Whose Fault?

It’s pretty safe to write that no matter what happens in the global monetary system it won’t be considered properly. Orthodox doctrine which dominates the media (why there are still credentialed economists quoted in these articles) essentially prevents it from happening. From terms like “capital outflows” spring up analysis predicated on there actually having been both capital and outflows of it, when in wholesale terms there never was either. What is offered as analysis is left as “analysis.”

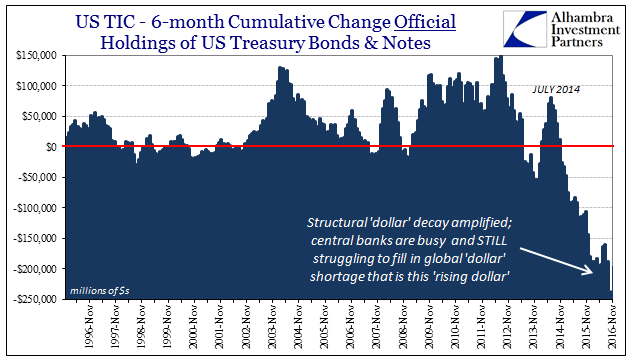

Foreigners have been dumping US Treasuries and have for several years now. There are several easy connections to make, though, again, the mainstream is prevented from ever making them. The “dollar” started rising, global markets spun into turmoil, and during all of it foreign holders, almost exclusively official holders, a fact almost never reported, “sold” primarily UST assets. To the media, why CNY devaluation spawned such great sustained financial as well as economic disruption is difficult if not impossible to piece together.

In October 2015, Bloomberg told us that:

The data flesh out some of the story behind the month’s global financial turmoil that contributed to the Federal Reserve’s September decision to refrain from raising interest rates. With China’s economy weakening and the greenback up 19 percent in a year against a basket of currencies, the People’s Bank of China on Aug. 11 unexpectedly devalued the yuan, resulting in its sharpest decline since 1994.

The story was in response to TIC data that showed in August 2015 huge selling that actually makes perfect sense when you switching from “rising dollar” to “dollar shortage.” A few months later, by March 2016, the media still operating by traditional “analysis” couldn’t then reconcile how “selling” of UST’s had so increased and yet UST bond yields only went lower. Bloomberg reported then:

Foreign governments and central banks sold long-term U.S. Treasuries at a record pace to start 2016, Treasury Department data showed Tuesday…

Despite the sales in the latest Treasury data, demand for U.S. government debt had pushed the yield on 10-year Treasuries down to 1.92 percent at the end of January from 2.27 percent a month earlier, as China’s actions on its currency and stock market rattled global financial markets.

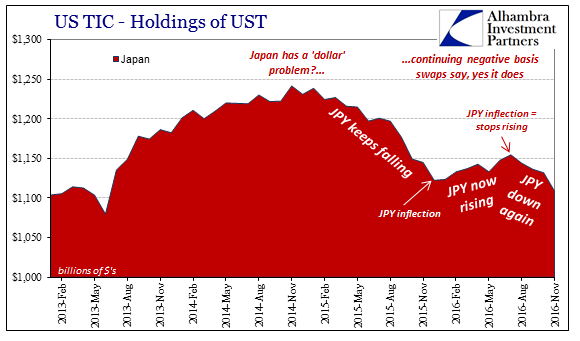

By August 2016, however, the account changed as did bond prices. It correctly focused now more so on Japan, though the correct reasons why continued to be elusive to Bloomberg:

That truism is now a thing of the past. Last month, yields on U.S. 10-year notes turned negative for Japanese buyers who pay to eliminate currency fluctuations from their returns, something that hasn’t happened since the financial crisis. It’s even worse for euro-based investors, who are locking in sub-zero returns on Treasuries for the first time in history.

We won’t get any TIC figures until later in the week, but preliminary foreign data from the other side showed again “outflows” in December. This is not at all surprising from the view of the “dollar shortage”, especially in Japan who is thought to have sold a tremendous amount of UST’s in that month. This time, however, Bloomberg now claims that the Japanese aren’t worried about yield differentials anymore so much as who is in the White House, though at that time he wasn’t even yet in the White House.

From Tokyo to Beijing and London, the consensus is clear: few overseas investors want to step into the $13.9 trillion U.S. Treasury market right now. Whether it’s the prospect of bigger deficits and more inflation under President Donald Trump or higher interest rates from the Federal Reserve, the world’s safest debt market seems less of a sure thing — particularly after the upswing in yields since November. And then there is Trump’s penchant for saber rattling, which has made staying home that much easier.

The article was written under the intentionally provocative headline America’s Biggest Creditors Dump Treasuries in Warning Trump. I suppose this is analysis far beyond any natural ability so as to be supernatural; to be believed we would also have to believe that the heavy and sustained selling of UST assets by other foreign governments starting in July 2014 was because those very same overseas elements were the entire time raising the alarm about the prospects of US voters daring to raise Donald Trump to the Presidency. This is the danger of unhinged “analysis”, for when the mainstream cannot correctly identify and relate what is going on they are free to speculate in a manner that isn’t presented or identifiable as speculation and even fiction.

(Click on image to enlarge)

If the “dollar shortage” was common knowledge, as it should be, this absurd Trump noise would never have been written let alone published. The Japanese selling isn’t even unexpected given huge drop in JPY (“reflation”) in November, “devaluation” that didn’t change direction until mid-December (and then was far less intense when it did).

(Click on image to enlarge)

(Click on image to enlarge)

The only part of this which has been consistently reported is that foreign holdings of UST’s have been dropping. The media then makes all sorts of assumptions from that thin starting point, starting with the notion that these balances are declining due exclusively to sales of those assets. As to why that might have been, might be now, or will be in the future, that is left as a contemporary narrative. Because this “dollar shortage” has gone on so long now, that narrative has been subject to change several times already (though I haven’t once seen “Obama” in any of them).

It is instructive given that the narrative really should be about the analysis, because the story of the “dollar”, both its rise and fall, is the greatest story yet to be written. The eurodollar may fall, having dominated for half a century, before practically anyone had ever heard of it. That actually explains a great deal about it, as well as how we got to this lowly, dangerous economic state. In that respect, depression is almost a guaranteed result from a prolonged state of ignorance and all that entails.

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more