Why Falling Oil Prices Won't Stop Tesla Or EV Sales In General

Summary

- Since falling prices are meant to be a structural phenomenon, they shouldn’t result in a substantial market rebound in the form of a decrease of EV sales.

- One way to verify this reasoning would be to find no strong positive statistical correlation between oil prices and EV sales.

- The results of a chart and correlation analysis for Tesla, the U.S. EV market and the world EV market provide considerable support to my supposition.

- However, evidence that falling oil prices hurt sales of 6 (out of 19) models (most of which priced at less than $36,000) in the U.S. places doubts on Tesla’s prospects.

- In this context, two additional results suggest that consumers could still be willing to buy many EVs from Tesla as long as it keeps producing high-quality products.

In the present article, I explain why falling oil prices didn't affect Tesla or EV sales last year and why, up to a point, they are not likely to do so in the future.

Following my latest contribution to Seeking Alpha, in the context of global warming and climate change, one of the causes of the current oil price downfall might be a diminution of demand for major petroleum derivatives (i.e. gasoline and diesel) due to a process of electrification in the global automotive industry. To the extent that falling prices are meant to be a structural phenomenon, they shouldn't result in a substantial market rebound in the form of a decrease of EV sales. One way to verify my reasoning would be to find no strong positive statistical correlation between oil prices and Tesla or EV sales in general.

In what follows, I test this hypothesis in turn for Tesla, the U.S. EV market and the world EV market.

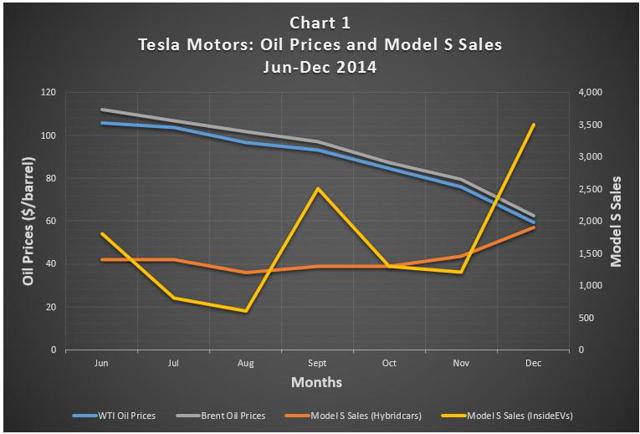

As for Tesla, in Chart 1 both WTI and Brent oil prices (as obtained from the U.S. Energy Information Administration) and Tesla sales (as obtained from both Hybridcars.com and InsideEVs.com) are shown for the period June-December 2014. I chose this lapse of time on the grounds that the downward price movement started around mid-June 2014 and continued throughout the year until the present time.

Source: EIA, Hybridcars and InsideEVs

As it can clearly be seen, there doesn't seem to be a strong positive statistical correlation between oil prices and Tesla sales in the period under consideration. Indeed, the opposite appears to be the case. In the second and third columns of Table 1, I present the corresponding computed correlation coefficients, as well as their statistical significance, which was determined following a standard procedure. Other things being equal, these results mean at least two things. First, that Tesla's sales are not dependent on oil prices in the way we could expect to occur when referring to other electric vehicles and, second, that there are additional factors influencing Tesla sales.

In the first case, it is my presumption that Tesla's Model S is mostly demanded by people whose level of income is far beyond that of those who use cars primarily as a means of transportation and not as, for example, a source of prestige or reputation. In the second, I would suggest that Tesla's shoppers are probably more concerned than ordinary car buyers about the effects of global warming and climate change and firmly believe that by purchasing a Model S they are making a positive contribution to surmount these pervasive phenomena. It goes without saying that in neither of these circumstances oil prices should matter much when deciding to buy a car.

In Charts 2 and 3 I extend my analysis to U.S. EV sales and world EV sales. Even though now the charts reflect at times a parallel movement between oil prices and EV sales, which is an indication of an underlying positive relation, their calculated correlation coefficients are too low (or not statistically significant at any reasonable level) to arrive at any definitive conclusion in this regard (See the fourth, fifth, and sixth columns of Table 1).

Read the rest of Juan's article at Seeking Alpha

Disclosure: None