Weekend Report

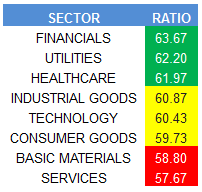

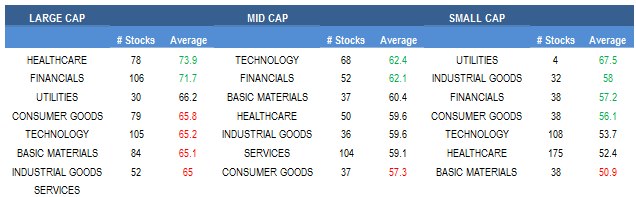

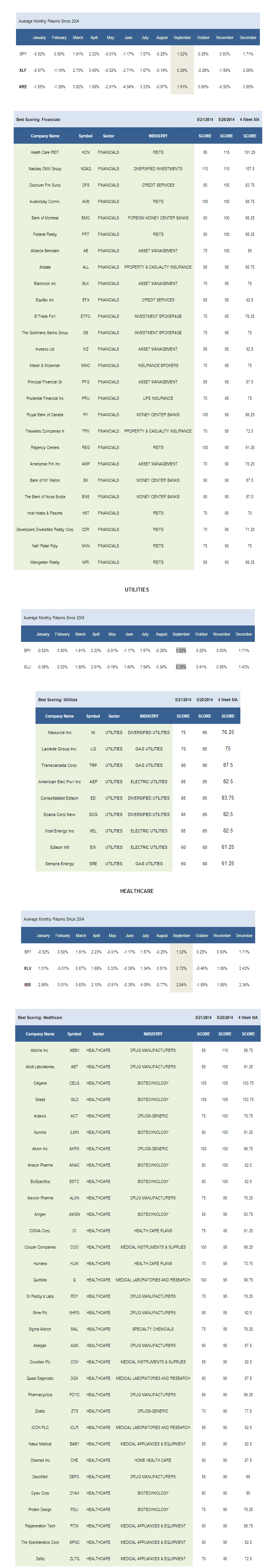

Financials are the best scoring sector across our universe.

The top scoring sector across our 1,800 stock universe is financials. Utilities and healthcare also score above average.

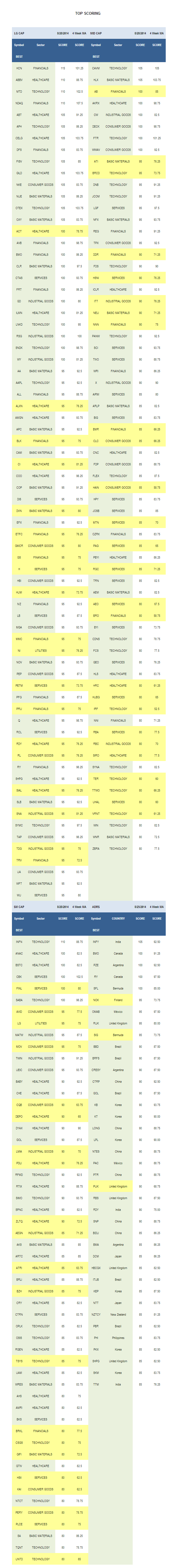

Industrials, technology, and consumer goods score in line. Basic materials and services score below average. Focus on small cap for industrials and consumer goods and mid cap for technology.

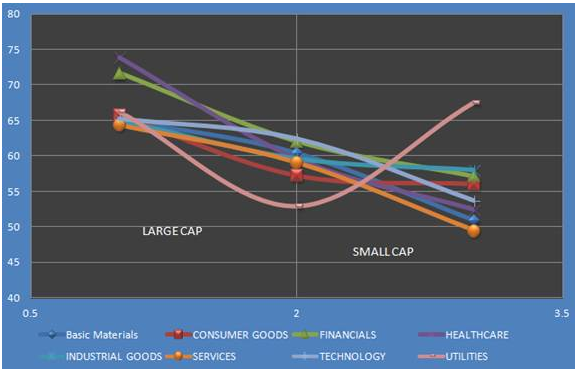

The following chart visualizes score by market cap and sector.

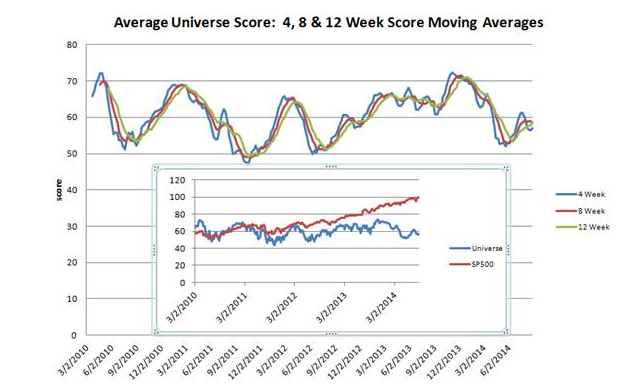

This next chart shows historical four, eight, and 12 week moving average score for the average stock in our universe since 2010.

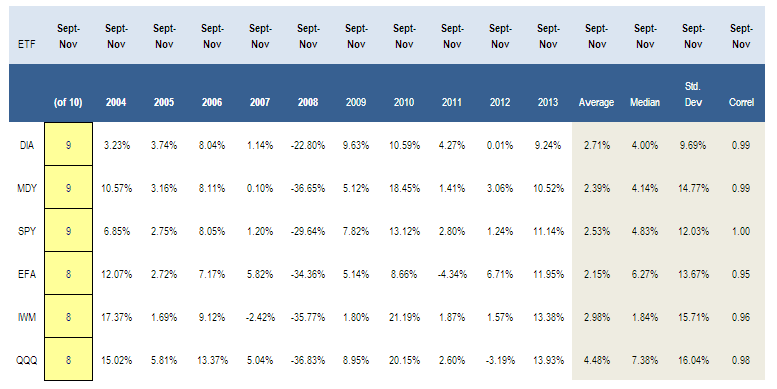

The next three months have treated investors kindly over the past decade. The SPY has finished November higher than it begins September nine times, producing a median 4.83% return. Mid cap (MDY) seasonality shifts positive and small cap (IWM) begins to move higher ahead of its typically strong year-end performance.

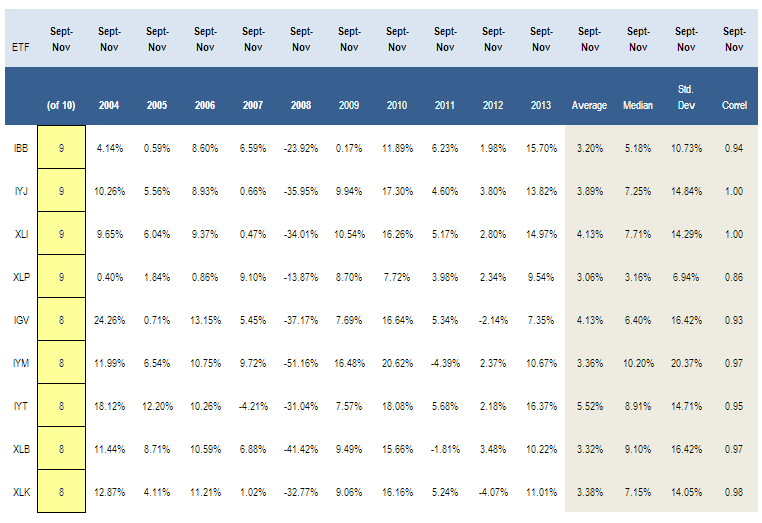

Biotech (IBB), industrials (IYJ, XLI), and consumer goods have all gained in nine of the past 10 years over the next three months. Software, materials, transports, and technology are also solid performers. Of those baskets, industrials offer the best median return for the period, with the XLI returning a median 7.71%. Across baskets that have gained in eight of the past 10 years, materials (IYM) and biotech (XLB) have the highest median return, gaining 10.2% and 9.1%, respectively.

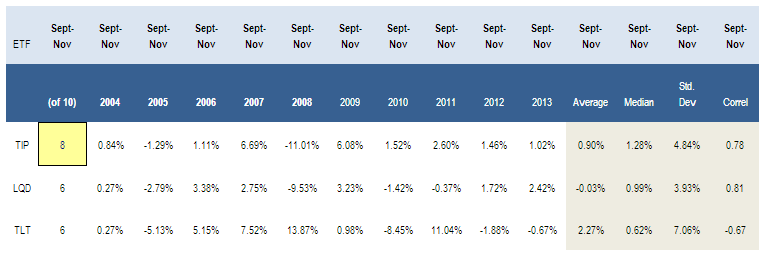

This next table breaks out seasonality for select Treasury bond ETFs. Inflation protected (TIP) tend to perform best over the coming three months.

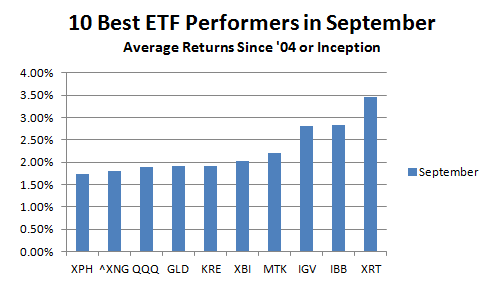

Of the widely traded ETFs in our seasonlity universe, the following 10 offer the highest average return for the month of September. Retail (XRT) is notable given that summer doldrums typically create opportunity for portfolio managers to boost exposure ahead of the fourth quarter.

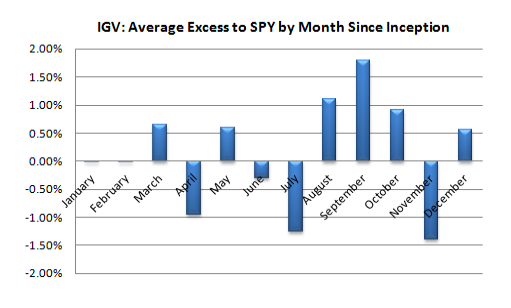

As you can see in the following chart, September is the best month of the year for software (IGV) since 2004.

FINANCIALS

Disclosure: None.