Weekly Energy Roundup: Offshore Drilling Companies, Dec. 18 - 22

The news cycle as a whole was somewhat slow this week, as is somewhat usual for the week leading up to the winter holidays. With that said, the last two weeks of the trading year are oftentimes subject to what is known as the “Santa Claus Effect.” Investopedia defines this phenomenon thusly,

“A Santa Claus rally is a surge in the price of stocks that often occurs in the last week of December through the first two trading days in January. There are numerous explanations for the Santa Claus Rally phenomenon, including tax considerations, happiness around Wall Street, people investing their Christmas bonuses and the fact that pessimists are usually on vacation this week.”

While it is certainly true that this effect will be most prevalent during the shortened trading week of December 26, it does occasionally start early so we may have seen some of the impact of it during this week. It may not have affected the offshore drilling sector as strongly as some other sectors however as the offshore drilling sector is still widely perceived to be fraught with risk, despite that fact that all the risk has been priced into the stocks for quite some time now and the industry has begun to recover. As usual, this weekly report will look at the price action of six representative stocks to serve as a proxy for the industry as a whole.

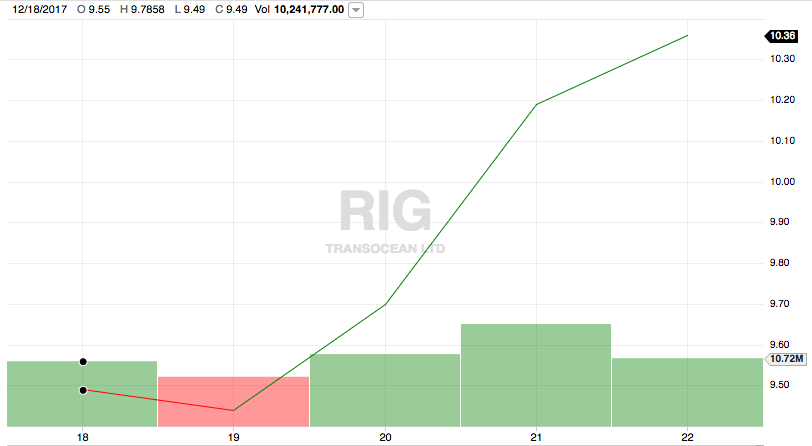

Transocean (RIG)

On Monday, December 18, 2017, Transocean opened at $9.55 per share. The stock declined slightly on Tuesday, December 19 then rallied and increased in price for the remainder of the week, closing at $10.36 per share. This gives the stock an 8.48% gain over the week.

Source: Fidelity Investments

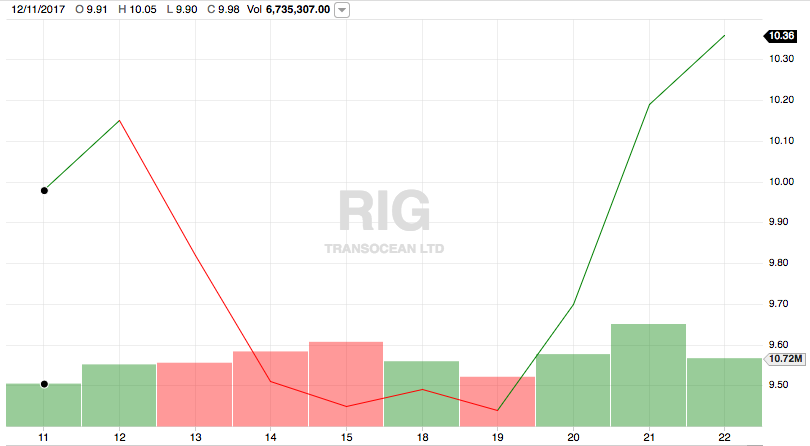

Transocean's stock price was quite volatile over the past two weeks. It declined quite sharply during the week of December 11, as was discussed during last week’s edition of this report, and then increased sharply this week. Overall, the stock gained 4.54% during the past two weeks. Traders may have liked the overall performance as well due to the volatility.

Source: Fidelity Investments

On Thursday, December 21, 2017, Transocean announced that it has secured a 22-well contract from Norwegian oil giant Statoil ASA (STO). This contract is expected to generate at least $286 million for the company beginning in the third quarter of 2019. While the contract itself will not commence for quite some time yet, the sheer size of it was enough to trigger a 5% rally on Thursday and provides us with further evidence that the offshore drilling industry as a whole has begun to recover.

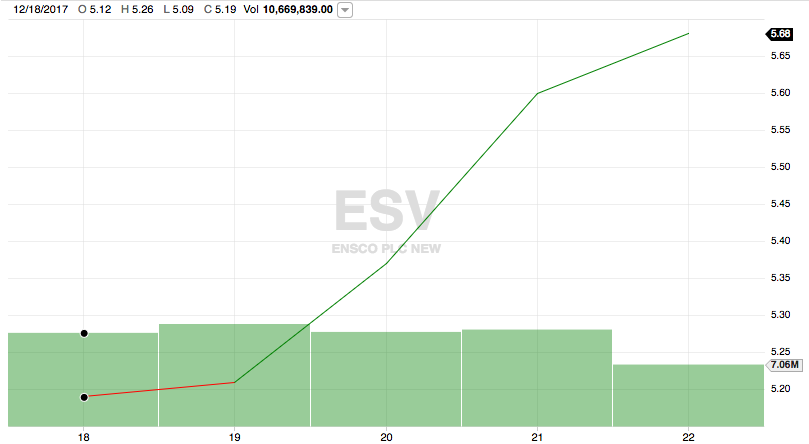

Ensco plc (ESV)

Ensco stock also increased over the week ending December 22, 2017. On December 11, the stock opened at $5.12 per share and closed out the week at $5.68 per share. This represents a gain of 10.9% on the week.

Source: Fidelity Investments

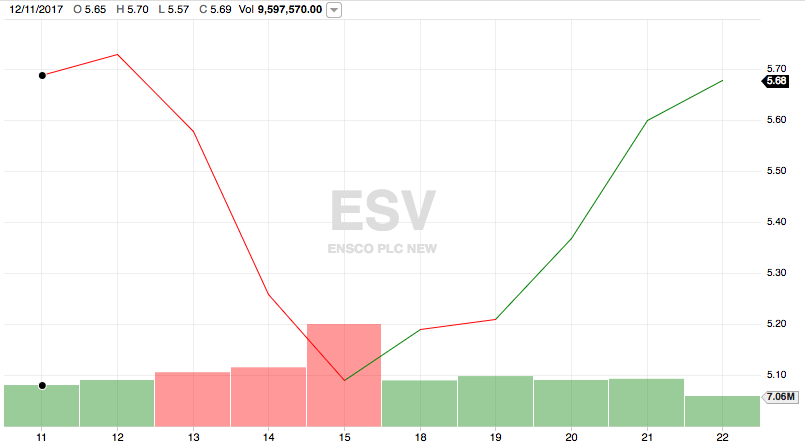

Ensco was significantly more volatile over the past two weeks, although in the end, the price was almost perfectly flat. On December 11, Ensco opened at $5.65 per share. This represents a two-week gain of 0.5%. As was the case with Transocean, however, Ensco’s stock was considerably volatile over the period, posting a fairly large loss last week and then a strong gain this week. This could have allowed some profit potential for a trader that could take advantage of the volatility.

Source: Fidelity Investments

Ensco had no news of any significant relevance to the stock price over the past week. It is certainly possible that the strong gains that it saw were due to revived faith in the industry due to Transocean’s large contract award and/or the Santa Claus effect.

Noble Corp. (NE)

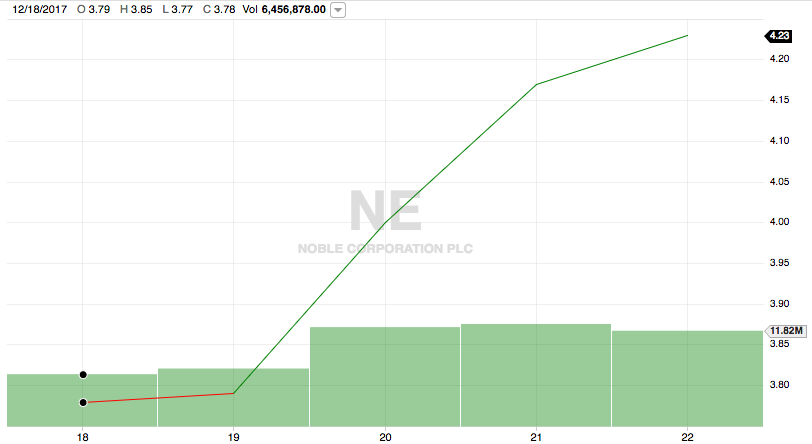

Noble’s stock also delivered strong gains to its holders over the past week. On December 18, Noble's stock opened at $3.17 per share. By the end of the week, the stock had gained $1.06 and closed at $4.23. This represents a gain of 33.44%!

Source: Fidelity Investments

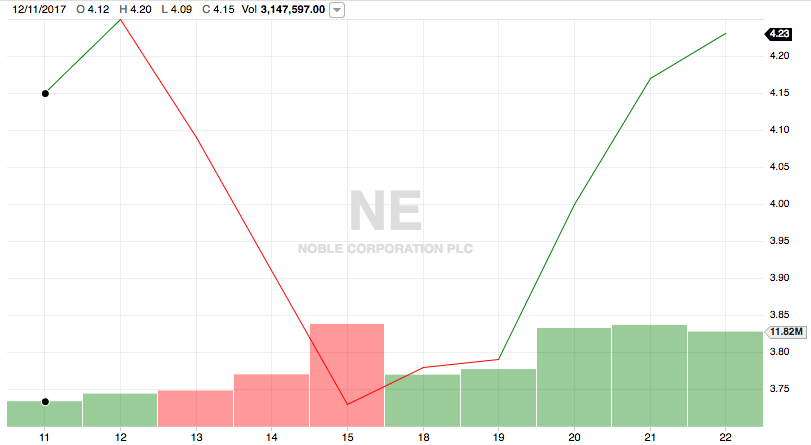

The company’s stock chart over the past two weeks looks quite similar to that of its peers in that it had a large decline last week and then a strong gain this week. On Monday, December 11, 2017, Noble opened at $4.12 per share. Thus, its two-week performance is a gain of 2.67% but with sufficient volatility that would please a short-term day trader that could take advantage of it.

Source: Fidelity Investments

On Monday, December 18, Noble was sued by Paragon Offshore (PGNPQ) that claims that the company jettisoned a fleet of old rigs by spinning off Paragon Offshore (which is admittedly how the deal looked to me a few years ago) and loaded up the latter company with $1.73 billion in debt. Paragon Offshore thus claimed that this spin-off was fraudulent. While that news did not appear to have an effect on the stock price this week, it is still something that investors should keep an eye on as this lawsuit could have a large impact on the company depending on how it is resolved.

Diamond Offshore (DO)

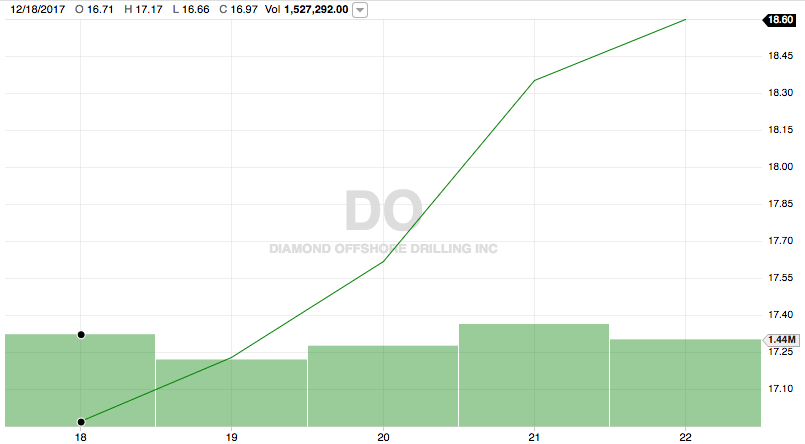

Diamond Offshore also benefited from significant stock market strength over the past week, climbing from $16.71 to $18.60 over the course of the week. The company’s stock was quite consistent at delivering these gains as well, seeing increases every single day.

Source: Fidelity Investments

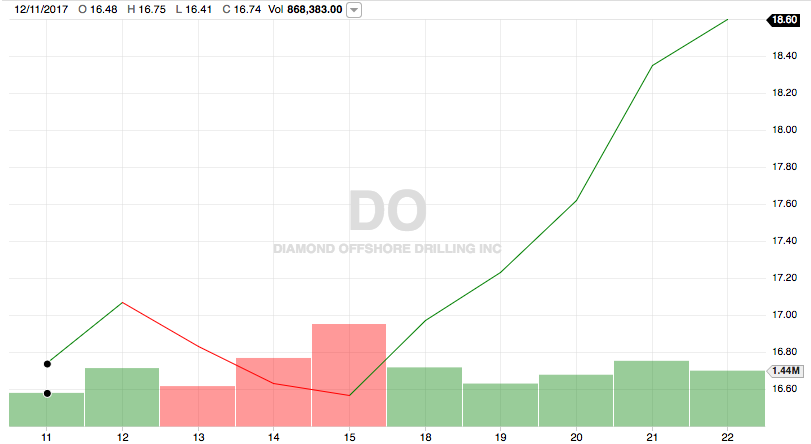

This gain comes on the heels of a slight loss last week. With that said, Diamond Offshore’s stock price has shown much more strength than most other offshore drilling companies over the entire course of the multi-year downcycle so it is unlikely to be a surprise that it was nowhere near as volatile as the peer companies that are also discussed in this report. Diamond Offshore opened at $16.48 per share, giving the company a two-week gain of 12.86%.

Source: Fidelity Investments

As was the case last week, Diamond Offshore had no notable news over the past week. It appears that the reason for the company's continued outperformance is largely its stability and incredibly low debt load compared to many of its peers. The fact that it has Loews Corporation (L) backing it may also add some appeal.

Rowan Companies (RDC)

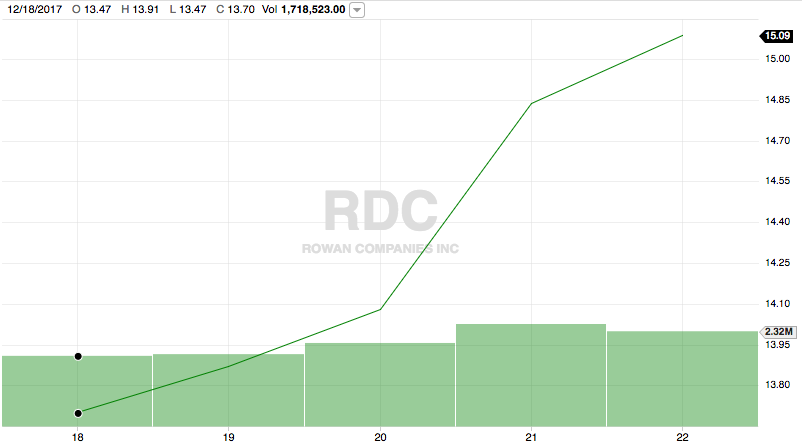

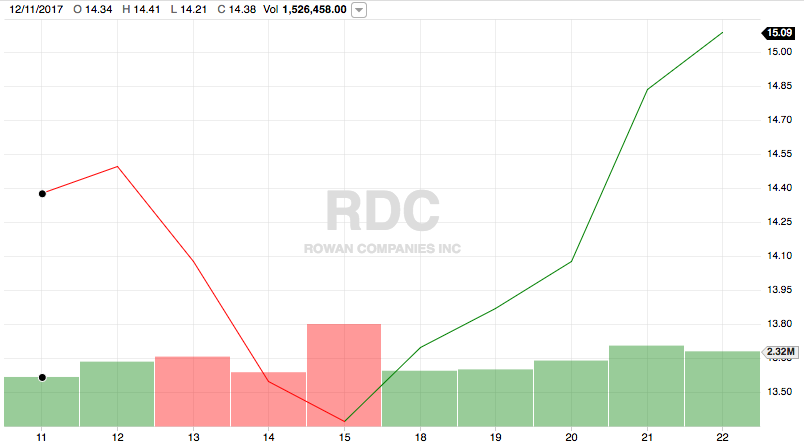

Rowan's performance over the past week was very similar to that of its peers in that the company's shareholders saw the values of their positions increase. Rowan's stock opened the week at $13.47 and gained consistently throughout the week, ultimately closing at $15.09 per share on Friday, December 22. This represents a gain of 12.03% for the week. This is better than what some of its peers returned as shown above.

Source: Fidelity Investments

Rowan’s two-week stock price performance resembles that of its peers Transocean and Ensco. The company’s stock endured a weeklong series of losses during the week of December 11, before reversing course this week and posting gains. Overall, Rowan posted a gain of 5.23% over the course of the two-week period.

Source: Fidelity Investments

As with many of its peers, Rowan had no notable news affecting the stock this week. It does seem to be less followed than some of the other companies discussed here by the American financial media as well so what impact that has could be anybody's guess, but that may have an impact on its overall performance.

Seadrill (SDRL)

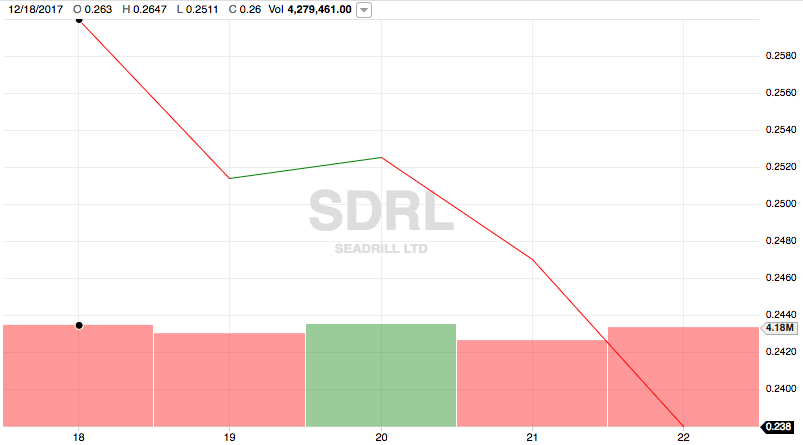

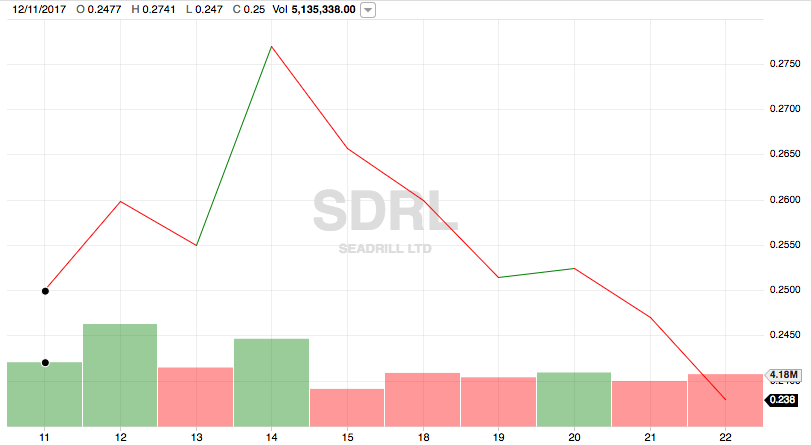

Seadrill is easily the most troubled firm on this list as it is the only one currently in Chapter 11 bankruptcy. However, it is also the only company here to have posted a loss over the past week. Seadrill opened the week at $0.263 per share and immediately began to fall. The stock closed the week at $0.238 per share. It was also perhaps the most volatile stock of those listed here over the period. Overall, Seadrill posted a loss of 11.4% over the week.

Source: Fidelity Investments

The company had a significant amount of volatility over the past two weeks, which is not atypical of a firm going through restructuring. Indeed, many view these stocks as being most appropriate for traders, which is a characterization that I would agree with. With that said, the stock opened at $0.2477 per share on Monday, December 11, 2017, and closed at $0.238 on December 22, 2017, which gives it a two-week loss of 3.92%.

Source: Fidelity Investments

Seadrill had no significant news affecting it over the past week, so the stock’s performance is entirely due to the uncertainty surrounding the company as it attempts to restructure itself. Long-term investors may wish to avoid it in general until more certainty is available, while traders may appreciate the volatility and wish to take advantage of the sharp swings to earn some money.