Will Central Bank Liquidity Dry Up In 2019?

Central Banks About To Break The Market

I think that many investors who are saying the Fed’s balance sheet unwind will be a nothingburger are tired of the story and they think it’s overkill. They are also myopic in their thinking. The chart below shows that even though we have been talking about an unwind and tapering for many months, not much has been done yet. The central bank liquidity as a percentage of GDP is still higher than it has been for most of this recovery. That’s about to change as a steep decline starts in 2018. When I say investors who focus on the Fed are being myopic, I mean that the reason the unwind is so critical is because it is happening along with global tapering. If the Fed unwound its balance sheet while the ECB was buying 80 billion euros in bonds per month, it wouldn’t be a big deal, but that’s not the case.

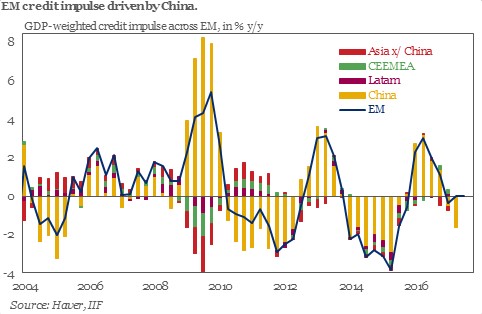

In a previous article, I showed the rate of change of central banks’ balance sheets compared with the S&P 500 rate of change on a year over year basis. They were nearly identical. We don’t know for sure if a selloff will be caused by this latest decline in central bank purchases, but it doesn’t look promising. The chart below is emerging market credit impulses. As you can see in the chart, it almost perfectly lines up with the central bank asset purchases. Lately the credit impulses have stagnated as some tapering has occurred. It looks like the credit impulses will start to fall in the next few months if their relationship with central bank purchases continues. That will be another indicator to watch out for in the next 3-18 months.

The chart above shows that the shrinking of the balance sheets will start in 2019. They haven’t shrunk since at least 2006. I expect significant volatility and some economic effects in 2018. It’s tough to know how much QE is improving the economy because growth has been weak. Is it possible that growth would be worse without it? Certainly, some weak corporations have benefited from low junk bond yields. If the central banks are creating the scenario for them to exist, it is effectively subsidizing weak firms. This supports the labor market in the short term, but hurts productivity because those inefficient firms shouldn’t exist. There is no question that if yields increase in 2018, there will be a large swath of bankruptcies across Europe and America.

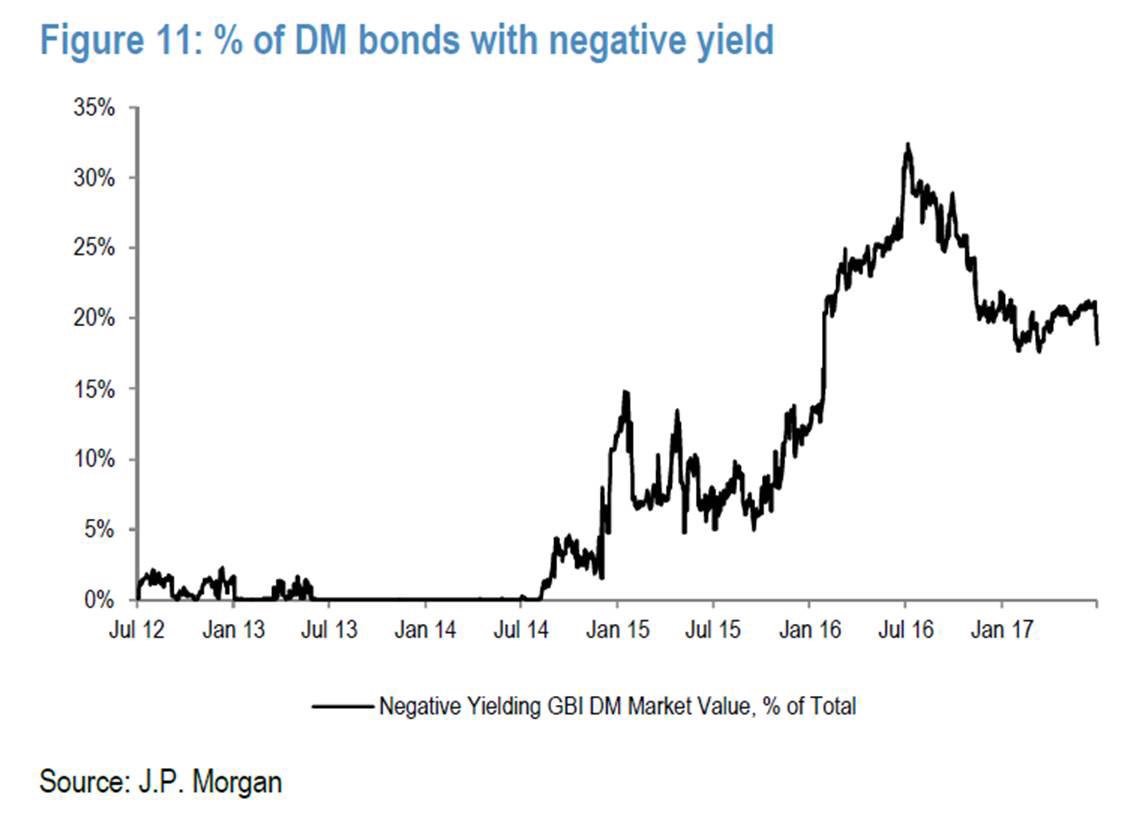

The chart below shows how we are still in a very unusual place in history despite the slight increase yields in the past year. Before the Fed was started in 1913, there were many periods were deflation occurred. Since then, there has been consistent inflation except for one short bout. Even with deflation in the 1700s and 1800s, interest rates never got to the negative levels seen in 2016. This shows how the central banks have manipulated markets. In the next few months, the central banks will attempt to normalize policy. The argument towards normalization is that free markets improve productivity as capital is used in the most efficient way possible. I don’t think the central banks will be able to keep tapering for long, but it appears they will keep going until something breaks. The question is what will break and how bad will it get. That’s something we’ll start researching at the end of 2017 when we have information on how the market reacts to the Fed’s unwind.

Dollar Weakens & Oil Strengthens

I often discuss the negative catalysts to earnings, but I would be remiss if I didn’t discuss the weakness in the dollar which will help international earnings. The chart below shows the dollar index in the past 12 months. It has been crashing in the past few months. Even with the decline, it still has had a negative effect on earnings in Q1 and Q2 because it was up on a year over year basis. Assuming the dollar index remains constant, the year over year change will switch from positive to negative. It will switch from a headwind to a tailwind starting in Q3. That might be a catalyst to earnings which isn’t priced in to the market. As a reminder, 30% of S&P 500 sales come from international markets. This dollar decline could further the S&P 500’s outperformance over the Russell 2000.

Looking at the recent news, oil prices rallied to a 7-week high on Tuesday because Saudi Arabia pledged to limit its exports to 6.6 million barrels per day in August which is about one million barrels per day less than last year. WTI oil increased 3.2% to $47.80 as it gets closer to the $49.75 price analysts expect Q3 to average at. On the American fracking side, Anadarko reported a larger than expected loss. It decided to cut its capital budget for the rest of the year by $300 million. This is the first signal that frackers are responding to declines in price by potentially lowering production. As one of the largest producers, this is a strong signal to the market. The problem is that the more prices rise, the less likely more cuts will be. OPEC will be more consistent with its cuts, excluding Iraq, Libya, and Nigeria which means they will bear the burden. That’s good for energy stocks in the intermediate term, but the back half of this year may still be challenging as they scale back production and deal with oil in the $40s.

Conclusion

I have discovered that emerging market credit impulses have matched the central banks’ collective balance sheets. That’s another indicator to watch in the next few quarters. On earnings, the weak dollar will help international corporate profits in Q3 and Q4. The tailwind will be the strongest in Q1 2018 as that was the peak in the dollar. However, tough comparisons make the odds of a break out quarter in Q1 2018 low. The price of oil reaching the highest since June 7th is positive, but the fact that production cuts are the catalyst is a negative as frackers are bearing some of the burden. The reason why OPEC can’t get oil to the $50s is because Libya, Nigeria, and Iraq aren’t doing enough to join in with Russia and Saudi Arabia.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more