What Positive Reversal?

Well, it was good while it lasted. After yesterday’s 2%+ rally off the early morning lows, some may have been starting to think that the market was taking a step in the right direction. Then, the after-hours came. With earnings tape bombs from Applied Materials (AMAT), Nordstrom (JWN), and Nvidia (NVDA), bulls are back in full retreat mode as futures are implying a moderate decline to the downside. On second thought, maybe the bulls aren’t in retreat but instead just still stuck in the massive northeast nightmare commute home from Thursday night.

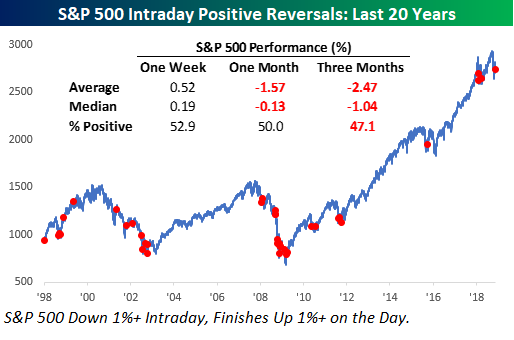

As mentioned in last night’s Closer report, over the last 20 years, Thursday’s reversal was the 35th time in the last 20 years that the S&P 500 was down 1%+ intraday but reversed higher to close up over 1% on the day. The chart below of the S&P 500 shows every occurrence in the last 20 years where we saw similar intraday reversals for the S&P 500. There’s no specific type of market environment that these declines occur in, as there were occurrences in both bull and bear market environments.

Looking ahead, average and median one-week returns were positive following these prior occurrences, but average and median returns in the one and three month periods were actually negative. Just like yesterday, positive reversals feel good at the moment, but it is pretty common for those good feelings to quickly wear off.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. ...

more