Weekly Wrap-Up, Market Forecast, Sector Watch: SPX, Nasdaq - June 29, 2015

“Greece” once again dominated the news in the financial markets. Last week, things were already volatile. Nasdaq popped to a new all-time high on Monday and SPX tested 2130 again. But, as talks between Greece and its creditors dragged on, markets pulled back. Selling picked up some speed as we headed into the weekend. But, still, stocks held up pretty well on Friday.

We traded well last week and my Ecstatic Plays Portfolio is at a new all-time high. The portfolio is up +28.21% in the past 90 days and +37.87% for 2015! Here are the closed trades for the week:

The big news this weekend was that Greece first announced a referendum to let its people vote on July 5 on the outcome of negotiations with its international creditors. Tonight, global financial markets are tumbling as Greece imposes capital controls and closes banks! At the time of this writing, Asian markets were down big, although China almost came all the way back to even momentarily!

For the week, the Dow was down 69.27 points; SPX slid 8.5 points; Nasdaq lost 36.49 points. Gold pulled back again to below $1180/ounce, while oil was little changed. Here are how US markets looked after Friday’s close:

SPX

SPX slid 0.82 point to close at 2101.49. It closed just below its daily MAs. The MACD was down.

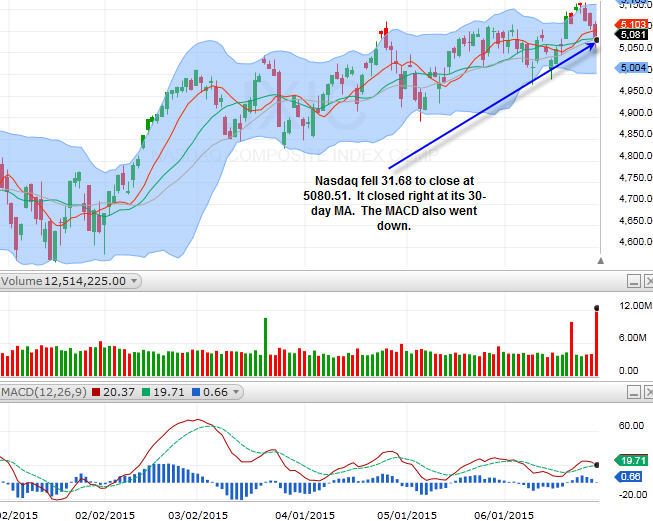

Nasdaq

Nasdaq fell 31.68 to close at 5080.51. It closed right at its 30-day MA. The MACD also went lower.Both SPX and Nasdaq showed a neutral stance at Friday’s close, as investors waited to see what would happen in Greece over the weekend. Well, as mentioned above, Greece has imposed capital control and ordered banks to close for a week, although ATMs will remain open with a 60 euro daily limit on withdrawals. For the new week…

Disclosure: None.