When The Next Crude Bear Market Strikes, Blame America

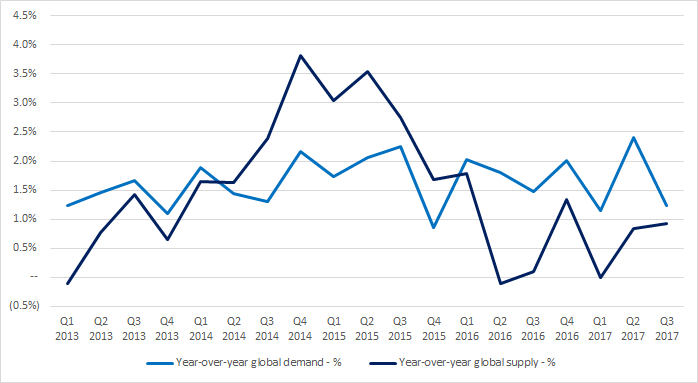

Crude oil remains in a bull market for one primary reason: demand growth continues to run ahead of supply growth. Looking over the longer term, crude oil prices have reacted sharply each time supply growth has moved above or below demand growth. The commodity cratered after the second quarter of 2014 once supply growth sharply outpaced demand. The bear market didn't end until the first quarter of 2016, once supply fell below demand growth. Today crude remains in a bull market, albeit a relatively tame one. The dynamics of supply versus demand are shown below for reference:

Changes in underlying market dynamics help predict the direction of crude

Source: International Energy Agency Oil Market Report

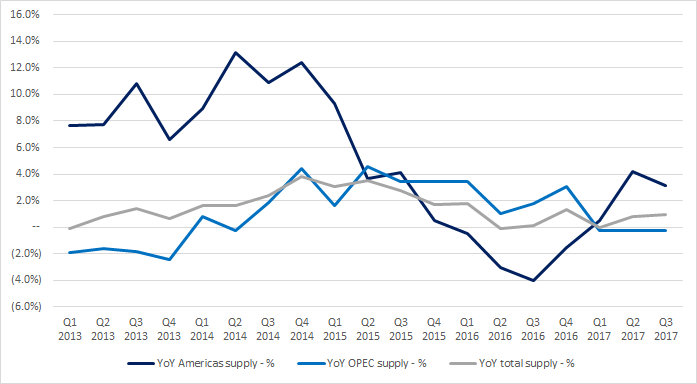

Looking at the chart above, growth in demand has been remarkably steady while supply has been much more volatile. Digging further into supply data, the biggest source of new supply has unsurprisingly originated from the US. For visual emphasis, this is shown below:

American shale ruins the OPEC party

Source: IEA Oil Market Report

Thanks to $100+ crude oil, easy access to junk bond markets, and fracking technology, US shale flooded the market with supply at an unprecedented scale. In the past, crude oil supply moved at a glacial pace as large extraction projects took time to assess, finance, and develop. Once fracking technology became widespread, nimbler US firms became the new ‘swing producers’. Unlike producers from the past, US firms can ramp production up and down much more quickly and are thus much more responsive to changes in the market. In short, OPEC finally met its match.

Following the 2014 and 2015 crude oil bear market, many US producers went bankrupt after failing to generate cash flows and losing access to financing. As fracking technology improved over time (lowering breakeven prices necessary to operate profitably), many had predicted another resurgence for US producers in 2017. However, this prediction failed to materialize given a variety of reasons including poor weather and infrastructure bottlenecks. While US supply has been positive following the second quarter of 2017, growth rates today remain subdued. The bull market in crude is thus intact.

So when’s the bust?

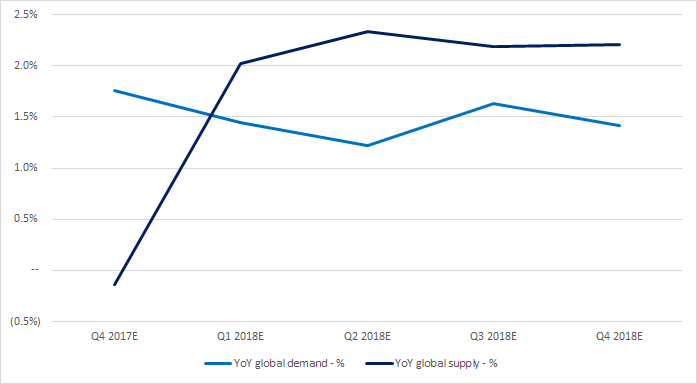

Based on the framework defined above, expect crude oil prices to re-enter a bear market once supply runs ahead of demand growth. Looking at the latest estimates from EIA’s Oil Market Report from October and the US Energy Information Administration’s estimates for OPEC supply growth, the bear market may be around the corner. Once again, US production will bear much of the blame. US supply growth is expected to accelerate beyond 5% in 2018, rising to 7% in the third quarter of 2018. As the US once again ramps up production, the crude oil market will return to being ‘imbalanced’ in the first quarter of 2018. This is visually shown below:

The next crude bear market?

Source: IEA Oil Market Report, US EIA OPEC supply estimates

Needless to say, these estimates are subject to substantial risk given the volatile nature of the crude oil market. Risks to the forecasts include Trump choosing re-enact sanctions on Iran (removing up to 1m barrels per day of supply), an escalation of the current tensions between Saudi Arabia and Iran, and more bottlenecks slowing down US supply growth. While these risks may delay the onset of another bear market, the current bull market may not continue for much longer. Ultimately, US shale is set to ruin the party once again.

Any opinions, news, research, analyses, prices or other information is provided as general market commentary and does not constitute investment advice. MarketsNow will not accept liability for any ...

more