Weakness In Junk Bonds Is Tied To The Weakness In Oil

Time to raise a bit of cash? There are too many new 52-week lows on the NYSE.

(Click on image to enlarge)

Junk bonds are not happy. I don't think the market is headed higher if junk bonds are headed lower.

(Click on image to enlarge)

The weakness in junk bonds is probably tied to the weakness in oil. Oil prices are so weak that a bounce is possible at this point, and a bounce in oil prices would help the stock market. But if the bounce doesn't come soon, then the market is headed lower along with oil.

(Click on image to enlarge)

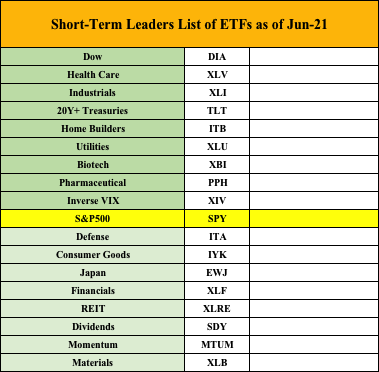

The Leader List

Mexico and the Mid Caps dropped off the leader list.

Bonds continue to out-perform.

(Click on image to enlarge)

Health Care is popular again after a couple years of being out-of-favor.

(Click on image to enlarge)

Outlook

The long-term outlook is positive.

The medium-term trend is up. Overdue for a correction.

The short-term trend is up as May-24. Looking for signs that the next downturn is starting.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more