Will We Hold It Wednesday – Fed Edition

What a wild ride yesterday was!

As we predicted, we opened down half a point and then raced all the way up to our strong bounce lines before tumbling back to give up all of those gains and more – a major technical failure for the markets but a huge profit for anyone who followed our trade ideas in the morning post.

Using the bounce lines we published early in the morning for the Futures trades gave the following outcomes on that morning spike:

- Dow (/YM) Futures 17,000 to 17,350 for a$1,750 per contract gain

- S&P (/ES) Futures 1,965 to 2,010 for a$2,250 per contract gain

- Nasdaq (/NQ) Futures 4,120 to 4,180 for a $1,200 per contract gain

- Russell (/TF) Futures 1,130 to 1,155 for a $2,500 per contract gain

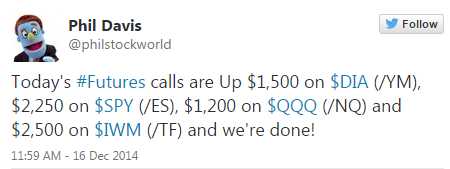

I called the top in our Live Member Chat Room at 11:42 and, since we had made a public pick in the morning, I also tweeted out the note to take profits for our followers (and on our Facebook page, of course). That's how we pick up a little spare change in the Futures while we wait for our bigger positions to play out.

In fact, we also cashed in a couple of our bearish positions on DXD and SQQQ that were up significantly on yesterday's drop, leaving us a little bit less bearish ahead of the Fed – just in case they actually do something today that boosts the markets. We don't really expect it, but not taking 100% gains off the table is just foolish – we can always find new hedges to cover our longs with.

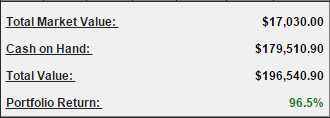

As you can see, our Short-Term Portfolio finished the day up 96.5%, a gain of $22,310 from Monday's close so of course we wanted to take some off the table. Our cash position has increased by $46,500, which was one of our primary goals (getting to mainly cash) into the holidays, which are just 7 days away now. All in all – perfectly timed this year!

We're still bearish but it's more of a long-term bearish with some April TZA calls and a June SQQQ bull call spread that can pay us up to $90,000 in a significant downturn. Not that we hope that will happen, the spread only cost us net $3,800 because we timed our entry perfectly and now we have covered our bullish plays into the second quarter of next year.

I'll be on TV this evening with our 2015 Trade of the Year, which is probably going to be Apple yet again. I hate that it makes it seem like I don't have any better ideas as this is the 3rd year in a row we're picking AAPL but our 2013 Trade of the Year made the full 614% and our 2014 Trade of the Year was taking 10 of the 2016 $450/600 bull call spreads and selling 10 of the 2016 $450 puts for net $24,000 and those are already at $112,700 – up 369% and well on track for the full 525% intended gain.

Given that we are able to consistently make 500% returns on cash using AAPL options and since AAPL has sold off a bit into today's show and given that we LOVE Apple as a long-term hold, I am hard-pressed to find anything I can possibly call a Trade of the Year that I like better so – it's AAPL again!

Hopefully the markets won't be in free-fall this evening (if the Fed blows it today) or we'll have to make a bearish trade of the year – and I really don't want to do that because I'm an optimistic person overall. NFLX and AMZN are still around $300 and GMCR is $135 so we certainly have some exciting candidates to short but, if the FREE MONEY train is going to continue, so may the ridiculous valuations of those companies.

At the moment, we are expecting the Fed to keep things going and we're long on the indexes again at 17,100 (/YM), 1,975 (/ES), 4,100 (/NQ) and 1,135 (/TF) but with tight stops below and, if any two are below the line then none of them should be played.

It's probably going to be another crazy day in the markets – be careful!

more