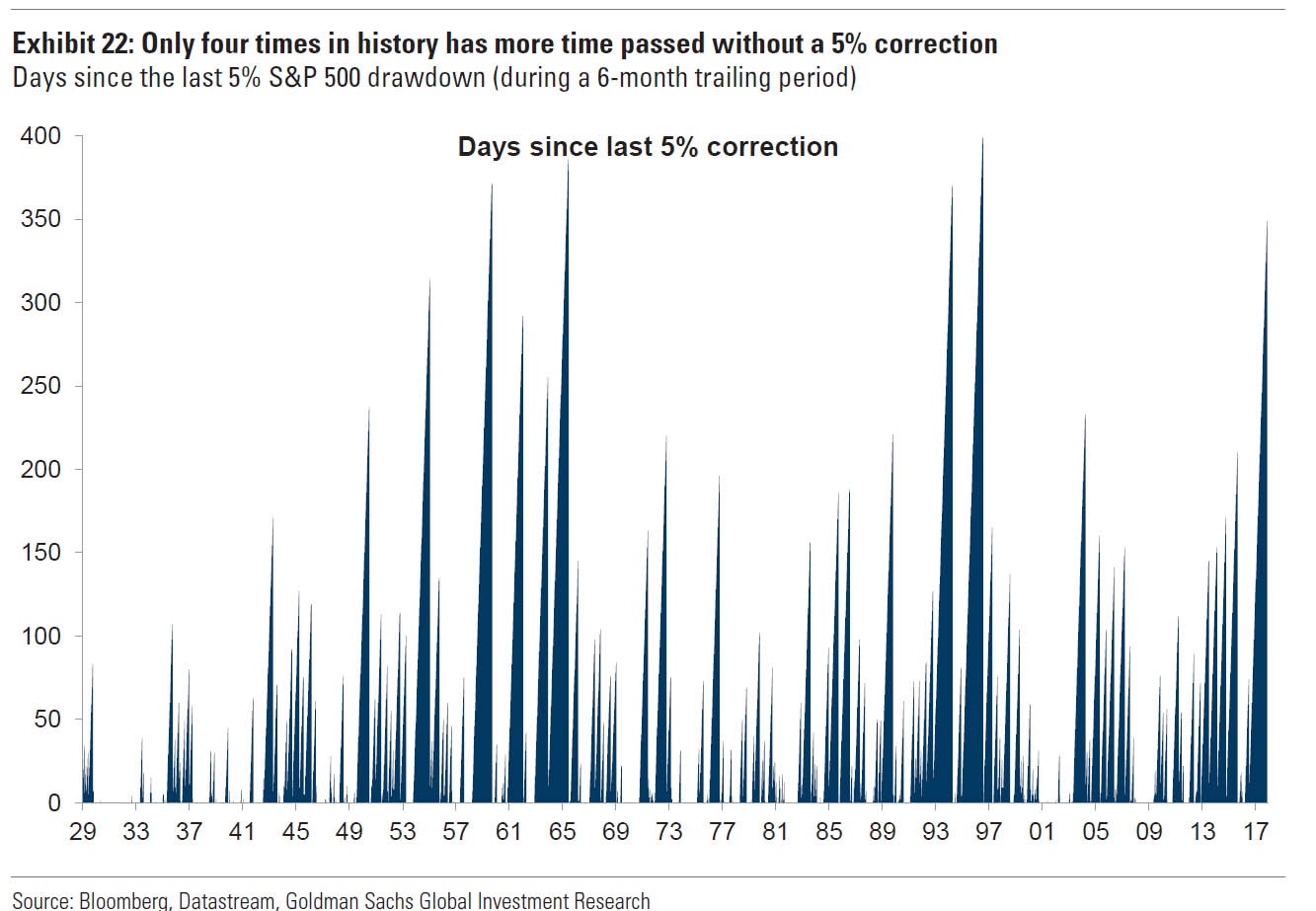

The biggest story in finance, besides the hyperbolic rise in bitcoin, is the flattening of the yield curve. It shouldn’t be a surprise that the yield curve is flattening because it generally flattens during expansions. The two reasons why it is a big story are because investors are hyper focused on when this bull market will end because it is closing in on becoming the longest one ever and because the yield curve has exited the one year period where it was stable. The sand time keeper that is the yield curve was temporarily turned on its head before the sand ran out. Besides the fact that this might be the longest economic expansion ever, the market is nearing the longest streak without a 5% correction; it already has the longest streak without a 3% correction. As you can see from the chart below, this market has had the 5th longest streak without a 5% selloff; in a few weeks, it will become the longest.

As I mentioned, the yield curve flattening is a big story. It’s helpful to see which assets have performed the best in this scenario to help us understand which assets will do the best in the next 12 months. The table below lays out the past few instances when the yield curve flattened from 100 basis points to an inversion. To be clear, that’s when the 10-year bond goes from having a 100 basis point higher yield than the 2-year bond yield to when the 2-year yield is higher than the 10-year yield. As you can see, the energy sector has had the best performance as it outperformed the S&P 500 83% of the time. However, it only has a median return performance of 5.0% which is lower than the 6.6% median return of the S&P 500. This chart’s best recommendation is to avoid the consumer discretionary sector and utilities. This price performance is likely because there is inflation at the end of cycles which is good for energy as oil prices rise, but bad for tech, consumer discretionary, and utilities.

The chart below gives an alternative view of which sectors do well in the period when the yield curve flattens. As you can see, the Brent oil price does the best while the telecoms and the consumer discretionary sector do the worst. Right on queue, the junk debt of telecom firms has been selling off in the past few months. That might be because of the business cycle or because there is pricing pressure in the industry. In the past 12 months, Verizon stock is down 6.77%, AT&T stock is down 12.29%, T-Mobile stock is up 14.19%, Sprint stock is down 21.76%, and CenturyLink is down 44.72%. That’s an average return of -14.27%. The Brent was $48.24 on November 28th, 2016 and now it’s at $63.72. Clearly, there is more to price performance than the business cycle, but these stats show stocks and commodities are acting in tune with the two charts in this article.

Bottom Up S&P 500 Earnings Update

Q4 is the most important quarter for the consumer discretionary sector as it includes the winter holidays. With that in mind, look at the chart below which shows earnings growth estimates within the retail sector. I’m more focused on the relative performance which is expected in Q4 than the recent few weeks of changes in estimates. Only the specialty store sub-industry had a notable change as expectations have fallen from expecting 3.6% growth to a 1.1% earnings decline. One of the major drivers of weakness in this sub-industry was the weakness in Signet Jewelers (SIG) which saw estimates fall from $4.53 to $4.00. The good news is this issue is company specific. The firm has had a world wind of issues hurting it in the past few quarters as there was sexual harassment allegations about management, worker discrimination issues, allegations that the firm was swapping returned diamonds for cheaper ones (when fixing them or augmenting them), and the biggest issue of all is the heightened default rates on loans given out to customers from the firm. This is the same issue the auto manufacturers are seeing. This is why banks should be giving out loans, not companies selling the product.

Ignoring those issues, the trends we’ve been seeing for several quarters have continued as millennials make their mark on the retail sector. Millennials love shopping online as they have been using the internet their whole lives unlike generation x or baby boomers. Millennials love to go to food distributors and food retailers because they are less likely to cook their own food as women are now focused on their careers more. Millennials also think of restaurants as an experience to share on social media. Restaurants are now the anchors of malls as stores like Macy’s have seen big declines in same-store sales. General retailers are the big losers to internet sales. The one aspect of this chart that doesn’t jive with the long-term trends is apparel retail growth. As you can see, the apparel retail earnings growth is expected to be 9.0% which is much higher than past quarters.

Because of the great earnings reports, the blended S&P 500 estimate for Q3 earnings growth ticked up another 0.1% to 6.3%. The revenue growth rate stayed the same at 5.8%. I said last week tech stocks had reported the lowest percentage of earnings which meant the blended result would move higher as tech reported results because it has had the highest beat rate. Tech continued its great performance as now 94.20% of S&P 500 tech firms have reported earnings and 89.23% of those firms have beat estimates. According to FactSet, Q3 blended tech earnings are expected to grow 19.9% and the blended revenue growth is expected to be 10.6%. Tech earnings growth makes it the second-best performing sector, while revenue growth is the third best. Energy has the highest earnings and revenue growth and materials have the second highest revenue growth rate.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more