Weekly Wrap-Up + Market Forecast

“For the new week, I think we will see more volatility. For SPX, 2070 is a support, below which the next support lies at 2050. Nasdaq has support first around 4900, then at around 4850. This could be a struggle. There will be profit-takers locking in big profits. On the other hand, there are likely still money on the sideline trying get in.”

Indeed, it was a very volatile week. The market was up on Monday. Then, it took a steep drop on Tuesday, with SPX ending below 2050. Wednesday, things slid a little more, with SPX touching 2040. But, Thursday saw a huge bounce, bringing SPX all the way back to 2065! Friday morning was weak, with SPX reeling back to below 2050. But, buyers came in in the afternoon and drop SPX back above 2050 for the close.

We had a mixed week. Here are the closed trades:

For the week, the Dow was down 107.47 points; SPX fell 17.86 points; Nasdaq dropped 55.61 points. Oil (WTI) took a big drop on Friday, closing under $45/barrel. Gold also dropped, closing below $1160/ounce. At the time of this writing, Asian markets were up, with China leading the pack, gaining +1.8%! Here’s where the US markets closed on Friday:

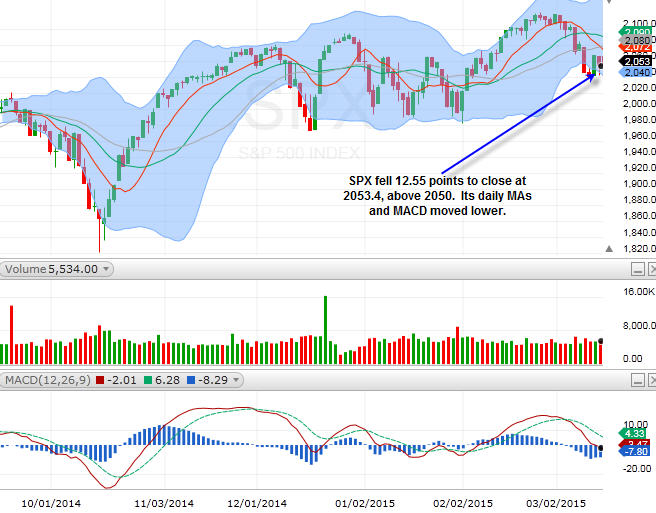

SPX

On Friday, SPX fell 12.55 points to close at 2053.4, above 2050. Its daily MAs and MACD moved lower.

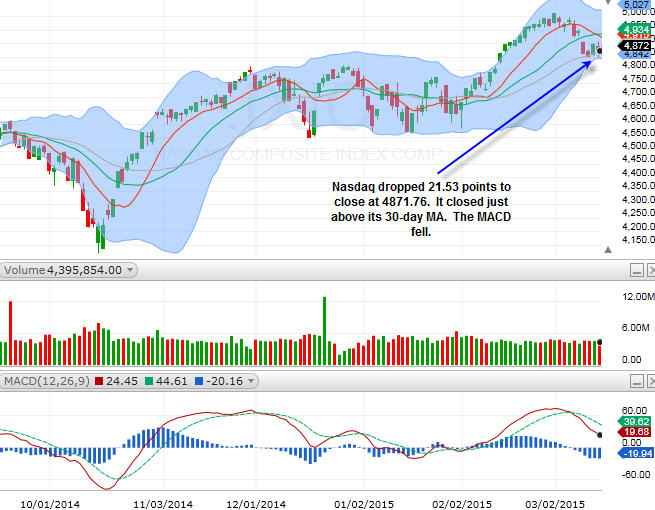

Nasdaq

Nasdaq dropped 21.53 points to close at 4871.76. It closed just above its 30-day MA. The MACD fell.

SPX closed below its daily MAs, but, Nasdaq still managed to close just above its 30-day MA. For the new week…

Disclosure: None