Why Is The Stock Market’s Biggest Tightwad Buying?

As many of you know, we admire Warren Buffett and his “sidekick,” Charlie Munger. They seek out quality businesses at bargain prices and have a stunning record of success. Both personally and with stock ownership, they are notorious tightwads with their own money and the money of our common stock holding, Berkshire Hathaway (BRK-B). Recently, Buffett outlined his view on the current level of stock prices in his shareholder letter and on TV. He argued that if interest rates stay near the 2.3% level on ten-year Treasury bonds, common stock investors would get rewarded for their ownership and patience.

As we approach the Berkshire Hathaway Annual Meeting, we thought it was a good time to explore why Buffett would be buying stocks in a stock market which looks relatively expensive on a Price-to-Earnings ratio (P/E) basis compared to history, and in a stock market which trades for over 120% of U.S. Gross Domestic Product (GDP). Why do we at Smead Capital Management get excited every day to own the companies we hold in our portfolio, including BRK-B in that same stock market?

We looked to research from Jim Sloan, published in a piece called, “Why Buffett Isn’t As Worried About Valuations As Some of Us Are.” In his piece, Sloan quoted from Buffett’s 1977 Fortune article called, “How Inflation Swindles Equity Investors.” It showed how Buffett views stocks as “equity bonds” which tend to perpetually compound retained earnings at 12%. Buffett did that writing to argue for owning stocks in both inflationary and deflationary eras because of the “magic” of internal compounding.1

Buffett referred to the period from 1949 to 1966 in that Fortune article as “the good old days”:

The news was very good indeed in the 1950s and early 1960s. With bonds yielding only 3 or 4%, the right to reinvest automatically a portion of the equity coupon at 12% was of enormous value.

Therefore, we thought our readers would like to see a few visual examples of why, in Buffett’s theory, extended periods of low long-term interest rates deserve much higher capitalizations than normal. We will do this by reintroducing the way we use the “Modern Graham formula” for calculating the intrinsic value of a company. In doing so, we will seek to show how heavily Ben Graham, the dean of value investing, believed that interest rates affected intrinsic value calculations.2

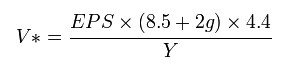

Graham did years of research and looked at 10-year AAA-corporate bond interest rates from 1900 to 1930 in the U.S. In this research, he concluded that a 4.4% interest rate was the average of those 30 years. To adjust intrinsic value based on interest rates, he divided 4.4 by today’s prevailing interest rate on 10-year AAA corporate bonds. His back of the envelope “modern version” looks like this for us:

EPS–trailing 12 month EPS

8.5 is the PE ratio of a stock with 0% growth

V–intrinsic value

g—long term expected growth rate

Y—the AAA ten-year corporate bond interest rate

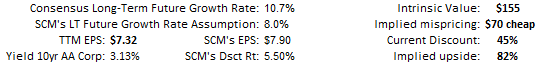

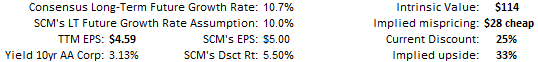

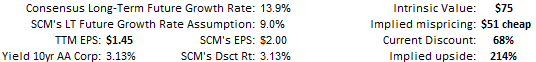

To establish a “high margin of safety” in your intrinsic value calculation you have two choices. You can either underestimate the long-term growth rate or use a higher interest rate. At Smead Capital Management, we do both. First, we have been using 5.50% as our discount rate as opposed to Graham’s use of the AAA corporate bond rate. We would note that in 2017, the AA corporate bond rate is more reliable due to its larger sample size than the AAA corporate bond rate that Graham used.

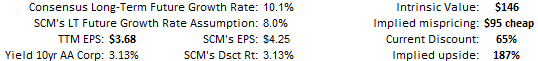

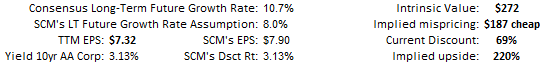

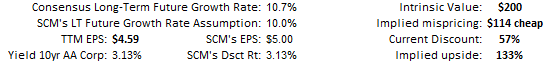

What would it do to our calculations if we used the actual AA corporate bond rate? First, here is our calculation for four of our portfolio holdings which we view as very attractive today with our “high margin of safety” approach.

Using our 5.50% discount rate:

Bank of America (BAC)

Lennar (LEN)

Alaska Airlines (ALK)

Walgreens (WBA)

Each of these companies sells at a significant discount to our “high margin of safety” estimate of their intrinsic value. Now let’s look below at the same companies via “Modern Graham” and use today’s 3.13% rate rather than the 5.50% discount rate.

Can you see how much more valuable these companies are intrinsically at the lower interest rates? Bank of America, Lennar and Alaska Airlines are trading for less than 33% of their intrinsic value at today’s rates, and Walgreens is worth over $86 per share more at the lower discount rate! This is exactly why Buffett called the 1949-1966 period “the good old days” and how a tightwad/value buyer like he and Munger could be comfortable buying at these prices.

Based on the pronouncements of many respected money managers lately about the dangers of owning stocks and the fear of the next bear market coming soon, it is ironic that the two men who have been the best judge of value over the last 50 years are taking the posture they have taken. None of this precludes a meaningful stock market decline nor does it predict the future. However, as long-duration common stock owners, we believe in owning stocks all the way through market declines. We do this while using them to refresh our holdings with companies which meet our eight criteria for common stock selection. We are unlikely to get that opportunity soon if interest rates stay in the 3-4% area on high-quality ten-year corporate bonds in the eyes of the “Oracle of Omaha.”

Disclaimer: The information contained in this missive represents SCM’s opinions, and should not be ...

more