Why Apple Pay Is A Game Changer

Apple is a revolutionary company. Starting with the iPod and iTunes, Apple has continually turned industries on their heads reaping big profits along the way. Now setting their targets on the mobile payments industry, Apple is about to hit another grand slam.

My regular readers here and with other financial content sources know that I have been a bull on Apple (NYSE: AAPL) for over a year and a half. When the stock traded below $400 (split-adjusted) a share in late June of 2013, the shares constituted the biggest position by far within my portfolio just like Gilead Sciences (NYSE: GILD) does now.

Apple is not the “pound the table screaming buy” now as it was then as the stock has appreciated more than 80% from its recent nadir. However the shares should continue to outperform the overall market given their valuation and the company’s growth prospects. The stock should also be one of the inaugural recommendations in the portfolio of Blue Chip Gems when it launches in early 2015, provided the stock stays below $115 a share.

My regular followers also know that I have been saying throughout 2014 that the company had a huge opportunity in mobile payments and that any offering in that space would be a much bigger positive catalyst for the company than anything in the wearable technology like the upcoming iWatch. The recent launch of Apple Pay makes me more confident in that thesis.

Quite a few people have written about Apple Pay but none have concisely conveyed the size of the opportunity Apple has in front of it. We’re going to attempt to address that gap. Let’s start with the obvious and not so obvious positive impacts of Apple Pay.

The Debit & Credit Market Opportunity:

The global credit and debit card transaction market is around $7 trillion globally and continues to grow as plastic continues to displace cash. The United States is by far the biggest debit and credit card market by volume in the world. In addition, mobile payments, although a small part of that overall base are growing rapidly.

Apple Pay launched with partnerships with banks that control over 80% of the debit and credit card transactions in the domestic market. Banks are lining up to get on the platform and I expect that number to be past 90% in a few months. Apple Pay is also accepted at over 200,000 retail locations including Whole Foods (NYSE: WFM) and Macy’s (NYSE: M), and that number will grow exponentially.

Apple gets 15 cents per every $100 of transactions. If Apple eventually captures 5% of the current global market this would still mean less than $1 billion in annual revenue to Apple. For a company the size of Apple, this is a drop in the bucket.

Differentiation:

What this does do for Apple is further differentiates the company from its competitors. Apple Pay will only be available on new products like the iPhone 6, 6 plus and iPad. This provides one more reason for consumers who were already looking to upgrade their smart phone for the larger screens in the new iPhone models to go ahead and do so.

In addition, it pokes another spear into the Apple’s primary competitor Samsung which already has been reeling lately with disappointing earnings results. Samsung runs on Android from Google (Nasdaq: GOOGL). Google has been trying to develop Google Wallet for years. Unfortunately, it has been unable to drive the partnerships with banks and merchants that Apple Pay already has at launch and will continue to develop.

Side Benefits:

Apple Pay also provides some side benefits to Apple I have not seen discussed in depth. Apple has over 750 million unique users on iTunes which is a dying platform as individuals migrate to Pandora (NYSE: P) and Spotify. These people are already comfortable with storing credit card information with Apple and should be early adopters of Apple Pay which provides additional security measures against credit card fraud.

The software and services side of Apple’s business is little understood part of the company by investors. iTunes, app downloads, and other services already provide some $20 billion in annual revenue to this tech giant. As can be seen below, this side of Apple is going to be a key driver to revenue growth in the years ahead. Apple Pay will just expand the company offerings in this space.

Finally Apple will now capture new users like your humble writer who has never downloaded an app in my life on my smartphone but will sign up for Apple Pay. Now that Apple has my credit card information, I might even join the 21st century and buy an app or two. I can’t be the only one. Apple Pay will support additional iPhone sales which already are robust, further bolster its substantial ecosystem, put greater distance between Apple and its competitors as well as generate additional buzz for the company.

Apple Pay is also just one more reason to invest in Apple which is already attractive on a valuation basis. Taking out its over $150 billion in cash, the stock goes for under 11 times forward earnings, a significant discount to the overall market multiple. I expect this discount to narrow significantly in 2015 providing another good year for Apple shareholders albeit at a slower pace than the capital appreciation in the shares over the past 15 months.

Other Impacts:

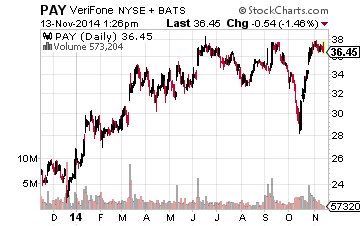

I expect Apple Pay to grow exponentially and change consumer behavior just like the launch of the iPod and iPhone before it. Near field communication chip makers obviously will benefit from the rollout of this capability.VeriFone (NYSE: PAY) should also benefit as the new technology triggers an upgrade cycle for credit card terminals at retailers.

VeriFone has easily beat earnings estimates for the past three quarters and in the midst of its own turnaround effort and the stock has responded lately. The company is tracking to flat earnings growth this year but the consensus has the company posting a 30% earnings gain in 2015. Revenue is growing in the high single digits annually and should accelerate somewhat thanks to the rollout of Apple Pay which will mean merchants will need to upgrade their equipment. The stock sells for just over the market multiple based on forward earnings. The shares have had a good run in 2014, but I would not hesitate to add a few more if we get any kind of pullback in the stock.

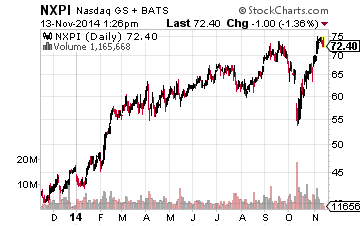

Near field communication chip makers could be a major beneficiary of the successful rollout of Apple Pay. Huge sales increases to Apple in the last quarter allowed NXP Semiconductors NV (Nasdaq: NXPI) to post 60% year-over-year gains last quarter to over $300 million in that segment. The company’s sales to the automotive sector were also strong and posted double digit gains in the quarter.

This Netherlands based chip manufacturer is posting revenue gains in the mid-teens in 2014 overall. Earnings are tracking to a 40% to 45% increase over 2013’s levels. The consensus has another 15% to 18% gain in store in 2015. Even with a recent rally, the shares are not expensive at less than 14 times forward earnings and the stock has a five year projected PEG of under 1 (.68).

Apple will continue to dominate investor interest and with good reason as its innovative streak, like with Apple Pay, sets it apart from competitors. It’s the type of company that will play an integral part in the portfolio of my upcoming new investing newsletter, Blue Chip Gems.

Find out more and how to get on ...

more