What Lies Behind The Stealth Rally In Bonds

While investors debate on whether the Trump rally in equities will continue, participants in the bond market have already made their decision. For the past two weeks the long end of the bond market has been quietly signalling that investors better take a second look at the prospects for growth and inflation. The evidence to support this viewpoint is located in the term premium.

In its simplest form, the term premium is the excess yield that investors require to commit to holding a long-term bond instead of a series of shorter-term bonds. A typical yield curve is sloping upwards since longer term investors normally require a greater return to compensate for the risks of holding debt over many years. The extra return - -referred to as the term premium -- reflects the investor's view of future economic growth and inflation among other considerations.

What goes into measuring the term premium? Researchers use a combination of data generated from surveys and models featuring data from the forward markets to measure the term premium. A rising term premium reflects concerns over excess supply of debt, deteriorating credit quality, and higher inflation in the future; a falling term premium has these factors moving in the other direction.

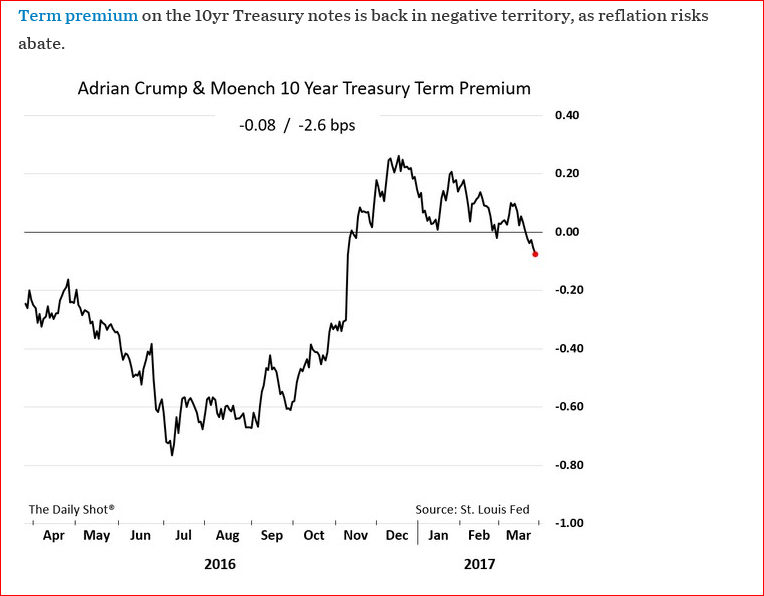

As the accompanying chart makes clear the term premium has moved into negative territory. At the height of the stock market euphoria over the Trump election, the bond market participants required a premium of over 20bps for the 10-year Treasury bond as inflationary expectations shot up. More significantly, the term premium was as low as negative 80 bps in the summer of 2016. Thus the move into positive territory was quite sudden and dramatic. Some bond analysts then started make the call that the long run bond market rally of the past 30 years has ended and a new era of rising bond yields was beginning. We are not hearing this calls anymore.

Ben Bernanke argues that the “low level of term premiums in turn reflects a number of factors, including: minimal investor concern about inflation; relatively low uncertainty about the likely future course of interest rates; a strong global demand for safe, liquid assets; and quantitative easing programs by central banks”[1] If the bond market is saying that inflationary expectations have abated, then the question arises: what will be path of short term rates that the Fed will set for 2017? Right now, the bond market is saying not to expect a rapid increase in those rates.

[1] https://www.brookings.edu/blog/ben-bernanke/2015/04/13/why-are-interest-rates-so-low-part-4-term-premiums/

Disclosure: None.