Why We Should Be Concerned About Low Oil Prices

Most people assume that oil prices, and for that matter other energy prices, will rise as we reach limits. This isn’t really the way the system works; oil prices can be expected to fall too low, as we reach limits. Thus, we should not be surprised if the OPEC/Russia agreement to limit oil extraction falls apart, and oil prices fall further. This is the way the “end” is reached, not through high prices.

I recently tried to explain how the energy-economy system works, including the strange way prices fall, rather than rise, as we reach limits, at a recent workshop in Brussels called “New Narratives of Energy and Sustainability.” The talk was part of an “Inspirational Workshop Series” sponsored by the Joint Research Centre of the European Commission.

My talk was titled, “Elephants in the Room Regarding Energy and the Economy.” (PDF) In this post, I show my slides and give a bit of commentary.

The question, of course, is how this growth comes to an end.

I have been aided in my approach by the internet and by the insights of many commenters to my blog posts.

We all recognize that our way of visualizing distances must change, when we are dealing with a finite world.

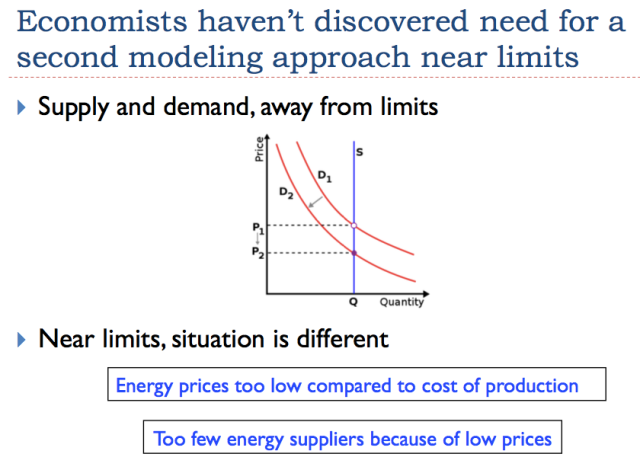

I should note that not all economists have missed the fact that the pricing situation changes, as limits are reached. Aude Illig and Ian Schindler have recently published a paper that concludes, “We find that price feedback cycles which lead to increased production during the growth phase of oil extraction go into reverse in the contraction phase of oil extraction, speeding decline.”

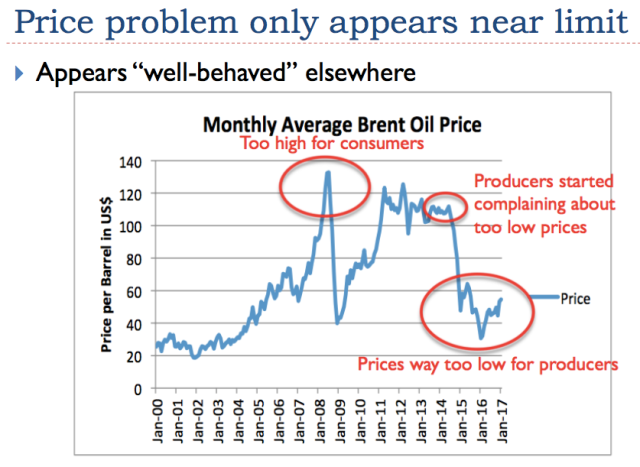

The comments shown in red on Slide 6 reflect a variety of discussions over the last several years. Oil prices in the $50 per barrel range are way too low for producers. They may be high enough to get “oil out of the ground,” but they are not high enough to encourage necessary reinvestment, and they are not high enough to provide the tax revenue that oil exporters depend on.

Most people don’t stop to think about the symmetric nature of the problem. They also don’t realize that the adverse impacts of low oil prices don’t necessarily appear immediately. They can temporarily be hidden by more debt.

There would be no problem, if wages would rise, as oil prices rise. Or if there were an easily substitutable source of cheap energy. The problem becomes an affordability problem.

The economists’ choice of the word “demand” is confusing. A person cannot simply demand to buy a car, or demand to go on a vacation trip. The person needs some way to pay for these things.

If researchers don’t examine the situation closely, they miss the nuances.

Many people think that growing use of tools can save us, because of the possibility of increased productivity.

Using a growing amount of tools leads to the need for a growing amount of debt.

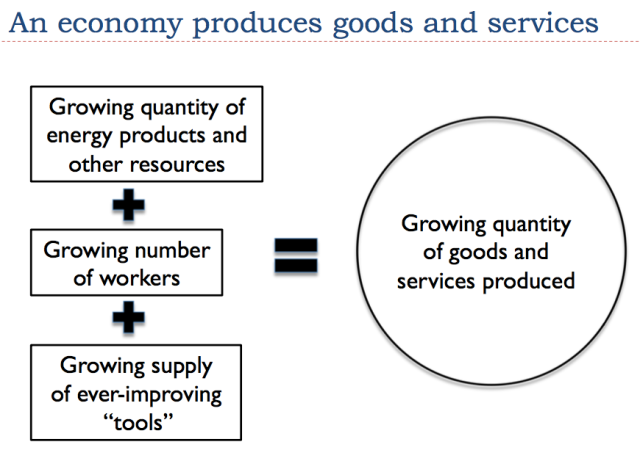

Read this chart from left to right. If we combine increasing quantities of resources, workers, and tools, the output is a growing quantity of goods and services.

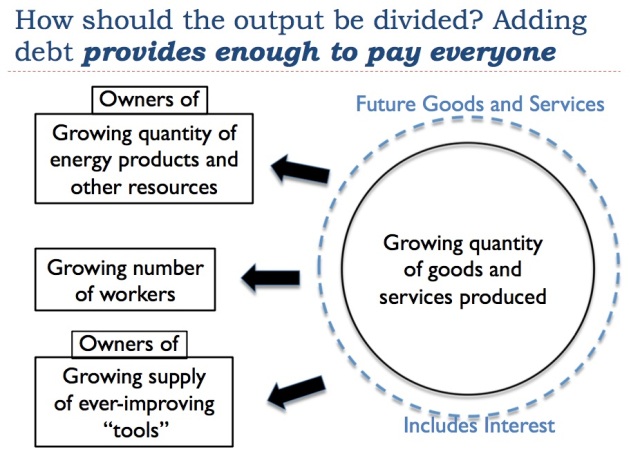

Read this chart from right to left. How do we divide up the goods and services produced, among those who produced the products? If we can only use previously produced goods to pay workers and other contributors to the system, we will never have enough. But with the benefit of debt, we can promise some participants “future goods and services,” and thus have enough goods and services to pay everyone.

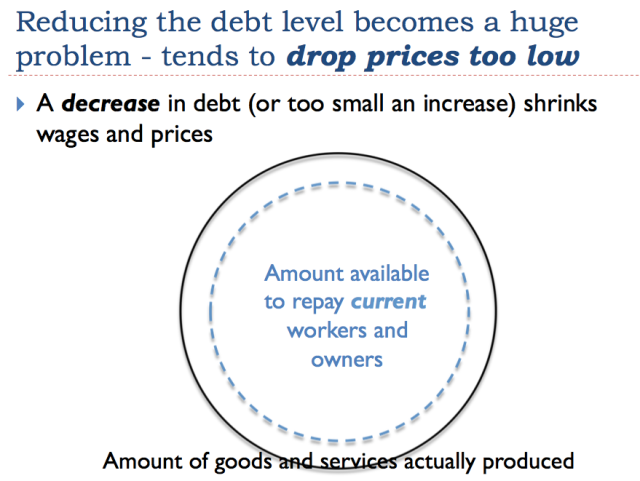

If we decrease the amount of debt, we have a big problem. Instead of the debt adding to the amount of goods and services produced, the shrinkage acts to decrease the amount of goods and services available for distribution as pay. This is why moving from deficit spending to a balanced budget, or a budget that reduces debt, is so painful.

When I say (resources/population), I mean resources per capita. Falling resources per capita makes it harder to earn an adequate living. Think of farmers trying to subsist on ever-smaller farms. It would become increasingly difficult for them to earn a living, unless there is a big improvement in technology.

Or think of a miner who is extracting ore that is gradually dropping from 5% metal, to 2% metal, to 1% metal content, and so on, because the best quality ore is extracted first. The miner needs to work an increasing number of hours, to produce the ore needed for 100 kilograms of the metal. The economy is becoming in some sense “worse off,” because the worker is becoming “inefficient” through no fault of his own. The resources needed to provide benefits simply are less available, due to diminishing returns. This problem is sometimes reported as “falling productivity per worker.”

Falling productivity per worker tends to lower wages. And lower wages put downward pressure on commodity prices, because of affordability problems.

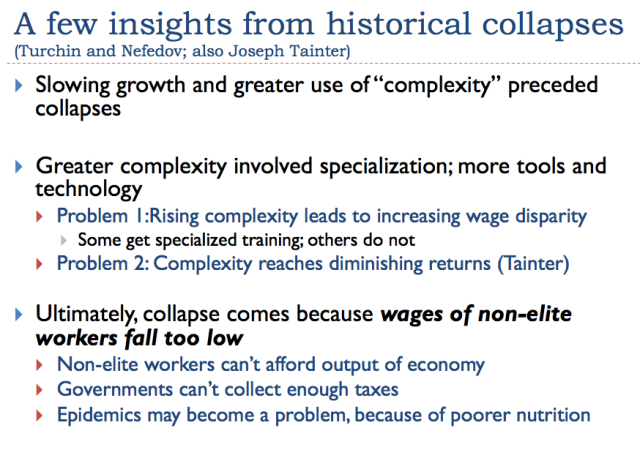

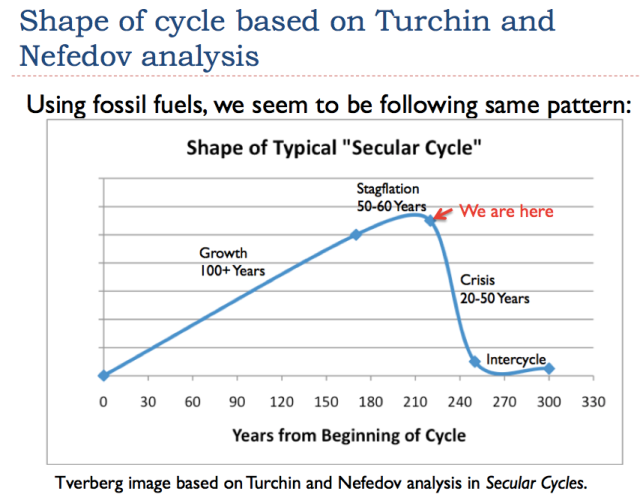

The problems that prior civilizations reached before collapse sound in many ways like the problems we are seeing today. We are seeing increased specialization, and falling relative wages of non-elite workers.

We seem to have already gone though a long period of stagflation, since the 1970s. The symptoms we are seeing today look as if we are approaching a steep downslope. If we are approaching a crisis stage, our crisis stage may be much shorter than the 20 to 50 years observed historically. Earlier civilizations (from which these timeframes were observed), did not have electricity or the extensive international trade system we have today.

The period since 1998 seems especially flat for wages for US wage earners, in inflation-adjusted terms. This is the period since energy prices started rising, and since globalization started playing a greater role.

This is a list I made, showing how, what looks to be beneficial–adding tools and technology–eventually leads to our downfall. The big problem that occurs is that non-elite workers become too poor to afford the output of the economy. Adding robots to replace workers looks efficient, but leaves many unemployed. Unemployment is even worse than low pay.

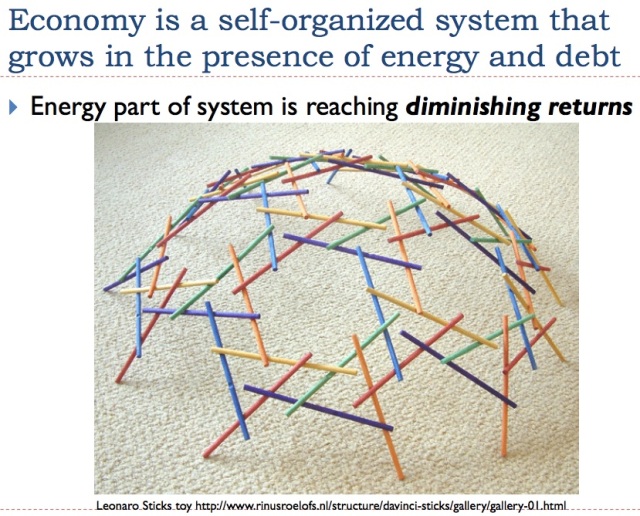

We can think of the economy as being a self-organized network of businesses, consumers, and governments. New products are gradually added, and ones that are no longer needed are eliminated. Government regulations change in response to changing business conditions. Debt is especially important for economic growth, because it makes goods affordable for customers, and it enables the use of “tools.” Prices are created almost magically by this networked system, through the interaction between supply and demand (reflecting affordability, among other things).

It is only in recent years that physicists have become increasingly aware of the fact that many types of structures form in the presence of flows of energy. We have known for a long time that plants and animals can grow when conditions are right. The networked economy illustrated on Slide 22 is one of the types of things that can grow and flourish in the presence of energy flows.

This is my view of how an economy, as a dissipative structure, works. “Tools and technology” are at the center. If a person doesn’t think too much about the issues involved, it is easy to assume that tools and technology will allow the economy to grow forever.

There is a potential for problems, both with respect to inputs and waste outputs. Early modelers missed many of these “issues.” M. King Hubbert created a model in which the quantity of energy supply and technology are the only issues of importance. He thus missed the impact of the Waste Output problems at the right. The Waste Outputs lead to falling prices as limited supply nears, and thus lead to a much steeper drop in production than Hubbert’s symmetric model would suggest.

Peak oilers recognized one important point: our use of oil products would at some point have to come to an end. But they did not understand how complex the situation is. Low prices, rather than high, would be the problem. We would see gluts rather than shortages, as we approach limits. Much of the oil that seems to be technologically extractable, will really be left in the ground, because of low prices and other problems.

Here, I am getting back to the topic I was originally asked to talk about. What else, besides low energy prices and too much debt, are likely to be problems as we reach limits?

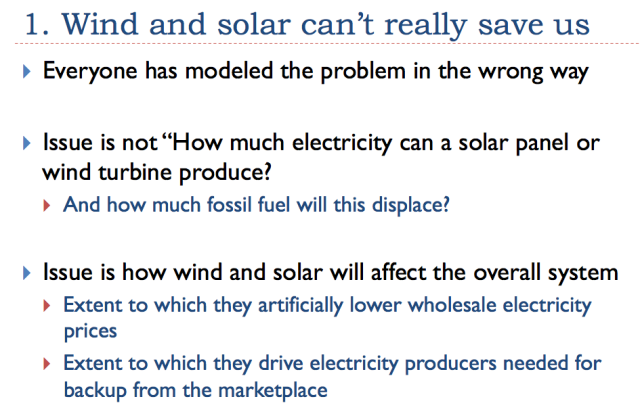

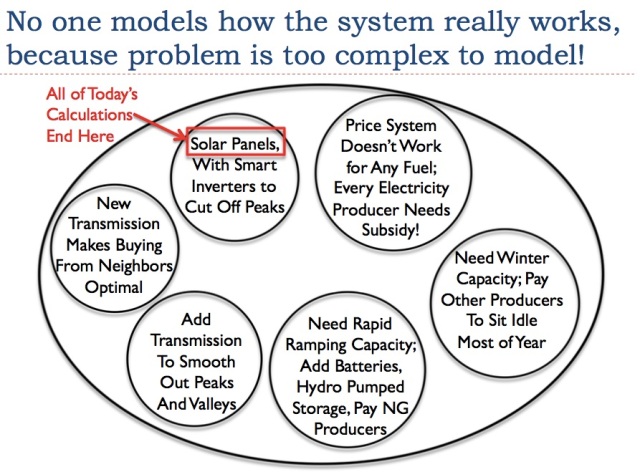

The easy way of modeling the use of wind turbines and solar turbines is to assume that the electricity produced by these devices is equivalent to electricity produced by fossil fuels, or by hydroelectric. Unfortunately, this is not the case.

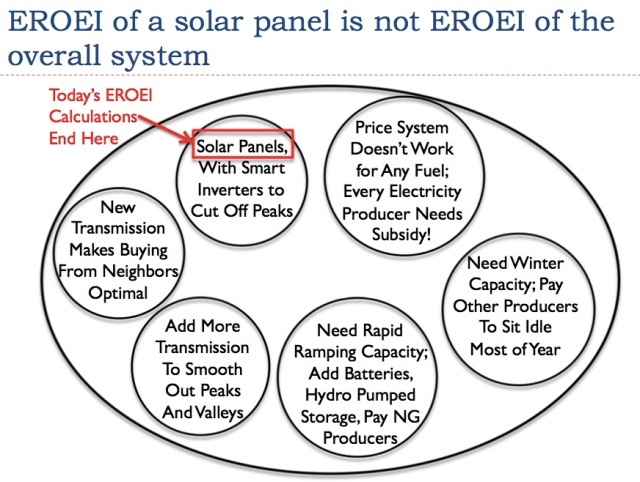

Trying to integrate solar panels into an electric grid adds a whole new level of complexity to the electrical system. I have only illustrated some of the issues that arise in Slide 28.

The fact that the price system doesn’t work for any fuel is a major impediment to adding more than a very small percentage of intermittent renewables to the electric grid. Intermittent renewables can only be used on the electric grid if they have 24/7/365 backup supply that can be ramped up and down as needed. Unfortunately, the pricing system does not provide nearly high enough rates for this service. We are now seeing how this works out in practice. South Australia lost its last two coal-fired electricity power plants due to inadequate wholesale electricity prices when it added wind and solar. Now it is experiencing problems with both high electricity prices and too-frequent outages.

Another problem is that new [long distance] transmission makes buying from neighbors optimal, over at the left of Slide 28. This is a new version of tragedy of the commons. Once long distance lines are available, and a neighbor has a fairly inexpensive supply of electricity, the temptation is to simply buy the neighbor’s electricity, rather than build local electricity generating capacity. The greater demand, without additional supply, then raises electricity prices for all, including the neighbor who originally had the less expensive electricity generation.

It is easy to assume that EROEI (Energy Returned on Energy Invested) or some other popular metric tells us something useful about the cost of integrating intermittent renewables into the electric grid, but this really isn’t the case.

We are now beginning to see what happens in “real life,” as intermittent renewables are added. For example, we can now see the problems South Australia is having with high eletricity prices and too many outages as well as the high electricity prices in Germany and Denmark (Slide 29).

Wind and solar are not very helpful as stand-alone devices. Yet this is the way they are modeled. Some researchers have included installation costs, but this still misses the many problems that these devices cause for the electrical system, especially as the share of electricity production by these devices rises.

A networked system works differently than a system that is “user controlled.” It builds itself, and it can collapse, if conditions aren’t right. I have shown the economy as hollow, because there is no way of going backward.

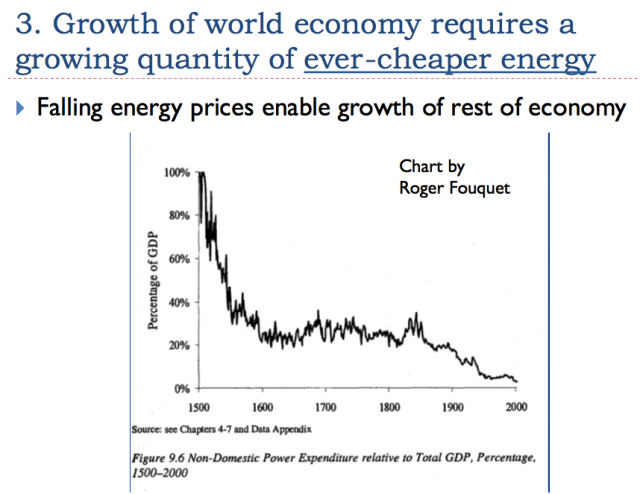

Many people miss the point that economy must keep growing. In fact, I pointed this out in Slide 2 and gave an additional reason why it must keep growing on Slide 16. As the economy grows, we tend to need more energy. Growing efficiency can only slightly offset this. Thus, as a practical matter, energy per capita needs to stay at least level for an economy to grow.

If energy prices rise, this will tend to squeeze out non-discretionary spending. If we cannot obtain energy products sufficiently cheaply, the system of economic growth will stop.

The fact that energy prices can, and do, fall below the cost of production is something that has been missed by many modelers. Prices can go down, even when the cost of production plus taxes needed by governments rises!

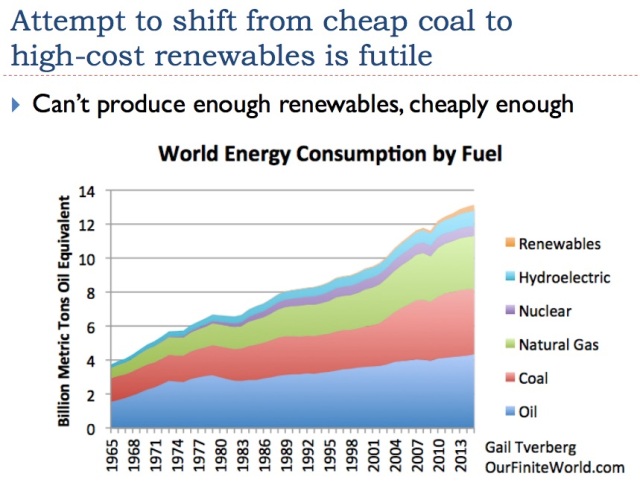

Wind and solar are part of the category at the top called “renewables.” This category also includes energy from wood and from geothermal. Many people do not realize how small this category is. Hydroelectric is also considered a renewable, but it is not growing in supply in the United States or Europe.

It takes energy to have an intergovernmental organization, such as the European Union. In fact, it takes energy to operate any kind of government. When there is not enough surplus energy to go around, citizens decide that the benefits of belonging to such organization are less than the costs involved. That is the reason for the Brexit vote, and the reason the question is coming up elsewhere.

The amount of taxes oil-producing countries can collect depends on how high the price of oil is. If the price isn’t high enough, oil-exporting countries generally have to cut back their budgets. Even Saudi Arabia is having difficulty with low oil prices. It has needed to borrow, in order to maintain its programs.

Oil prices have been too low for producers since at least mid-2014. It is possible to hide a problem with low prices with increasing debt, for a few years, but not indefinitely. The longer the low-price scenario continues, the more likely a collapse in production is. Also, the tendency of international organizations of government to collapse (Slide 38) takes a few years to manifest itself, as does the tendency for civil unrest within oil exporters (Slide 39).

It is easy to miss the point that modeling a piece of the system doesn’t necessarily tell a person very much about the system as a whole.

Once an incorrect understanding of our energy problem becomes firmly entrenched, it becomes very difficult for leaders to understand the real problem.

Disclosure: None.

The issue is not no investment in the future for oil, rather it's too much speculative money from banks to build oil production at prices that are not affordable to keep companies from defaulting on their debt because they are doing economically unsound things. It's an issue of bad banking and low interest rates not resource limitations.

The other issue is that people need to think about the future. Actually America was benefiting by importing cheap oil, as long as the supply doesn't get cut. The simple fact is, the country that extracts oil last gets to use or sell it at the highest price. It is absurd we pump oil and then buy and dump oil back in the ground as a strategic reserve. This is simple insanity.