Why Worry Wednesday – We’re In Cash Suckers!

And we're OUT!

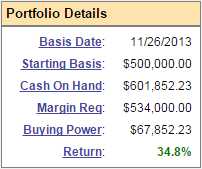

That's right, we took advantage of yesterday's BS rally to cash out our Long-Term Portfolio at the exact high of 34.8%, up $173,815.03 in 16 months. We keep several virtual portfolios for our Members (and you can join us here) and the generally bullish LTP is paired with our Short-Term Portfolio, which acts as a hedge to the LTP positions but also makes short-term bets when the opportunities arise.

The STP has also performed much better than expected and is up 83.8% over the same time-frame at $183,820 off our $100,000 start for a combined gain of $257,635, which is 42% of our initial investment and that was our goaaaaaaaaaaaallllllllllllll for two years (see "How to Get Rich Slowly") and it's only March – of course we deserve a rest!

Cashing out our largest portfolio, in addition to protecting our profits, also helps us re-focus on what positions we REALLY want to play for the rest of 2015. We'll be making a new Buy List for our Members and we'll also be double-dipping on some of our winners (AAPL comes to mind) as soon as we see a good re-entry. One of the trades we did keep will be featured tonight on my TV appearance on Business News Network's Money Talk and we found 11 other trades we liked enough to keep in play (mostly ones that were underperforming) through the upcoming correction.

Also, it's not too late to participate in our "Secret Santa's Inflation Hedges for 2015" as inflation has not officially been recognized yet (so our picks are still cheap) but, as currencies race each other towards the event horizon, we have faith that our inflation hedges will begin to pick up the slack. In any case, the way we designed our hedges, we don't need a big move in the market to make big gains on our spreads.

For example, ABX has gone nowhere since our December entry and, at the time, we called for the ABX 2016 $10/15 bull call spread at $1.60 to be paid for by selling the 2016 $8 puts for 0.70 which was net $900 at the time. Even though ABX is only at $11.37, that spread is now $120, already up 33% due to the simple decay of the premium we sold.

All we are doing is following our basic "Be the House – Not the Gambler" strategy, which is the first lesson we teach our Members at PSW and is also the primary means by which we construct our very successful long-term positions. When you build a portfolio full of positions that can make 33% in 3 months, even when the underlying stock goes nowhere – you can really spruce up your portfolio's returns!

Obviously, we still have serious concerns about the economy, so we're not rushing into anything but that doesn't mean we don't see lots of great bargains we can be picking up. That ABX play, for example, is now $1.20 but, even at that price, it still returns $5 if all goes well – so another $3.80 left to gain (316%) by January. Not so bad, even if you did miss our original entry.

This morning we had a disappointing durable goods report that was down 1.4% vs. up 0.4% expected by leading economorons. Even ex-aircraft, we were down 0.4% so a 200% miss by "experts" who can't possibly read the paper or do any sort of research at all before reaching these ridiculous conclusions. There was nothing in February's data that gave any indication that durable goods would turn up.

I'm done with doom and gloom now that gloom won and we decided to cash out so I'll let SocGen have the last word as they list their 6 potential "black swan" events for 2015 – starring China, with a 30% chance of a hard landing in the next 6 months (ouch!).

Good luck out there, we'll be cheering from the sidelines for now!

more