Weekend Report: Utilities, Industrials, And Financials

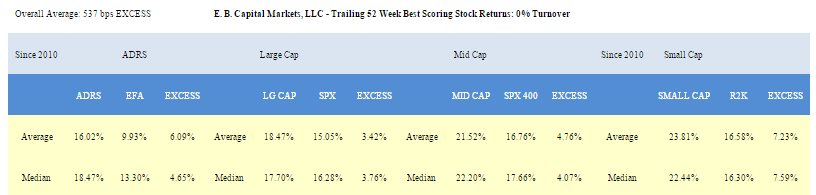

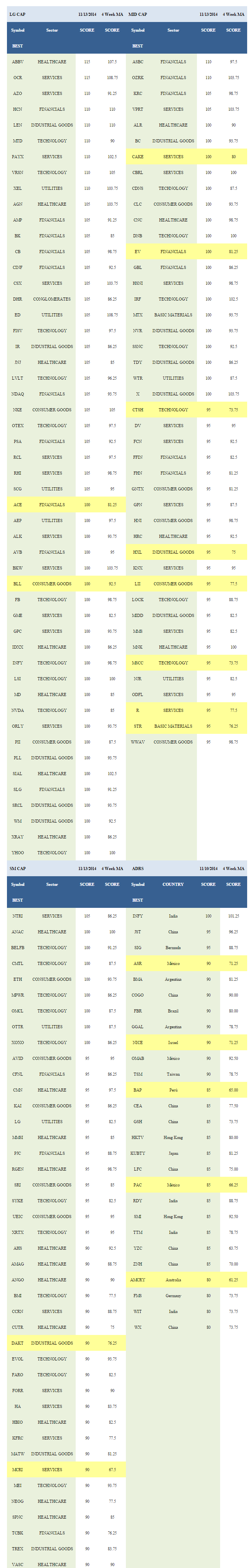

Top scoring weekly returns: Buy and Hold 1 Year

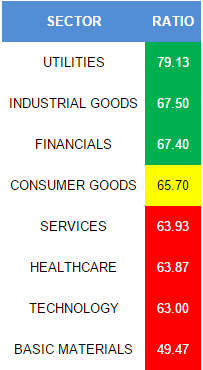

The top scoring sector across our 1,600 stock universe is utilities. Industrial goods and financials also score above average.

Consumer goods score in line with the average universe score.

Services, healthcare, technology, and basics score below average.

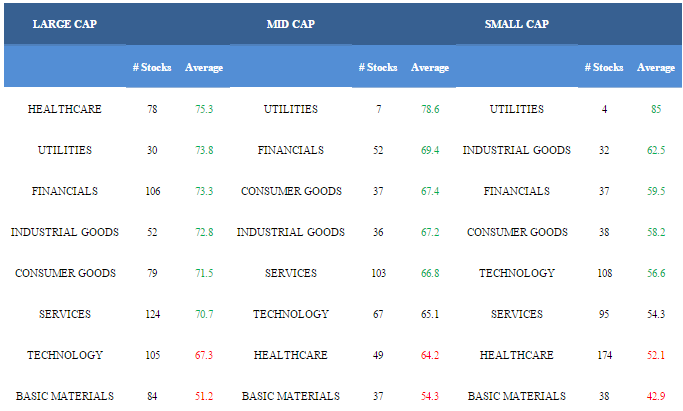

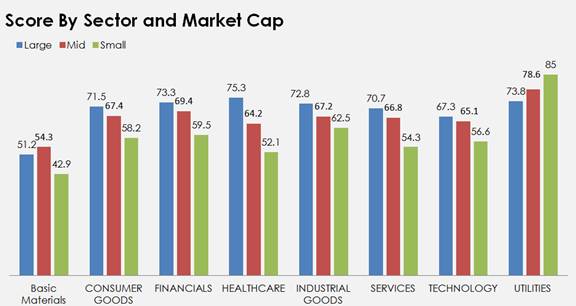

The following chart helps visualize score by sector and market cap.

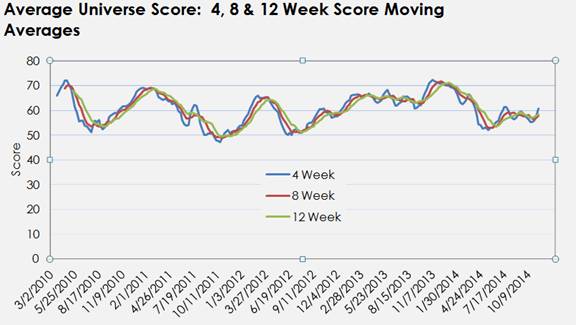

This next chart shows historical, weekly score since 2010.

UTILITIES

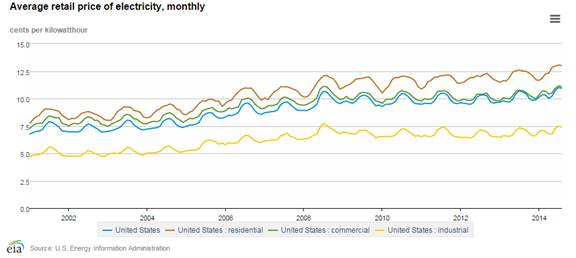

In August, residential retail electricity prices were 4% higher than a year ago. The EIA projects U.S. total electricity retail sales will grow by 0.7% in 2015.

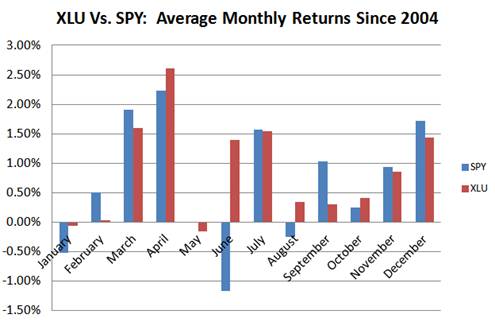

Interest in dividend paying companies continues to support utilities stocks as markets flirt with highs. As you can see in the following chart, utilities tend to lag the broader market into year end, but still provide positive absolute returns.

INDUSTRIAL GOODS

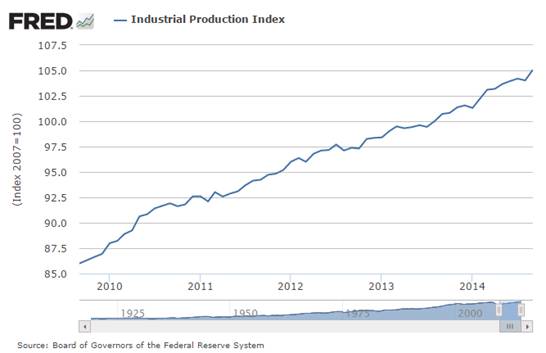

In September, industrial production grew 4.3% year-over-year. Production of primary metals, fabricated metals, machinery, motor vehicles, and aerospace were among groups that posted faster than average year-over-year growth that month.

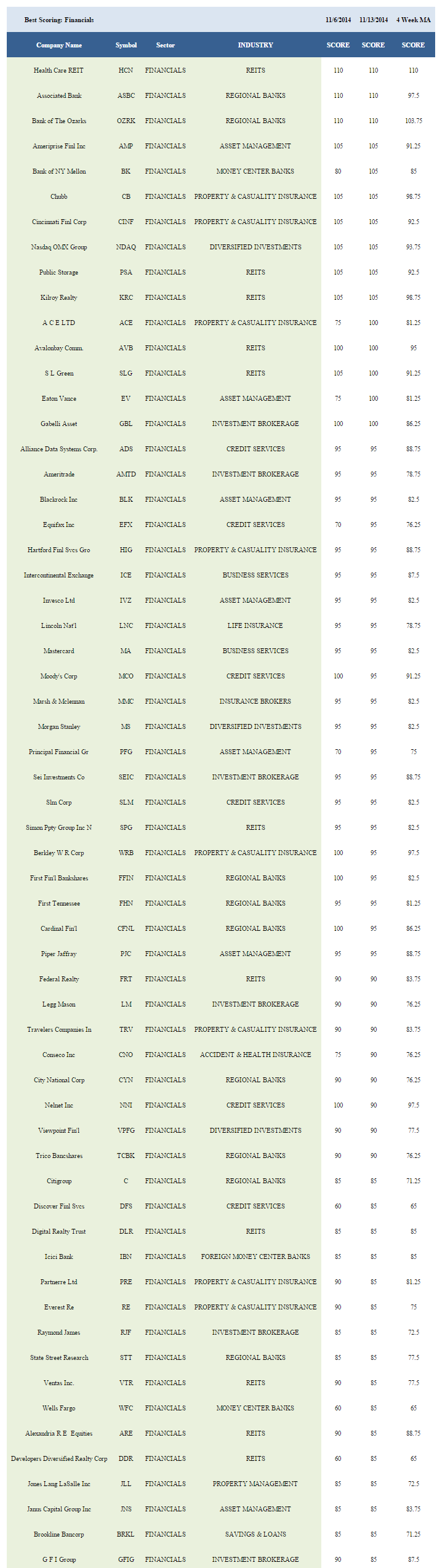

FINANCIALS

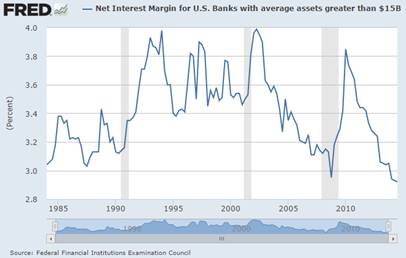

Net interest margin continues to decline, but loan volume growth is more than offsetting that headwind. In the third quarter, net interest margin at U.S. banks with greater than $15 billion in average assets declined to 2.92%; its lowest reading on record back to 1984.

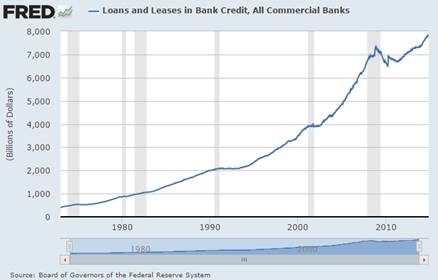

Meanwhile, loans and leases at U.S. commercial banks reached a new high of $7,825 billion in the first week of November, up from $7,800 billion in early October.

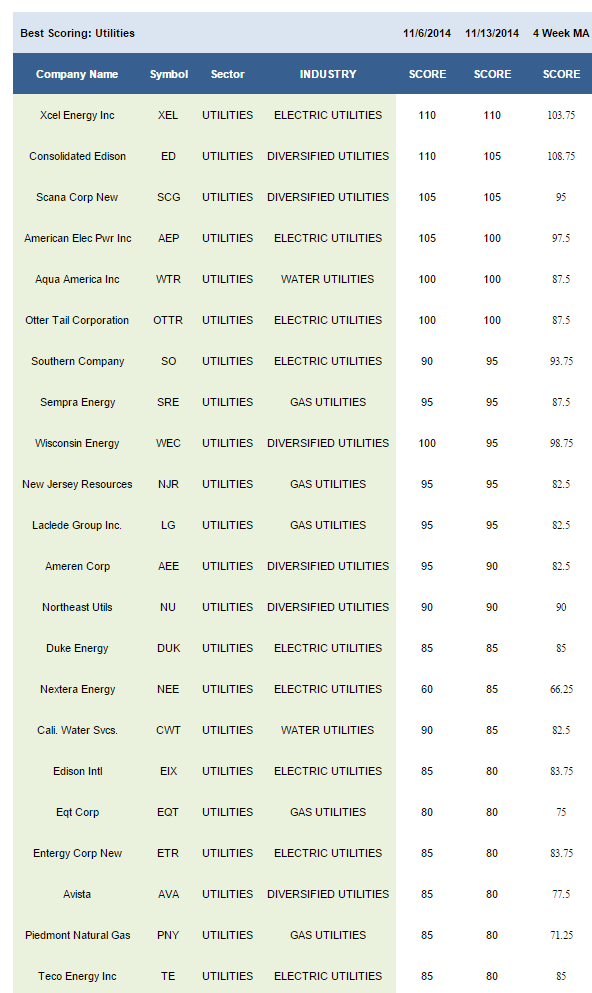

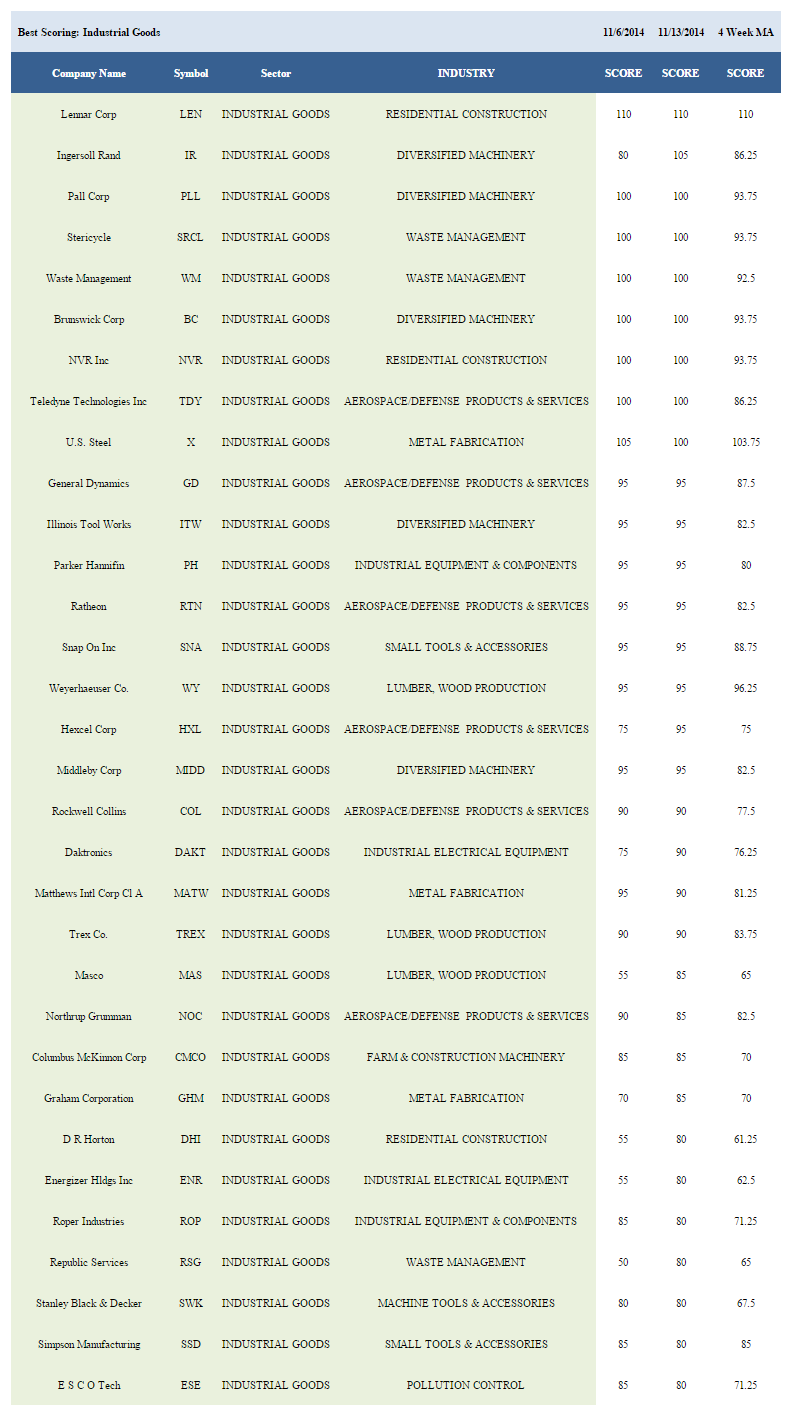

TOP SCORING

Disclosure: None.