Weekly Energy Roundup: Offshore Drilling Companies, September 17 To September 21

It has been a very exciting week in the offshore drilling sector, most notably because we saw four different major offshore drilling companies get awarded new contracts. These contracts were primarily for harsh-environment semisubmersibles, which is an area that has been seeing a lot of attention over the past year or so, but do provide us with a clear indication that the offshore drilling industry has begun to recover. This is something that we have been waiting for a long time as the lengthy industry downturn has been forcing multiple companies either into bankruptcy or mergers with larger entities. Now may be the time for investors to pull the trigger however as profitability looks to be slowly coming, particularly for those companies that own harsh-environment rigs.

Transocean

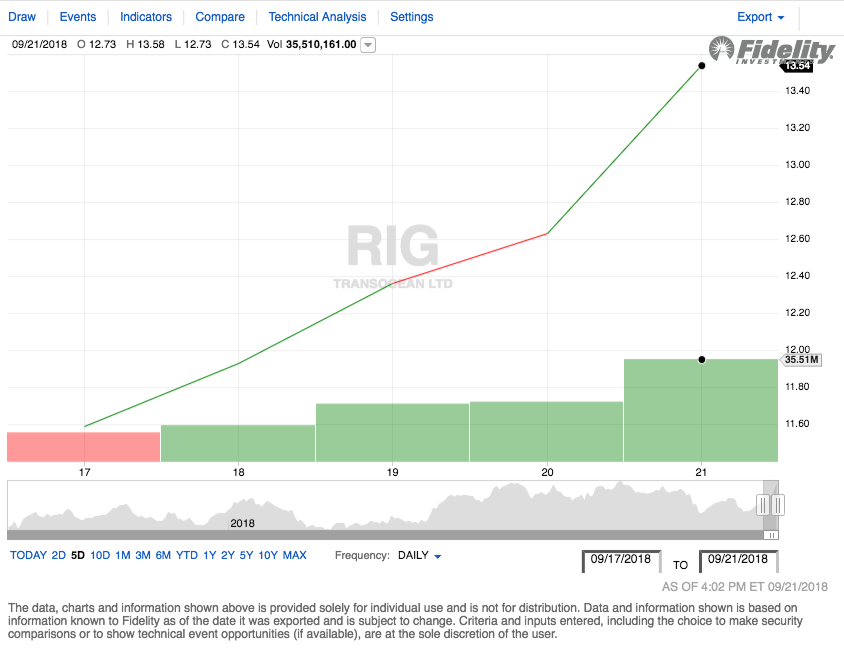

On Monday, September 17, 2018, Transocean (RIG) opened at $11.87 per share. The stock climbed on every day over the course of the week, with its sharpest gain coming on Friday. Ultimately, Transocean closed out the week at $13.54. This gives the stock a 14.07% gain on the week, a very respectable performance.

Source: Fidelity Investments

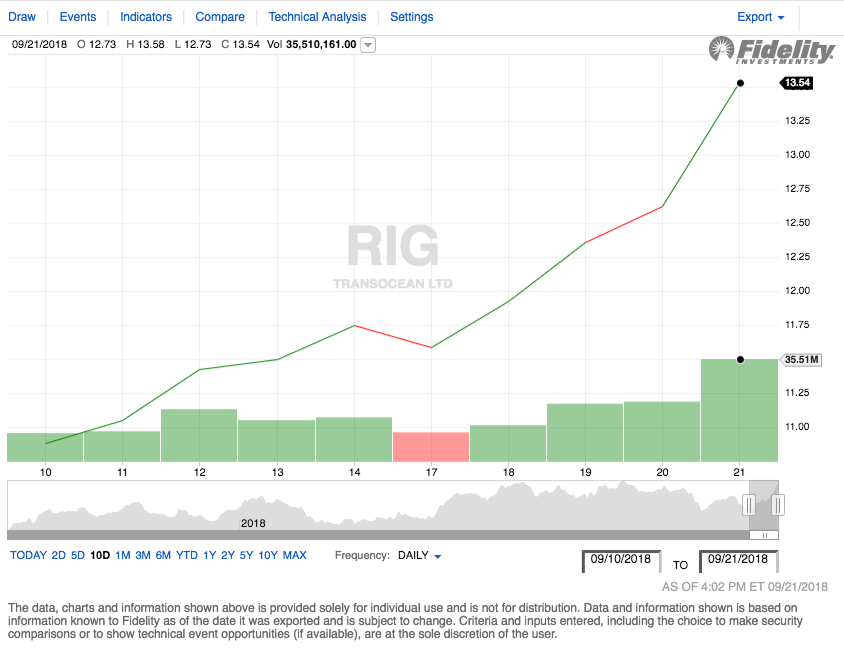

Transocean's stock performance was largely positive over the trailing two-week period. In fact, the stock only saw one day in which its share price declined. Transocean opened at $10.91 on Monday, September 10 and climbed to $13.54 by Friday, September 21. This gives the stock a two-week gain of 24.11%, which any investor should be able to appreciate.

Source: Fidelity Investments

One of the biggest pieces of news that the company reported was that one of its new rigs, the harsh-environment semisubmersible Transocean Norge, secured a 300-day six-well contract with Norwegian energy giant Equinor ASA. This contract should prove to have a positive effect on the company’s cash flows once the rig begins working on it next Spring. It is also one of the four contracts that we saw get announced over the course of the week.

Ensco plc

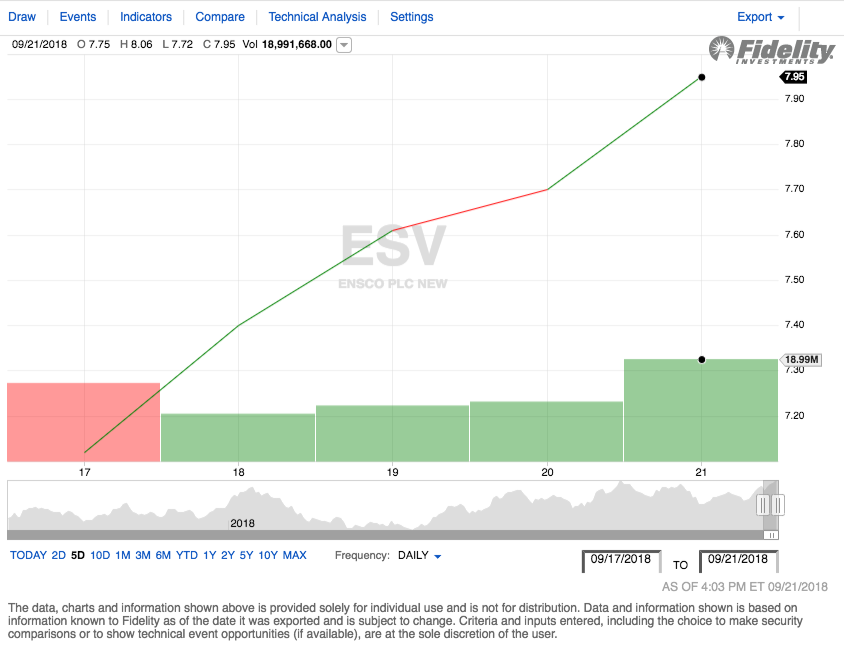

Ensco (ESV) stock also increased over the week ending September 21, 2018 and it likewise went more or less straight up over the period. On September 17, the stock opened at $7.55 per share and closed out the week at $7.95 per share. Overall, the stock delivered a gain of 5.30% on the week.

Source: Fidelity Investments

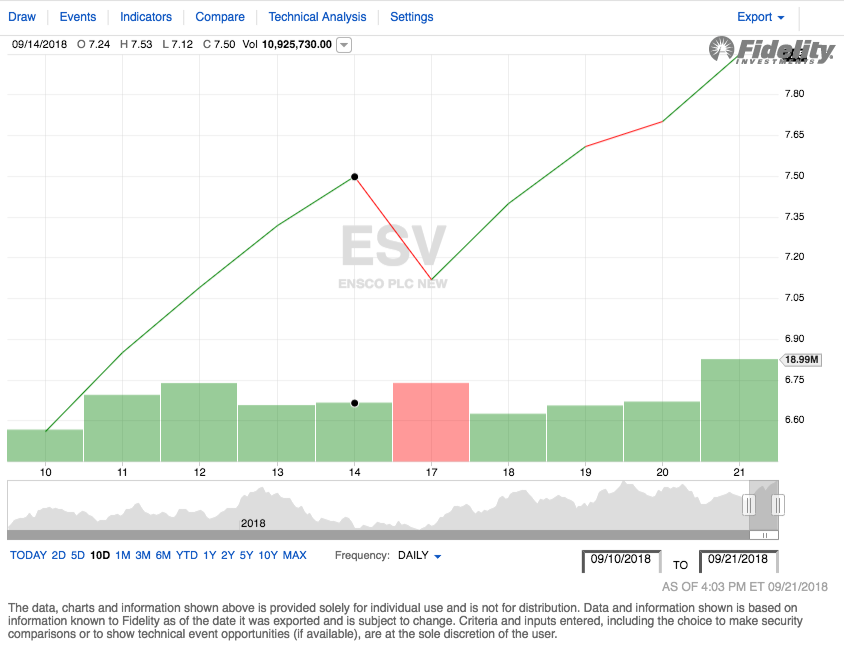

The stock's performance over the trailing 10-day period was also quite strong, although like Transocean it did see one day in which it ended in the red. On September 10, 2018, Ensco’s stock opened at $6.50 per share and largely delivered daily gains over the following two-week period. The stock saw only one down day, delivering a 22.3% gain over the two-week period.

Source: Fidelity Investments

On Wednesday, Wells Fargo (WFC) analyst Judson Bailey raised his price target for Ensco to $7.50, which may have had a positive impact on the stock performance. Although with that said, Ensco is already above that target price.

Noble Corp.

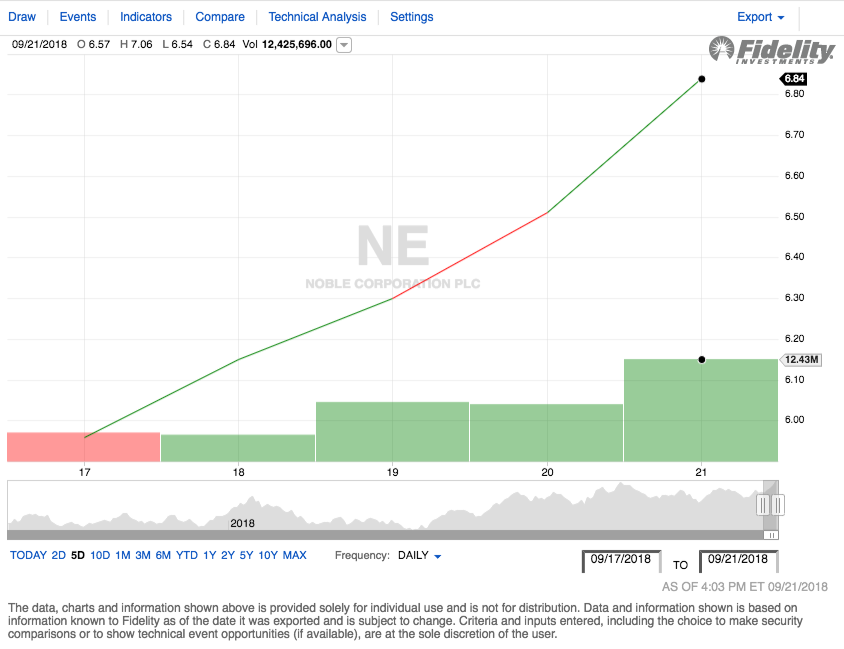

Noble’s (NE) stock also delivered strong gains to its holders over the past week. On September 17, 2018, Noble's stock opened at $6.10 per share. By the end of the week, the stock had gained $0.74 and closed at $6.84. This represents a gain of 12.13%.

Source: Fidelity Investments

Noble’s stock delivered solid gains over the trailing two-week period, although it did have somewhat more volatility than its peers. The stock saw two days in which it ended the day in the red. On Monday, September 10, shares of Noble Corp. opened at $5.74. As they closed at $6.84 on September 21, the company’s stock delivered a total gain of 19.16% over the two-week period. This is certainly a performance that should be appealing to any investor.

Source: Fidelity Investments

Noble was another company that benefited from the ongoing recovery in the offshore drilling industry during the week. On Friday, September 21, 2018, the company announced that it is buying a high-specification jack-up rig and that it has already secured a contract for the rig. The company provided little detail on the contract except for the fact that it is an exceptionally long three-year job in the Middle East. This was the only one of the four major contract awards this week that did not go to a harsh-environment rig.

Diamond Offshore

Diamond Offshore (DO) had somewhat more volatility in its stock price over the past week than some of its peers, but it likewise delivered a gain to stockholders. Diamond Offshore’s stock opened the week at $17.64 per share. The stock closed out the week at $19.34 per share, giving the company a return of 9.64% over the week.

Source: Fidelity Investments

The stock exhibited considerable volatility over the past two weeks, at least when compared to its peers, giving traders plenty of opportunities to profit. On Monday, September 10, 2018, Diamond Offshore opened at $16.27 per share and proceeded to deliver a series of daily gains and losses. Overall, the stock delivered a gain of 18.87% over the two-week period.

Source: Fidelity Investments

Diamond Offshore’s share price may have benefited from upgrades at Morgan Stanley (MS) and RBC (RBC) for the industry as a whole, although the company itself was not explicitly upgraded. Otherwise, there was no significant news affecting Diamond Offshore over the past week.

Rowan Companies

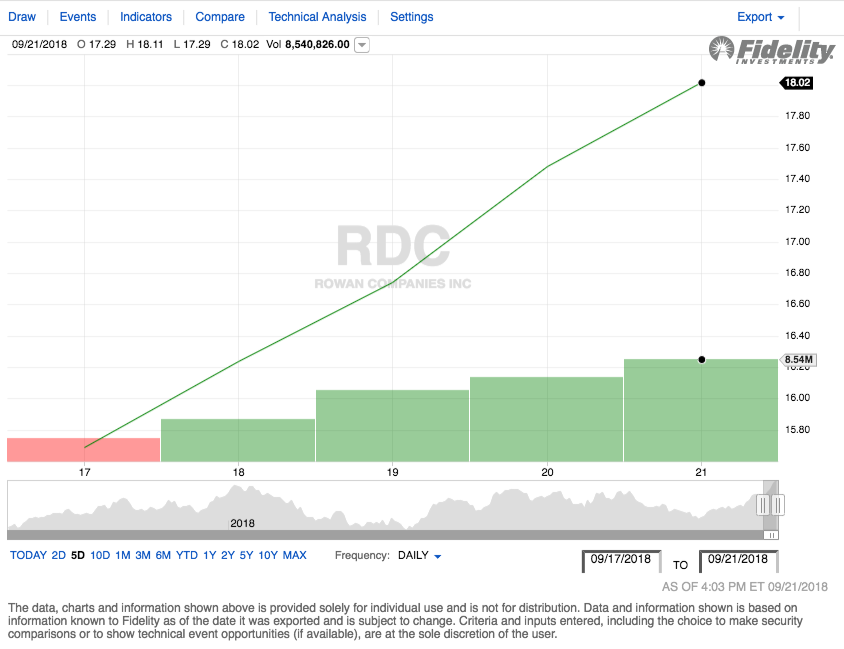

As was the case with many of the offshore drilling companies tracked by this report, Rowan (RDC) saw its share price almost go straight up over the past week. The stock opened at $16.05 per share on Monday, September 17, 2018 and closed out the week at $18.02. This represents a gain of 12.27% over the week.

Source: Fidelity Investments

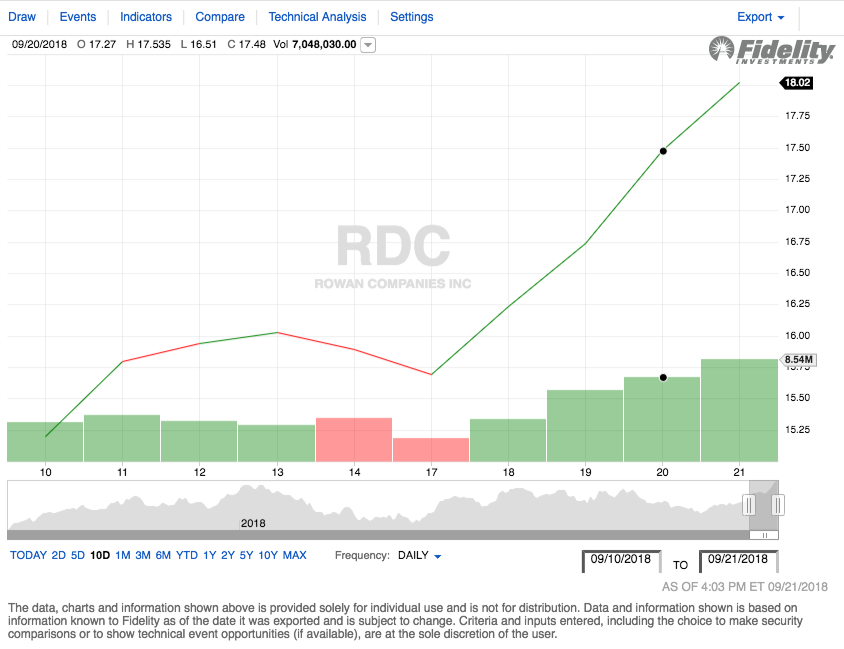

Rowan’s two-week stock price performance was likewise more volatile than a few of its peers as it did have some down days. On Monday, September 10, 2018, Rowan shares opened at $14.99 and rose over much of the week before declining on Friday. It then proceeded to post a strong performance during the second week of the period. Overall, the stock delivered a two-week gain of 20.21%.

Source: Fidelity Investments

As was the case with Diamond Offshore, Rowan had no notable news affecting the stock this week. With that said though, Rowan was one of the drillers that was upgraded by RBC during the past week due to the improving conditions in the industry. Rowan also has a very strong presence in the Middle East so it is possible that the company’s share price reacted positively to Noble’s new contract in the area.

Seadrill

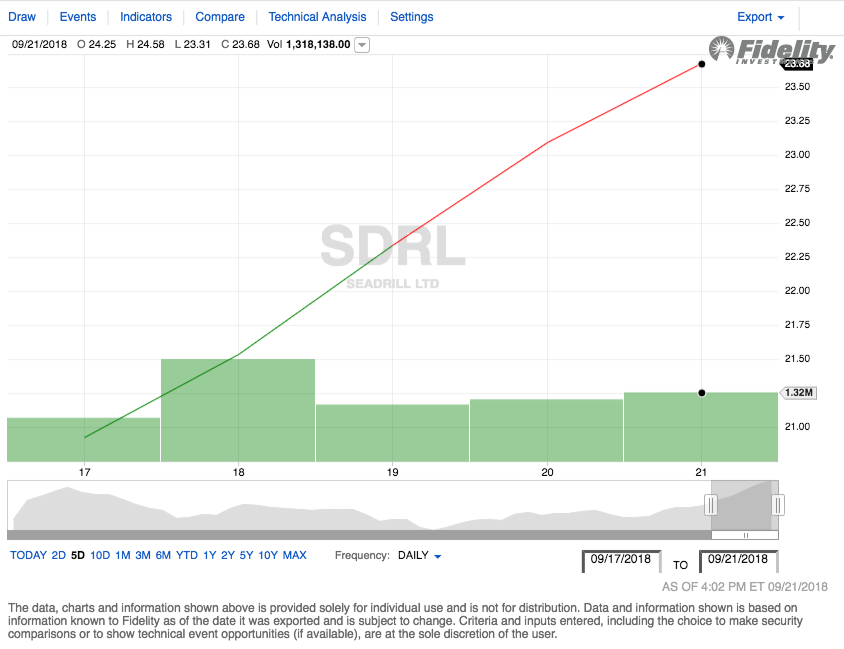

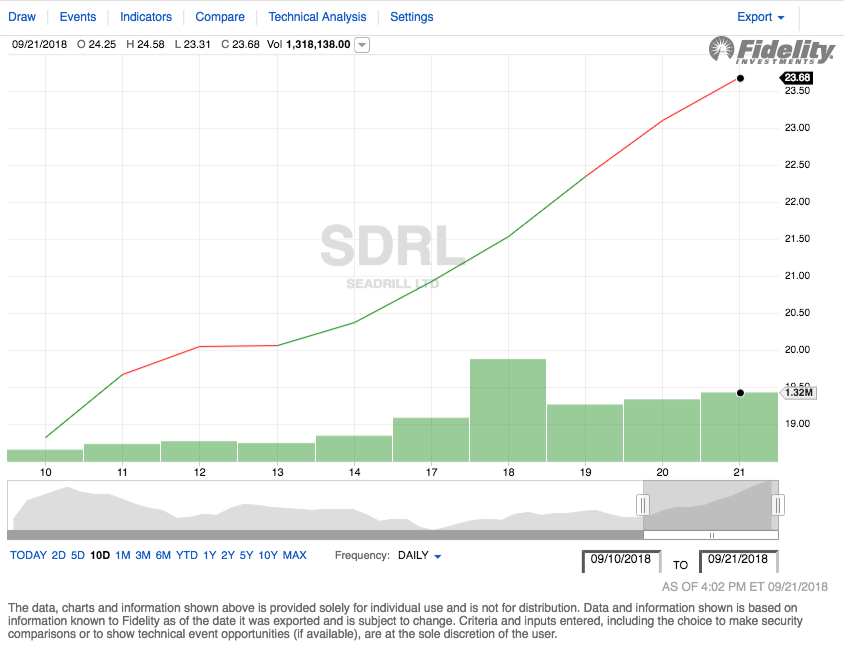

Seadrill (SDRL) has been performing fairly well since it emerged from bankruptcy, although the specter of the Chapter 11 restructuring likely hangs over the stock in the eyes of many investors. On September 17, shares of Seadrill opened at $20.70 and saw some very strong performance over the remainder of the week. The shares closed out the week at $23.68, representing a gain of 14.40%.

Source: Fidelity Investments

The company had relatively little volatility over the past two weeks, as it posted almost consistent gains. The stock opened at $18.75 per share on Monday, September 10, 2018 and closed at $23.68 on September 21, 2018, which gives it a two-week gain of 26.29%.

Source: Fidelity Investments

Seadrill was another of the companies that was awarded a harsh-environment drilling contract over the course of the week. In this case, the contract was for the use of the West Hercules in the Barents Sea (a marginal sea of the Arctic Ocean). The harsh-environment ultra-deepwater sector is one of the few sectors in which drilling firms are able to generate solid, if not enormous, cash flows from their drilling rigs so this is definitely something that should benefit the company going forward.

Disclosure: I have no positions in any stocks mentioned in this article and no plans to take any positions in any stock mentioned in this article within the next 72 hours.