What To Believe?

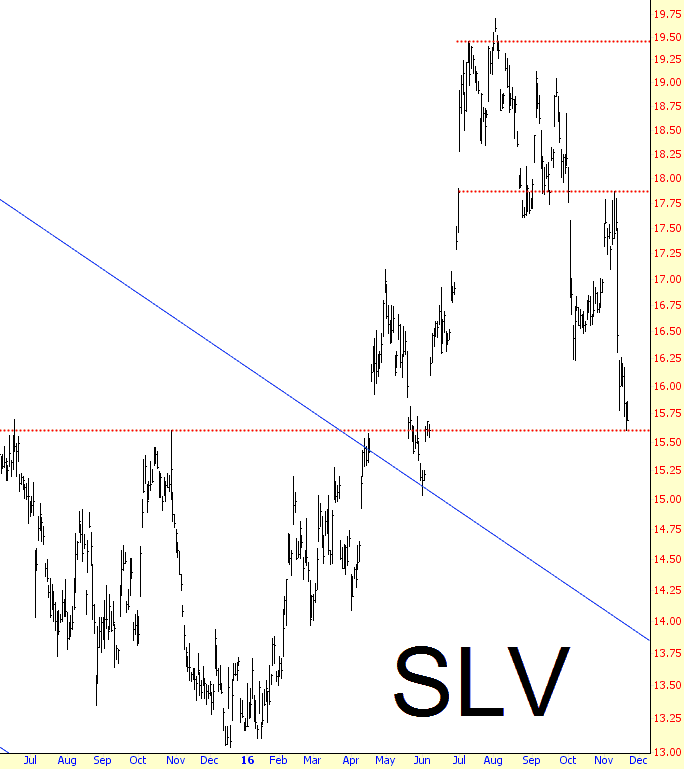

Precious metals present a conundrum at the moment. On the one hand, the metals themselves, such as silver, seem to be battered to a very “cheap” level.

(Click on image to enlarge)

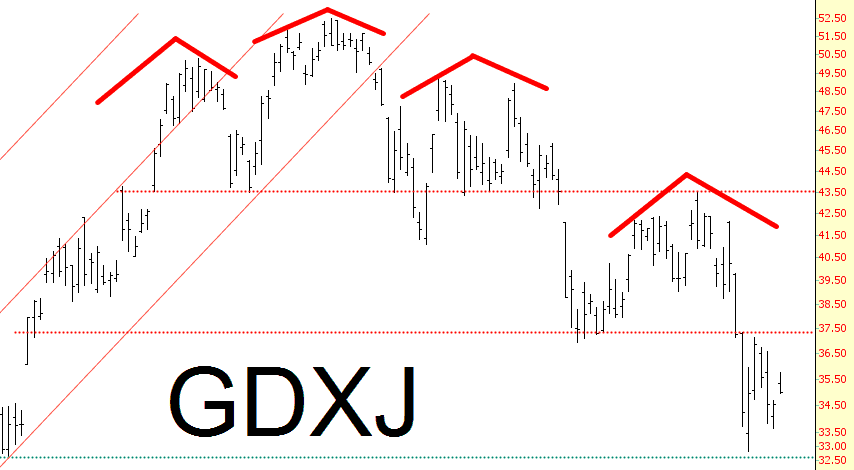

On the other hand, as I’ve mentioned ad nauseum, the miners are positioned for a cataclysmic decline.

(Click on image to enlarge)

I suppose, if I had to choose a side, I’d be in the “brief bounce” camp, since sentiment for precious metals is in the lower single digits. Longer-term, however, I think metals are pretty much hosed.

Disclosure: None.

I am a 'brief bounce' camper too. But the PMs are in the mirror to a US stock market entering blow off mode. PMs will get croaked and then... 2017 contrarian opportunity.

Part of that opp. will be to fade or short the Trump bull market too. It's a return of trickle down economics? Well, Reagan came in after a bear. That's not the case for Trump.