WTI Crude Oil And Natural Gas Forecast - Monday, July 16

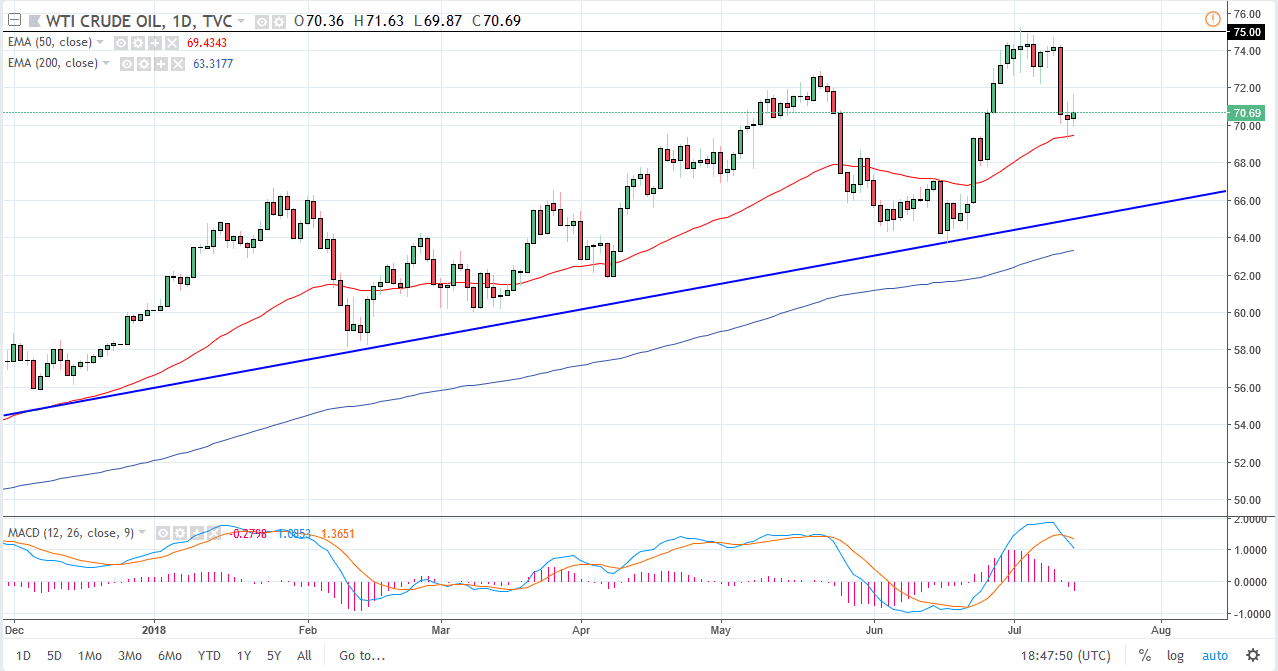

WTI Crude Oil

The WTI Crude Oil market rallied on Friday, gaining 0.5% by the time the Americans were ready to call it a day. We are testing the 50 EMA and have seen support there so far. Beyond that, the $70 level has come into play and offered support as well. However, we gave back quite a bit of the gains for the session, so it makes sense that we could continue to face a lot of trouble. The $75 level above has been massively resistive, so a break above that level is obviously a very bullish sign. Overall though, I think that the market will continue to sell in the short term. The uptrend line, of course, offers quite a bit of support as well, so I think that even though I would expect lower prices, or perhaps selling of a rally, it’s somewhat limited in its distance that it will travel.

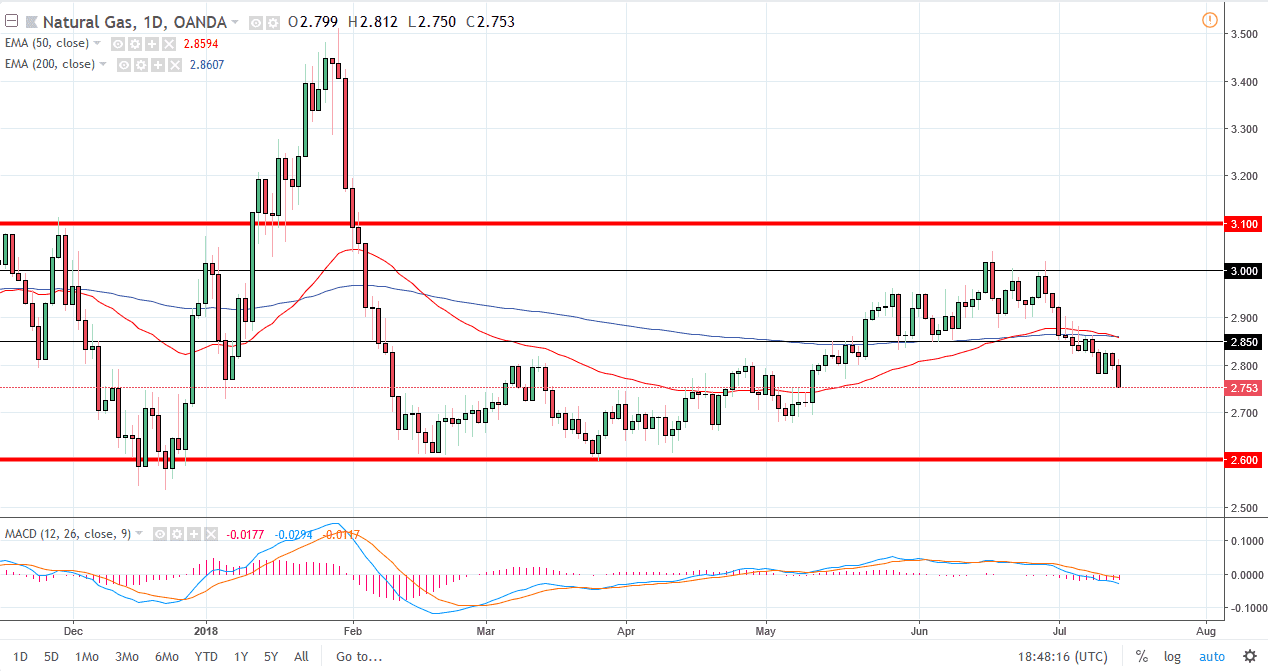

Natural Gas

Natural gas markets initially tried to rally during the day on Friday but gave back 1.75% of value again. The market looks as if it is ready to break down below the $2.75 level, and perhaps drift down to the $2.70 level next, followed by the $2.60 level. This is a market that continues to see a lot of volatility, but at the end of the day, we continue to see an oversupply of natural gas and of course a relatively strong US dollar. Both of these are working against the value of this market, and I think that it’s likely we will continue to see a bearish pressure. Beyond that, Piedmont Natural Gas announced during the trading session that they were going to build a huge storage project in North Carolina, which of course will add to oversupply.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more