Why This Might Be A Bad Week For Stocks

Historically, the month of September has a reputation for increased volatility, especially the weeks following monthly option expiration. The weeks leading into the end of the 3rd Quarter have usually been a constant source of discomfort since 1990. Only three times over the past 26 years have all the major indexes posted month-end gains (1998, 2002 and 2010) while many other times they were hit with huge losses.

As reported by Jeff Hirsh in the Stock Trader’s Almanac, since 2008 the major indexes have been dismal during the last week of the 3rd Quarter. The end of September, 2010 was the last year where the major indices produced solid, across-the-board gains. The S&P 500 has been the worst since 2008, down 7 of the last 8 years during the last week of the 3rd Quarter. Some market pundits speculate that end of quarter portfolio restructuring is the most probable explanation for this trend as money managers trim summer under performers and start re-positioning for end of third-quarter window dressing.

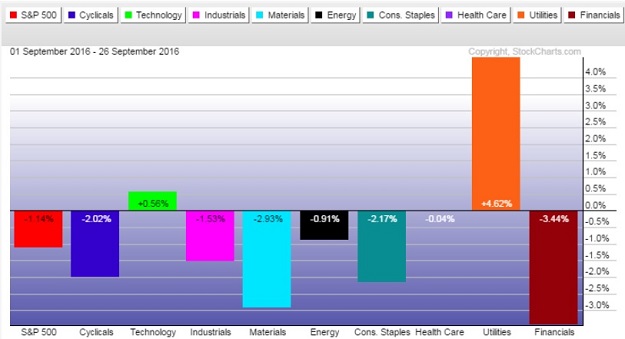

The updated S&P ETF Sector chart below supports September’s reputation for market under performance. Investors are bidding up the price of utility stocks as they are selling off the other S&P sectors. Money managers have gone into defensive mode and since the Fed left interest rates unchanged, utilities and bonds provide good protection.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be ...

more

Thanks for sharing

thanks for sharing

thanks for sharing