Weekly Technical Perspective On The New Zealand Dollar (NZD/USD) - Wednesday, August 8

Updated weekly technicals for NZD/USD- price range in focus just above critical support

In this series, we scale-back and take a look at the broader technical picture to gain a bit more perspective on where we are in trend. The New Zealand Dollar is trading just above a critical support zone heading into tonight’s RBNZ interest rate decision- here are the key targets & invalidation levels that matter on the NZD/USD weekly chart.

NZD/USD WEEKLY PRICE CHART

(Click on image to enlarge)

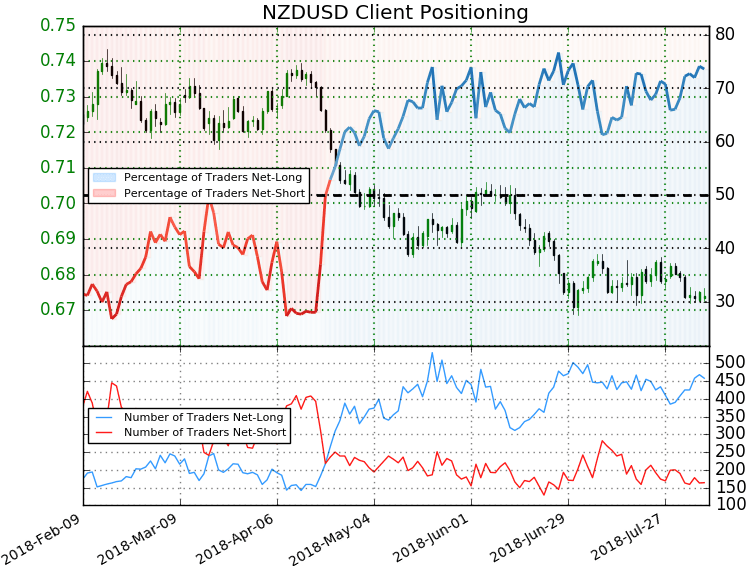

Notes: The New Zealand Dollar has been trading within a well-defined range just above a critical support zone for more than five weeks now. The area in focus is “6663-6717 - a region defined by the 61.8% retracement of the 2015 advance and the 100% extension of the 2017 decline.” The broader short-bias remains vulnerable heading into this region.

Initial resistance stands with the May 2017 low-week close / May 2018 low at 6851/54 – note that the 61.8% line of the descending pitchfork formation converges on this threshold over the next few weeks. A break lower from here targets the median-line (currently around ~6580s) backed by the 78.6% retracement / 2015 low-week close at 6453/88- look for a larger reaction there IF reached.

Bottom line: NZD/USD has carved out a multi-week range just above key support with the immediate focus on a break of the 6663-6854 zone for guidance. From a trading standpoint, I’m on the lookout of a near-term exhaustion low on a drive lower into this support zone. That said, we’ll need to respect a break below 6663 with such a scenario risking accelerated Kiwi losses. Ultimately, a breach above the July range highs would be needed to suggest a more significant low is in place. Keep in mind the Reserve Bank of New Zealand (RBNZ) interest rate decision is on tap later tonight with the central bank widely expected to hold interest rates at 1.75%. I’ll publish an updated NZD/USD scalp report once we get some more clarity on near-term price action.

NZD/USD TRADER SENTIMENT

(Click on image to enlarge)

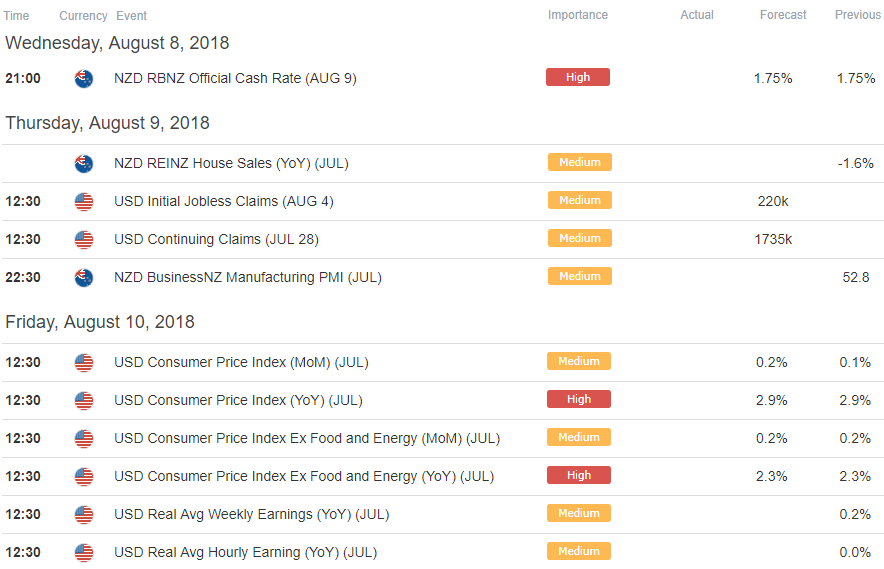

- A summary of IG Client Sentiment shows traders are net-long NZD/USD - the ratio stands at +2.79 (73.6% of traders are long) – bearish reading

- Traders have remained net-long since April 22nd; price has moved 7.3% lower since then

- Long positions are3.2% lower than yesterday and 11.7% higher from last week

- Short positions are 4.7% lower than yesterday and 13.7% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias from a sentiment standpoint.

RELEVANT NZD/USD DATA RELEASES

(Click on image to enlarge)

Check out our 3Q projections in our Free DailyFX Trading Forecasts

Join Michael for Live Weekly ...

more