What The Market Is Focused On

Market Outlook

As reported by Barbara Kollmeyer in MarketWatch.com, Wall Street is largely positive on the U.S. stock market, with bullish sentiment at high levels and major indexes having recovered much of the ground they lost in the recent correction. Nonetheless, investors may not be paying enough attention to one of the most significant—and most positive—trends in the economy.

Recent trading has been largely driven by the specter of inflation, the prospect of which has resulted in volatility returning to markets in dramatic fashion. “We’ve been ignoring corporate news. The market has been focused on higher bond yields and rising rates, and those two concerns have overshadowed earnings, which have been strong,” said Mark Grant, managing director and chief global strategist at B. Riley FBR Inc., who added that “investors need to consider all these factors” and that he expected fundaments to return to the foreground of investor attention soon. “Investors have largely looked through one of the strongest earnings seasons on record,” wrote Goldman Sachs, noting the “muted” responses to both positive and negative corporate results. This trend has limited the broader market’s advance, as the news this season has been typically good.

With the season more than 80% over, 54% of S&P 500 companies topped earnings expectations, “the highest percentage since 2010,” according to Goldman. “While rising long-term rates will ultimately become a negative for profits and multiples, we do not see current levels as a reason to de-risk and sell equities,” wrote Dubravko Lakos-Bujas, the chief U.S. equity strategist and global head of quant research at J.P. Morgan Securities.

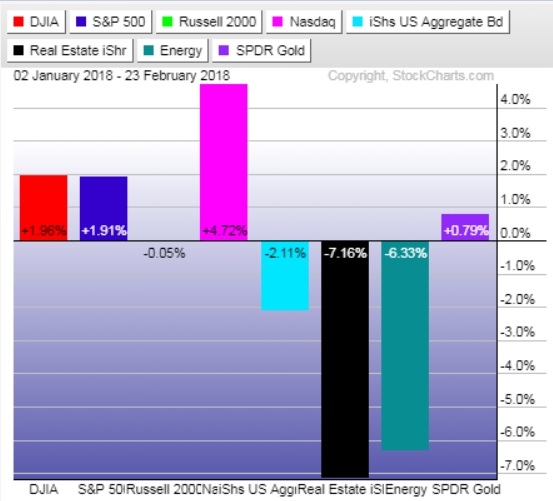

In the graph below, as they have over the past few years’ tech stocks are again taking the lead pulling the equity market higher. After the recent correction Nasdaq shares are leading the equity index rebound in the middle of the middle of the 1st quarter. Over the past several years tech stocks have led the market and are again leading the market recovery bounce. Interest rate sensitive sectors like bonds and real estate are getting pounded by rising interest rates. Energy stocks are being hurt by excessive crude oil inventories.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to ...

more