What To Expect From Tomorrow’s Job Report

The markets have been wild again this week, mostly influenced by another sell-off in China on Tuesday and extremely volatile commodity prices, making Friday’s jobs report even more important to observe as investors look for a read on the health of the US economy. While the events mentioned have caused economists to push out their predictions for the Fed’s timeline on lifting rates, many want to see if Friday’s numbers will be good enough to prompt more immediate action. The three numbers to watch on Friday are Nonfarm Payrolls, Average Weekly Earnings and Unemployment.

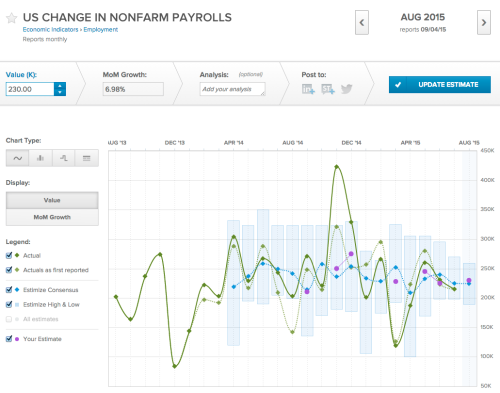

Nonfarm payrolls had a rough second quarter, with readings from both June and July missing the Estimize consensus and falling month-over-month (MoM) by 20.4% and 4.6%, respectively. For August, the Estimize community is predicting a reading of 225,800, a MoM increase of 5.0%. This morning, ADP released their version of the nonfarm payrolls report, which came in at 190,000, below expectations for 205,500 but still growing 2.6% MoM. The ADP report isn’t always indicative of what’s to come for US Nonfarm Payrolls. Since the beginning of the year ADP results have missed this Estimize consensus for all months except May and June, whereas US Nonfarm has only missed in March, June and July. Nonfarm payrolls represent about 80% of the workforce in the United States and therefore is a good representation of the health of the US private sector.

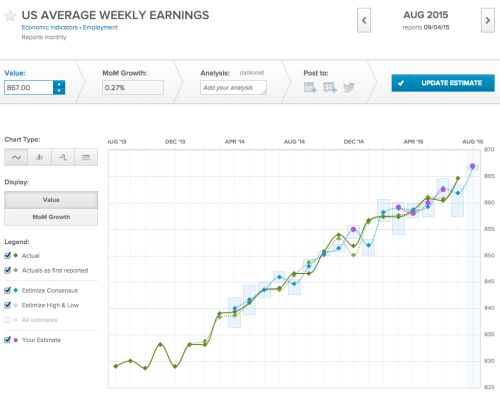

After putting up lackluster numbers for most of the year, average weekly earnings came in at $864.65 in July, the highest level of the year, and the second highest MoM increase at 0.49%, just behind January’s increase of 0.57%. Despite the latest increase, wage growth is still not where it should be at this point in the recovery considering how far unemployment and nonfarm payrolls have come. Janet Yellen has made it very clear that any rate tightening will be based on the improvement of two indicators: jobs and inflation. While nonfarm payrolls and unemployment have been steadily improving, average weekly earnings seems to be the missing piece of the jobs puzzle. August expectations are no different, with the Estimize consensus predicting a reading of $866.73 representing a slight MoM growth rate of 0.24%.

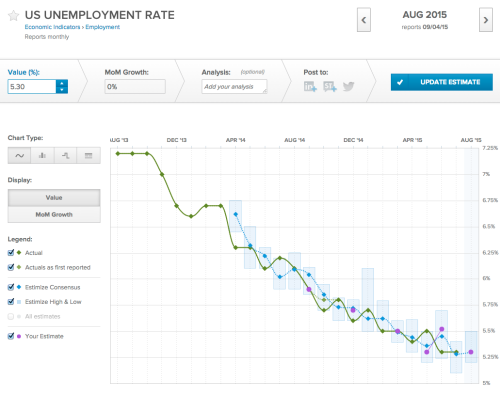

For August, Estimize predicts unemployment will remain unchanged at 5.3% for the third consecutive month. The unemployment rate has been on a gradual decline from its peak of 10% in October 2009, following the global financial crises. The main criticism against the unemployment reading is that it doesn’t fully account for discouraged or underemployed workers. However, the Bureau of Labor Statistics does provide alternative measures of labor underutilization, and one such indicator shows total unemployment including the two aforementioned parties, and that reading has fallen to 10.4% in July from 11.3% in January.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.