World Markets Fall On Greece

Financial markets around the global fell on Monday as Greece imposed capital controls and shut down banks! US markets were holding up pretty well throughout the morning, down only about 1%. But, as the day went, the selling continued. SPX ended down 2.09% for the day. The Dow fell 1.95%, and Nasdaq tumbled 2.4%.

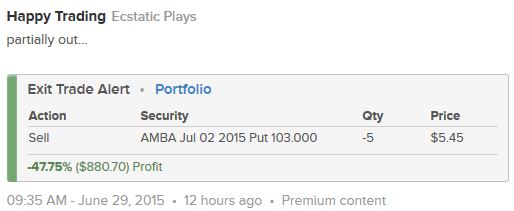

We were mostly in cash going into the weekend, but, held on to some downside plays. We locked in profits in AMBA puts in the morning for gains as high as +47.8%:

PCLN was really weak, and we did some intraday trades on the puts. We also cashed out VIX calls in the afternoon. EXPE puts also gave us some quick profits. These trades helped pushed my Ecstatic Plays portfolio to a new all-time high! It is now up +39.53% for 2015 and up +28.75% in the last 90 days. The portfolio’s value is now approaching the $300,000 mark. (I started trading this portfolio in August 2014, less than a year ago.)

JUNO popped more than +37% after the market, as CELG takes a stake in the company. CELG will pay $1 billion for 9.1 million shares of JUNO at $93 per share. JUNO traded as high as $80 after market, but, settled at $63.5 this evening, up from the $46.3 close during the regular session. We will look to buy calls on JUNO tomorrow.

Internet stocks let the decline in technology stocks today. Aside from PCLN, GOOG was down 1.91%. AMZN fell 1.88%. LNKD tumbled 5.73%. GS led the banks in their pullback, closing down 2.6%.

Asian markets were mixed. China was down again, falling another 3.5%, but, I think buyers may start to show up later. I think we will see some bounces tomorrow, but, without a clearer picture of what is to come for Greece, buyers may not show conviction.

Disclosure: None.