Weekend Update - SPX Bounces, Challenges Its Short-Term Support

VIX made a new high off its seasonal low at 11.02 on August 9. However, it corrected back to its trendline. The next important milestone is Cycle Top resistance at 24.20 where a long-term breakout and a change of trend may occur.

(ZeroHedge) By Mr. Risk - State Street Global Markets: Thanks for nothing, central banks!

-

If central banks provided the prototypical inflection point, risk assets should get destroyed next week.

-

Feast your eyes on a compendium of volatility charts. The beast wants out.

-

Keys to watch: DXY, EUR/AUD, and 10-year yields. Move over ZEROHEDGE. There is a new BEAR in town…

SPX bounces, challenges its Short-term support

SPX bounced above its Intermediate-term support at 2139.91 to challenge Short –term resistance at 2168.04. It remains on a sell signal with weekly MACD confirming it. Long-term support and mid-Cycle support between 2060.96 and 2050.17 appear to be the next targets for the decline. However, the more important targets may be those of the two Orthodox Broadening /Tops. The Broadening Top trendline and 4.5-year trendline intersect near 1940.00. Should those supports be broken, a panic decline may follow.

(WSJ) U.S. stocks fell Friday but notched weekly gains as global central banks assuaged investors’ fears about the possibility of an end to easy money.

Friday’s declines deepened as tumbling oil prices pulled down shares of energy companies. Energy shares in the S&P 500 fell 1.3%.

The Dow Jones Industrial Average fell 0.7%, and the S&P 500 declined 0.6%. The Nasdaq Composite also slipped 0.6%.

For the week, the S&P 500 gained 1.2% after the Federal Reserve held off on raising interest rates and the Bank of Japan revamped its monetary policy.

NDX made a new all-time high

NDX made a new all-time high. Before you go out to celebrate, consider this; the previous all-time high was March 23, 2000 at 4816.35. Not counting inflation or compounding, the NDX made exactly .1% per year (1.64% total) for the last 16.5 years. The Nasdaq Composite did a little better making a 4.1% total gain over the past 16.5 years.

(CNBC) U.S. stocks closed higher on Thursday, with the Nasdaq having another record-setting session, as investors digested several economic data releases while processing the Federal Reserve's latest monetary policy decision.

The Dow Jones industrial average rose 156.18 points at session highs before closing about 100 points higher, with Boeing contributing the most gains.

"You had a little bit of a concession before this; ... now you're getting back to where we were," said Gene Tannuzzo, portfolio manager at Columbia Threadneedle Investments. "I think this a bit more of a technical rally, which should make you a little bit cautious."

"It's a hope that the economy is bad enough for the Fed to stay accommodative and good enough to stay in risky assets," he said.

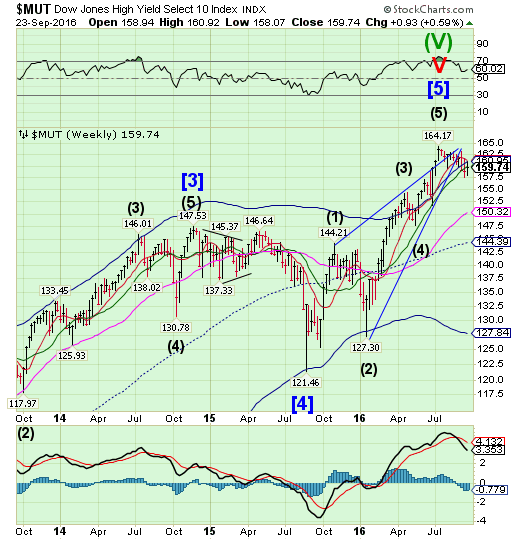

High Yield Bond Index has an inside week

The High Yield Bond Index had an indecisive week, closing beneath weekly Intermediate-term resistance at 159.86, putting the potential for a final rally at risk before a probable large decline. The selling climax discussed last week may be the first of many as it makes its way to the next low due in just two weeks.

(FT) The high-yield bond market may be at its most overvalued in eight years says one of the sector’s most prominent analysts.

Writing for S&P Global Market Intelligence, Marty Fridson, chief investment officer of Lehmann Livian Fridson Advisors, notes that the risky fixed income sector seems overly sanguine about economic prospects.

Recent polls of economists have shown they see a roughly one in five chance of a US recession in the next 12 months. Indeed, this summer JPMorgan raised eyebrows when it said there was a 37 per cent chance of such a contraction over that length of time.

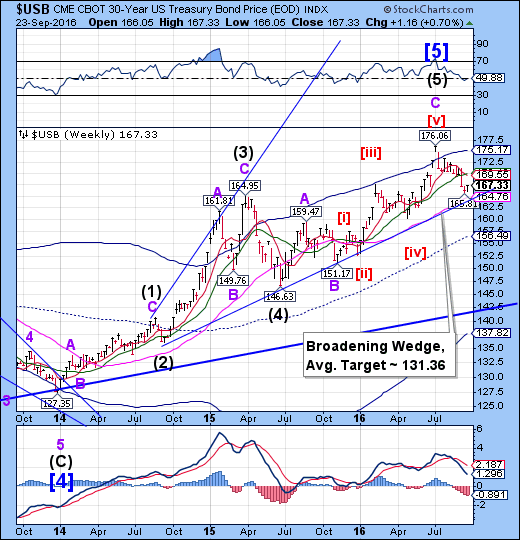

USB reverses above Long-term support

The Long Bond reversed higher, as indicated last week. However, the Cycles Model only suggests a probable 2-week rally that may not be able to challenge the Cycle Top at 175.17. Should it remain beneath it, it would suggest that the 34.4-year uptrend may be broken.

(WSJ) U.S. government bonds strengthened modestly Friday, capping their biggest one-week rally since the end of July.

Yields, which fall as bond prices rise, have declined since Wednesday afternoon, when the Fed kept interest rates steady and strongly suggested that it will be slow to raise rates over the longer term.

The Fed’s decision, along with a move earlier in the day by the Bank of Japan to target a 0% yield for the 10-year Japanese bond, has largely put to rest concerns that central banks could abruptly tighten their monetary policies.

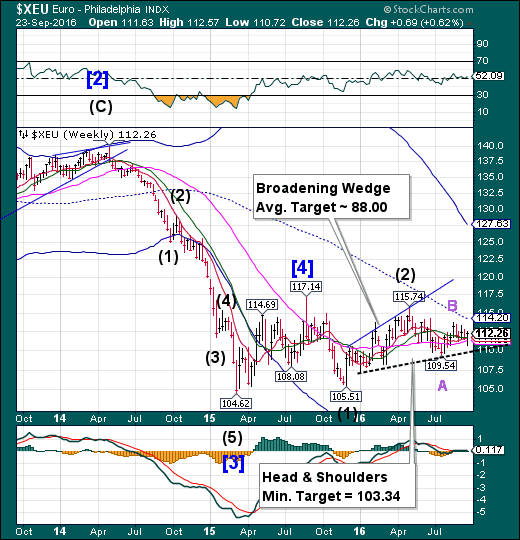

The Euro challenges support

The Euro challenged its cluster of supports, but rallied back above them, all within the same day. The Cycles Model suggests that, having made a Trading Cycle low today, a bounce toward its mid-Cycle resistance at 114.20 may ensue over the next week or so.

(Reuters) Euro zone business activity has expanded at its weakest rate since the start of 2015 this month as growth paths diverged and firms stopped discounting for the first time in a year, surveys showed on Friday.

Markit's composite survey showed a big split between buoyant manufacturers and a struggling service sector, and a similar divide in growth rates among members of the currency union: French business activity hit a 15-month high, while Germany's private sector growth slowed to a 16-month low.

EuroStoxx bounces from Intermediate-term support to the trendline

The EuroStoxx 50 Index declined last week, making a new Master Cycle low. This week it bounced back to but was repelled from the lower trendline of the Bearish Flag. The wide swings suggest a return of volatility that may influence price to the downside, as the Bearish Flag suggests.

(CNBC) European stocks closed lower Friday as investors paused for breath after recent gains and digested the latest data on manufacturing and services activity in the euro zone.

The pan-European Euro Stoxx 600 Index ended the day down 0.7 percent provisionally with the German Dax and France's CAC 40 both down by 0.4 percent. The FTSE 100 closed flat on the day

The banking sector was the worst performer after a rally in the previous session aided by the weaker dollar following the rate decision by the U.S. Federal Reserve.

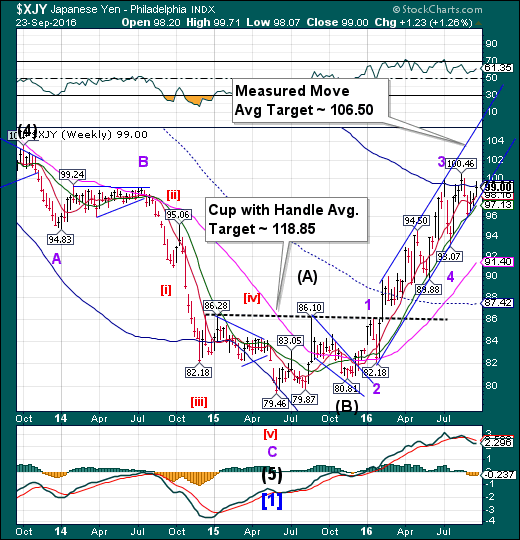

The Yen challenges Cycle Top resistance

The Yen challenged its weekly Cycle Top at 98.24, closing above it. This is a good indication that the uptrend may be supported at that level. There appears to be a new period of strength emerging through late September, giving it time to attempt to make its Cup with Handle target, or the lesser Measured Move target.

(Bloomberg) The yen rose to a three-week high on growing sentiment that the Bank of Japan’s move to more flexible approach to expanding stimulus won’t reduce demand for the nation’s currency.

It reversed an initial slide, suggesting investors are skeptical that BOJ policy makers will achieve their long-term goal of boosting inflation. Japan’s currency extended gains versus the dollar after the Federal Reserve left its key interest-rate target unchanged and emphasized a gradual path toward tighter monetary policy.

The Nikkei weakens at Long-term resistance

The Nikkei bounced off Intermediate-term support at 16324.99, making a sharp retracement to test Long-term resistance at 16815.18. The rally attempt failed to overcome resistance. A selloff may send the Nikkei back to the Head & Shoulders neckline. The Cycles Model suggests the decline may last through the end of October.

(Reuters) Japan's Nikkei share average edged down on Friday morning as investors took profits on financial stocks that had soared in the previous session, and worries about a stronger yen kept the market on edge.

The share market re-opened after a national holiday in Japan on Thursday, when the dollar tumbled to a nearly four-week low of 100.10 yen in reaction to the U.S. Federal Reserve paring its longer-term expectations for interest rate increases.

The Nikkei fell 0.2 percent to 16,777.09 in mid-morning trade after soaring 1.9 percent on Wednesday as investors took heart from the Bank of Japan's decision to overhaul its monetary policy.

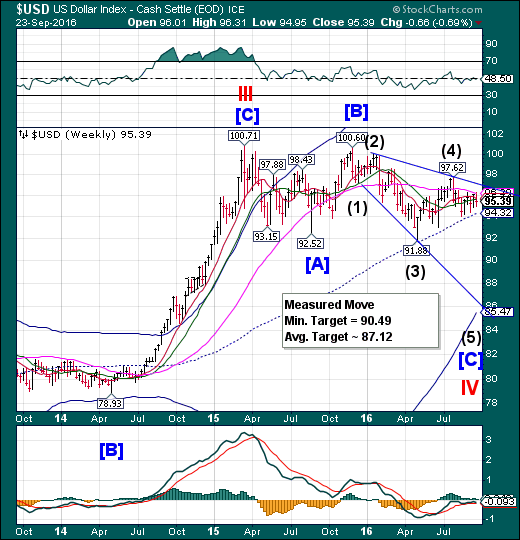

U.S. Dollar reverses at Long-term resistance

USD reversed at Long-term resistance at 96.20 after a week of indecision prior to the FOMC decision, closing beneath Intermediate-term support at 95.57. The Cycles Model now suggests work to be done on the downside, once mid-Cycle support at 94.32 is broken. The next month may unhinge the Dollar bulls.

(Reuters) Speculators pared back favorable bets on the U.S. dollar for a second straight week, according to Reuters calculations and data from the Commodity Futures Trading Commission released on Friday, reflecting expectations the Federal Reserve would raise interest rates just once this year.

The value of the dollar's net long position fell to $6.56 billion in the week ended Sept. 20, the data showed, one day before the Fed kept interest rates unchanged and flagged a December rate hike. The previous week's long U.S. dollar

position was $7.13 billion.

"The U.S. dollar remains vulnerable in the aftermath of the September 21 FOMC meeting, with U.S. real yields having retreated sharply," said Daniel Katzive, head of FX strategy for North America at BNP Paribas in New York.

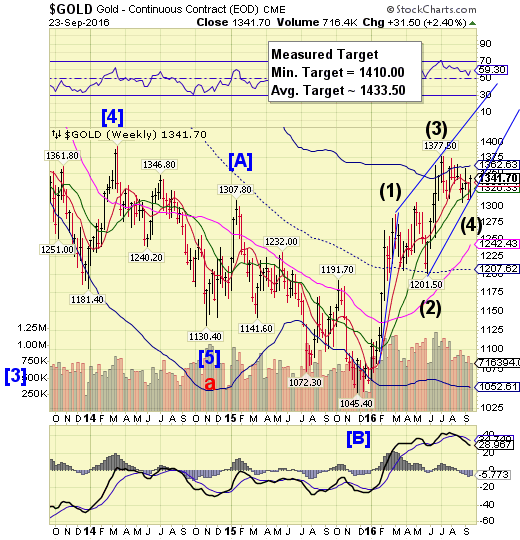

Gold finds support at the trendline

Gold found support at the Trading Channel trendline, getting a boost above all nearby Cyclical resistance. The Cycles Model now projects a period of strength that may last as long as mid-October. The next immediate target is the minimum Measured Target at 1410.00.

(Reuters) Gold steadied in a lackluster session as the U.S. dollar also flattened on Friday,

but bullion stayed on track for its biggest weekly gain in nearly two months after the Federal Reserve sounded a cautious note on the pace of interest rate hikes.

The Fed signaled an increasingly careful approach to future rate increases after a policy meeting on Wednesday, reassuring investors who had feared the U.S. central bank could move more quickly to tighten monetary policy.

Gold is highly sensitive to rising U.S. interest rates, as these increase the opportunity cost of holding non-yielding bullion, while boosting the dollar, in which it is priced.

Crude reverses down from Intermediate-term resistance

Crude reversed down from Intermediate-term resistance at 46.01 again. This week it closed beneath Short-term support/resistance at 44.78, as well. That leaves only Long-term support between it and the Lip of the Cup with Handle formation. There is now the probability of a month-long decline that may test the February low.

(BusinessInsider) West Texas Intermediate crude oil was down 4.06% at $44.44 a barrel on Friday afternoon after getting hit by a one-two punch of bad news. First, Bloomberg reported that a member of the Saudi delegation said he did not expect an agreement to freeze oil production to be reached at next week's meeting in Algiers, Algeria.

There had been hope that Saudi Arabia and Iran would be able to overcome their differences and agree on a freeze. Earlier Friday, Reuters reported that Saudi Arabia offered to reduce its oil production if Iran would agree to put a cap on its own output. At the time, Iran had not yet accepted or rejected the deal.

Shanghai Index declines to Intermediate-term support

The Shanghai Index is squeezed between Intermediate-term support at 2997.70 and Short-term resistance at 3040.50. A break of the Bearish Flag trendline at 2975.00 may set the next decline in motion. The fractal Model suggests the Shanghai is due for another 1,000 point drop, possibly starting next week. The next Master Cycle low is due in mid-October.

(ZeroHedge) After a struggle to repay its debts since 2015, Guangxi Nonferrous Metals Group, a regional Chinese state-owned metal producer, has finally been declared bankrupt by a Chinese court, becoming the country’s first interbank bond issuer to fail. It is also China's first bankruptcy case in which a state-owned company has liquidated. As Caixin first reported, nine months after the state-owned Guangxi first filed for bankruptcy, a Nanning court on Sept. 12 granted the company's application to liquidate.

What makes this bankruptcy unique is that while several state-owned enterprises have already gone bankrupt in the past two years due to a failure to repay bank or corporate debt, until recently an unheard of event in China, Guangxi Nonferrous is the first SOE to fail after defaulting in the highly liquid interbank bond market.

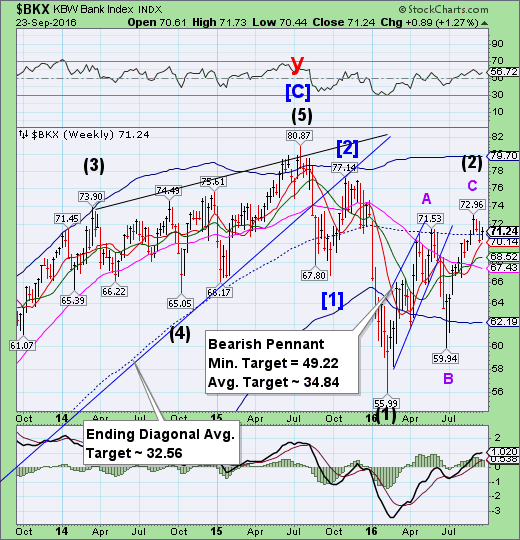

The Banking Index breaks below mid-Cycle support

BKX had an inside week, rising above its mid-Cycle support/resistance after challenging Short-term support at 70.14. Last week’s low was a Master Cycle low. Normally we would expect a 3-week rally/bounce out of a Master Cycle low, but it was three weeks late already, compressing the time allowed for a retracement. Expect the decline to resume imminently.

(ZeroHedge) Just a few short days after Germany's premier financial publication Handelsblatt dared to utter the "n"-word, when it said that in the aftermath of last week's striking $14 billion DOJ settlement proposal, "some have even raised the possibility of a government bailout of Germany’s largest bank, which would be a defining event and a symbolic blow to the image of Europe’s largest economy", German lawmakers are finally starting to get nervous.

According to Bloomberg, Deutsche Bank’s suddenly troubling finances, impacted by the bank's low profitability courtesy of the ECB's NIRP policy as well as mounting legal costs courtesy of years of legal violations, "are raising concern among German politicians." At a closed session of Social Democratic finance lawmakers on Tuesday, Deutsche Bank’s woes came up alongside a debate over Basel financial rules. Participants discussed the U.S. fine and the financial reserves at Deutsche Bank’s disposal if it had to cover the full amount.

(ZeroHedge) While the recent congressional hearing targeting John Stumpf, in which Elizabeth Warren suggested he should resign and be criminally charged, was nothing more than a "kangaroo court" meant to refocus public anger on banks, with good reason, the reason why we concluded that nothing would actually change is that ultimately there was no evidence the bank's executive management was aware of the bank's illegal, fraudulent tactics involving the creation of some 2 million fake customer accounts to "sandbag" retail banking fees. That assumption, however, may need revision now that CNN reports that it has heard from former Wells Fargo workers - some of whom were named - around the country, who tried to put a stop to the bank's illegal tactics only to be met with harsh, prompt and severe retaliation by the bank.

(FT) Banks will have to carry billions of dollars in extra capital if they trade hazardous materials such as oil and natural gas under a proposed US regulation meant to lessen the risks of liability from spills, explosions and other catastrophes.

The Federal Reserve on Friday released a proposed rule governing Wall Street’s involvement in physical commodities that would stiffen capital requirements, tighten limits on trading activity, remove banks from the business of running power plants and restrict their activities in the copper market. Banks that stay in the market despite the restrictions would have to reveal their commodities holdings to the public.

(ZeroHedge) Ever since two months ago, when Italy's third largest bank - and the world's oldest - Sienna's Monte dei Paschi, failed Europe's latest stress test, it had scrambled, and assured markets, that it would obtain a private sector cash injection, aka bailout, amounting to roughly €5 billion in fresh capital, there was significant speculation in the Italian press that the capital raise was not going well as third party investors were uncomfortable to allocate funds to a bank whose history of failure and unprecedented bad NPL book remained a daunting obstacle. The reason why Monte Paschi was forced to seek a private sector bailout is that Germany had repeatedly shut down Italian PM Matteo Renzi's attempts to pursue a public sector bailout. Instead, the Germans demanded that instead of a public sector bailout the bank should implement a bail-in, and impair various liabilities, which however could result in another bout of public anger, due to the substantial retail investment in the bank's unsecured bonds, perhaps culminating with a run on the bank.

Have a great weekend!

Nothing in this email or article should be ...

more