When The Stock Market Rises, Who Benefits?

from the St Louis Fed

-- this post authored by Lowell Ricketts

The recent stock market volatility has generated a lot of discussion. Many Americans grapple with what it exactly means for the broader economy as well as its impact on their household balance sheets.

Surprisingly, though, only around 50 percent of American families have anyexposure (direct or indirect) to the stock market. In fact, stock market wealth is heavily concentrated, with the wealthiest 10 percent of households owning around 83 percent in 2016.1 Consequently, the risk - and rewards - associated with the stock market don’t accrue to many Americans. As a matter of fact, we discussed this in a recent New York Times article on the recent market gyrations.

Demographics of Stock Market Participants

Within the Center for Household Financial Stability, we believe that demographic factors - age, race/ethnicity and education - are meaningful dimensions by which to study household balance sheets. While families can see their position in the income and wealth distribution change year-to-year, these demographic factors remain stable.

So how are stocks distributed across American families using a demographic lens? The differences are arguably more striking.

Examining Middle-Aged Families

Using the Survey of Consumer Finances (SCF), I looked specifically at families headed by someone between the ages of 40 and 61. I focused on this group for two main reasons:

- Younger families haven’t had much time to accumulate assets.

- Older families preparing for retirement tend to transition their portfolio to assets that are less risky than stocks.

Therefore, I expect middle-aged families to have the greatest capability and desire to invest in stocks.

Examining Participation by Race and Education

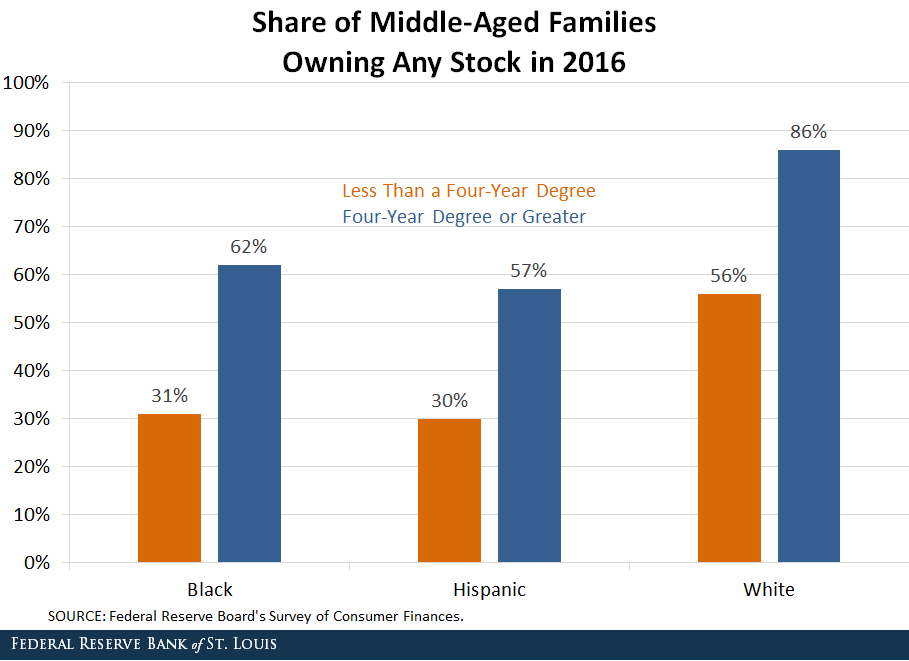

The figure below shows ownership rates of any stocks in 2016 for groups defined by race and ethnicity2 as well as education, measured by whether the head of the household had a four-year degree.

(Click on image to enlarge)

As it turns out, a college degree is strongly correlated with stock ownership. Differences in ownership rates were largest between college-educated families and their non-college educated peers, regardless of race and ethnicity.

Registering the highest rate by far was college-educated white families, with 86 percent having some of their assets in stocks.

However, college does not - yet again - level the playing field. College-educated white families had a commanding advantage compared to their black and Hispanic college-grad peers. The share of those families with some stock exposure was around 60 percent, roughly 26 percentage points less than whites.

Concentration of Wealth

Moving beyond exposure to stocks, the concentration of these assets reveals an even starker divide. White college grads (of all ages) collectively owned around 77 percent of all stock market wealth in 2016 but accounted for only 26 percent of the total U.S. household population.

At the same time, only 2.4 percent of stock wealth was on the balance sheets of black and Hispanic college-grad families, while they represented 5.5 percent of all households.

Stock Market Gains

While the recent market volatility is concerning, the returns to these assets following the recession have been stunning. Between 2009 and 2017, the total return to stocks (as measured by the S&P 500 Total Return Index) averaged around 15.7 percent. Compared to housing returns estimated by economist Edward Wolff, stock returns have been substantially higher in every holding period except the years 2001-07, when the housing bubble was inflating.3 As our demographic focus suggests, those rewards predominantly went to families who were white, college-educated, and middle-aged or older.

It is important to remember that past performance does not guarantee future results. That being said, many families without any exposure to the stock market could benefit from asset diversification. Policies that seek to expand access to stock ownership should be sensitive to these powerful demographic predictors.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only. The reader is solely responsible for determining whether any ...

more