Why Is There A Common Perception That The Stock Market Is Rigged?

While there are many credible reasons as to why this bull market seems to be the most hated of all time, frankly I must admit that the argument that markets are ONLY moving higher because of (insert pessimistic observation here) is perplexing to me. As the earnings and revenue numbers always seems to be left out of the equation.

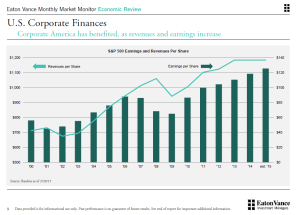

The above chart comes from the latest Monthly Market Monitor from Eaton Vance Investment Managers. This chart shows the annual revenue and earnings numbers for all the companies inside of the S&P 500 market index (SPY). As you can see both Earnings and Revenues are well above their Great Recession highs. And since owning stocks entitles you to a slice of every dollar of profit, these figures are one of the most important elements in investing.

Here’s a long term chart of the S&P 500 during the same time frame of the Earnings and Revenue chart. If we look at the current highs in Earnings per share, it shows an increase of about 38% above the 2008 peak. ($90 to $125)

Now if we compare the nominal price increase in the S&P 500 index above it’s 2007 highs, we come up with about 34.5% increase (1576 to 2119). This increase in the nominal value of the S&P 500 seems to coincide with the increase in Earnings Per Share during the same time period. I honestly don’t see this as just a coincidence and in turn I wonder why we continue to hear commentary that paints a picture of a stock market that is “floating on air”.

Again I am not advocating for or against any political or ideological argument that concludes assets prices should not be this high. In contrast, I do think there are many well formulated arguments to be made. But I feel it is unfair to imply that the stock market is completely rigged or is moving higher ONLY because of external forces as well.

Disclosure: None

I would be inclined to agree with you on this article. But the thing is that the stock market is not rigged in terms of which direction it flows. It is rigged in the sense that individual stocks are manipulated with wishy-washy headlines made for the purpose of dragging stocks one direction or another. The market movement is fine as it is made up of a mix of high-frequency computers, traders,investors and money managers. But the SEC needs to get a handle on individual stock manipulation.

Hi Terry. I was thinking more in terms of the macro picture but you make an excellent point. Individual stock manipulation or front-running is a problem. Thanks for reading.