WhatsTrading Recap - 01/23/2015

Trading is cautious after the big rally Thursday and ahead of boatload of event risk in the final week of January. Not only is it the busiest week for Q4 earnings reports, the economic calendar includes a flood of data as well as an FOMC meeting on Wednesday.

The S&P 500 is down 3.90 points to 2059.25 through midday Friday.

Treasury bonds are sporting solid gains as stocks slip and the yield on the benchmark ten-year is finishing the week around 1.8%. Gold gave back $11 to $1289.5 after a year-to-date $115 surge sent the yellow to multi-month highs beyond $1300 the day before. Still no fuel in crude as prices drop another 60 cents to $45.70 per barrel.

On the options front, an even number of puts and calls have traded across the 12 exchanges so far, or roughly 5.2 million puts and 5.2 million calls. Projected volume of the day is 16.1 million contracts and 5% above the recent daily average.

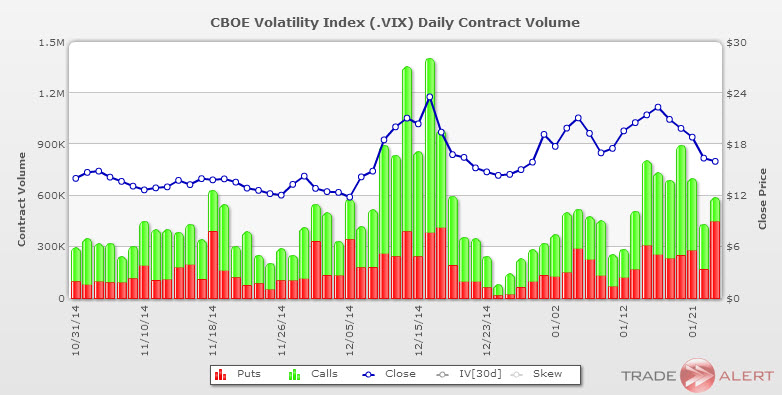

Yet, CBOE Volatility Index (VIX) is down .40 to 16 after the steep losses yesterday and the largest trade in the options pits Friday is a buyer of 200,000 Feb 14 puts on VIX. This rather bold trade ($320 mln in notional) seems to be expressing the view that volatility is heading lower over the next few weeks. 232,000 VIX Feb 14-strike puts have changed hands.

Meanwhile, Apple (AAPL) expiring Weekly 113 calls, 112 calls, 112 puts are the most active equity options as shares cling to the $113 level.

FXCM, Alcoa (AA), and Apache (APA) are also busy today and bears (put buyers) are active in Hartford (HIG), Aeropostale (ARO), and Colgate (CL).

That’s a wrap for this week. Have a nice weekend!

Disclosure:None