Walmart Hit Over E-Commerce Issues

Walmart Inc. (WMT) is a multinational retail corporation which operates a chain of hypermarkets, discount department stores, and grocery stores. Walmart Inc., formerly known as Wal-Mart Stores, Inc., is headquartered in Bentonville, Arkansas.

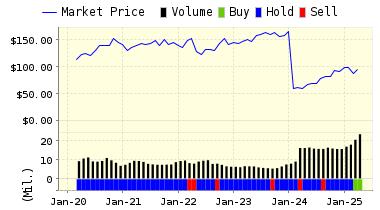

Wal-Mart reported an earnings miss yesterday, and investors were not pleased. The shares took a hit of 10% once the news came out. The company reported earnings of $1.33/share vs analysts expectations of $1.37. In addition, the company also lowered overall guidance for the new fiscal year. They now expect earnings of @$4.75-5.00.

Of more concern for analysts was the company's slow growth for online sales. Wal-Mart posted an e-commerce growth rate of 23%. That figure caused concern because in the prior quarters of 2017 the figure was in excess of 50%.

As we have been hitting over-and-over, the key for retailers these days is both the real and perceived ability to keep up with the Amazon.com juggernaut. So, when Wal-Mart showed e-commerce figures which were less than expected, the stock got hit more than it might have just for the slight miss.

This bad news may have been more of a shock given the company's recent efforts to clean up its bad reputation for dirty, un-stocked stores, poor worker pay and conditions, and other factors that were turning off customers. Wal-Mart seemed to be on an upswing as the management addressed these negative factors.

And, the company has actually slowed real, brick-and-mortar outlet construction in order to focus on online sales. Currently, the company garners just 4% of annual revenue from e-commerce. When you are talking $500 billion in revenue, every boost there is key, and the overall potential is huge. If the company can make the right moves and return to the large percentage growth of the past few quarters, then all should be well. But, further stumbles should--rightly--cause real concern for investors.

ValuEngine continues its BUY recommendation on WALMART INC for 2018-02-20. Based on the information we have gathered and our resulting research, we feel that WALMART INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Momentum.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

94.60 | 0.52% |

|

3-Month |

94.78 | 0.71% |

|

6-Month |

97.52 | 3.62% |

|

1-Year |

99.93 | 6.18% |

|

2-Year |

103.04 | 9.49% |

|

3-Year |

103.18 | 9.64% |

|

Valuation & Rankings |

|||

|

Valuation |

15.24% overvalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

0.52% |

1-M Forecast Return Rank |

|

|

12-M Return |

31.71% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

0.50 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

8.43% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

16.74% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

13.29% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

303.33 |

Size Rank |

|

|

Trailing P/E Ratio |

21.20 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

18.71 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.60 |

PEG Ratio Rank |

|

|

Price/Sales |

0.61 |

Price/Sales Rank(?) |

|

|

Market/Book |

5.00 |

Market/Book Rank(?) |

|

|

Beta |

0.43 |

Beta Rank |

|

|

Alpha |

0.38 |

Alpha Rank |

|

Disclosure: None.