Why Ligand Pharmaceuticals Is A Good Long-Term Investment Opportunity

Investing in a biotechnology company involves most of the time considerable risk, however, this kind of businesses could bring tremendous reward when a new drug is approved. On the other hand, when a new drug in development fails in the trial, shares of the company could crash. To demonstrate this situation, let's observe the 52-week price change of the shares of the best biotechnology performers and the worst performers. The average 52-week price change of the best ten performers among the 172 biotechnology companies which are included in Russell 3000 index was at 215.5%, while the average of the ten worst performers was a decline of 89.6%, as shown in the tables below.

Ten Russell 3000 Best Performers Biotechnology Companies

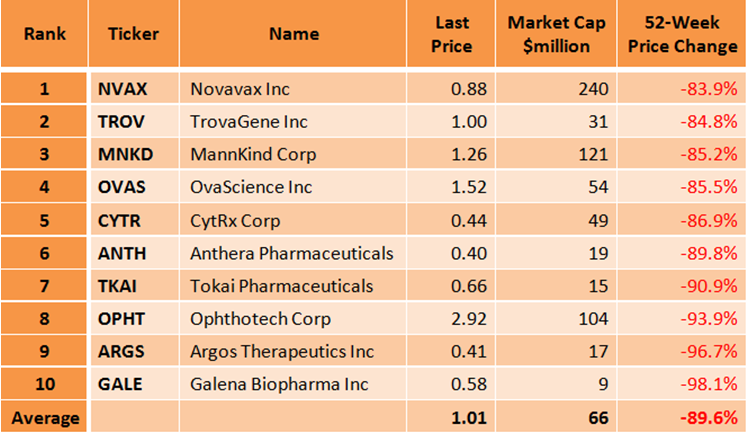

Ten Russell 3000 Worst Performers Biotechnology Companies

Source: Portfolio123

A very promising biotechnology company which provides relatively small risk is Ligand Pharmaceuticals Incorporated (LGND) due to its distinctive business model. Ligand is a biopharmaceutical company which is developing or acquiring technologies which enable pharmaceutical companies to develop new drugs. According to the company, their business model is based on doing what they do best: discovery of new medicines, early-stage of the drug development, product reformulation and partnering. Ligand's partners on their part are doing the late-stage development, regulatory management, and commercialization. Ligand has established numerous partnerships, licenses and other business relationships with the world's leading pharmaceutical companies. Ligand's business model enables the company to obtain revenue streams that are going along with an efficient and low corporate cost structure. By investing in Ligand's stock investors can participate in the high-promising biotech industry in a profitable, diversified and lower-risk business than most of the biotechnology companies.

Latest Quarter Results

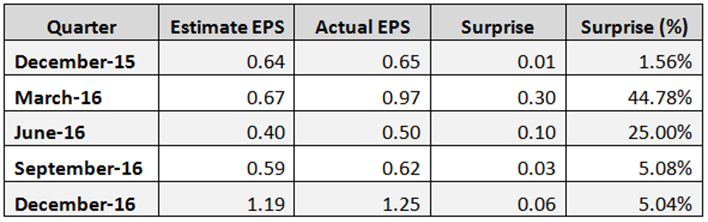

On February 23, Ligand reported its fourth quarter and full year financial results and provided an operating forecast and program updates. Fourth quarter earnings per share beat analysts' expectations by $0.06 (5%). Ligand's revenues of $38.19 million for the quarter were76.6% higher than in the previous quarter, and up 80.2% year-over-year. Royalty revenues of $19.6 million were 70.4% greater than in the same quarter last year. Ligand showed earnings per share surprise in its most recent five quarters, as shown in the table below.

Along with its earnings release, the company provided guidance for the current year. Ligand said that it expects revenues of about $130 million in 2017, a 19.3% higher than in 2016. Moreover, the company stated that it could potentially receive additional $30 million if some contracts would materialize. Ligand's revenues in 2017 are expected to come from royalties of about $87 million material sales of about $23 million and contract payments of at least $20 million. The company expects adjusted earnings per share of about $2.70 for the year 25.6% higher than in 2016.

Analyst Day Event

On February 28, Ligand held analyst day event in New York City where it gave information about the recent progress of its business, its revenue growth opportunities and its portfolio of partnered assets and development programs. According to the company, it has more than 155 wholly funded programs in partnership with more than ninety-two different pharmaceutical and biotechnology companies, and based on the success it is eligible to receive more than $2 billion in milestone payments. While currently 14 products have been approved and are generating revenue for the company Ligand projects that by 2020 more than 28 of its products will be commercialized and generating revenues. The company said that it estimates that its partners will spend more than $2 billion on research and development to advance partnered programs, including funding 39 Phase 2 trials and 32 Phase 3 trials. Worldwide product sales by partners on which the company is entitled to receive royalty payments are projected to be about $1.9 billion in 2017. The average royalty rate to Ligand in 2017 is expected to be about 4.6% of net sales.

Growth

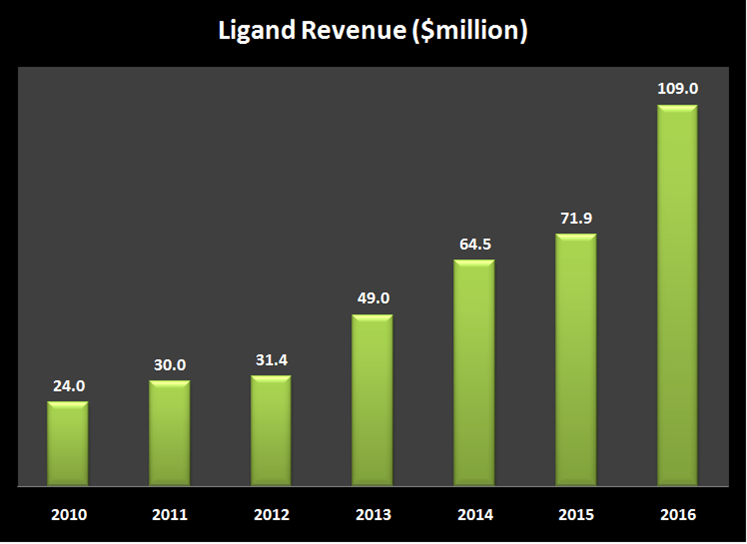

While Ligand has achieved substantial revenue growth for many years, its growth has accelerated in the last four years, as shown in the chart below. The higher growth rate is not surprising since the company has accumulated more products that have been generating revenues in the last few years. Ligand's annual average revenue growth over the previous five years was very high at 29.4%. What's more, the company's average annual income from operations growth over the past four years was extremely high at 288%, and its book value per share had increased by a very high average annual rate of 87% over the same period. Analysts also expect a very high annual average earnings per share growth rate of 35% for the next five years. In my view, these growth figures are very impressive. Moreover, Ligand's growth rate could even increase when more generating revenue products are approved.

Summary

Ligand is a fast growing biopharmaceutical company with a distinctive business model which enables it to obtain revenue streams that are going along with an efficient and low corporate cost structure. As I see it, investors can participate in the high-promising biotech industry by investing in Ligand's stock with lower-risk than investing in a typical high-growth biotechnology company.