VIX Leads The Way For The SPY In The Opposite Direction

- SPX Monitoring purposes; Long SPX 8/17/17 at 2430.01

- Monitoring purposes Gold: Neutral

- Long Term Trend monitor purposes: Neutral

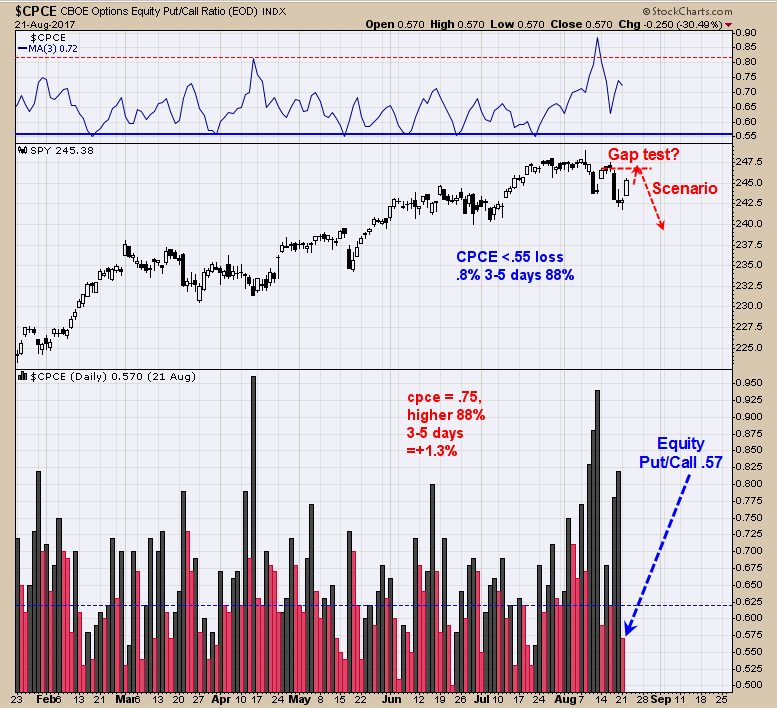

Yesterday’s Equity Put/Call ratio (CPCE) closed at .57. Readings of .55 and less predict a lower market in 3 to 5 days with an average loss of .8%. Though yesterday’s reading of .57 is not less than .55 it does carry a bearish lean. Today’s CPCE will come out later today and with today’s rally could have pushed the CPCE readings in bearish levels. With yesterday’s low CPCE readings, it suggests the current rally may not carry on long.

It is said that VIX leads the way for the SPY in the opposite direction. Today the VIX tested its August 17 low, suggesting the SPY may test its August 17 high. The August 17 high on the SPY comes in near the 2470 range which is also where a gap lies. Gaps are resistance areas if tested on lighter volume and if today’s light volume continues into tomorrow and the gap gets tested, it would suggest the gap has resistance and we could exit our long SPX position. Long SPX on 8/17/17 at 2430.01.

I have been a reliable bullish development for GDX over the years when GDX/GLD ratio is out performing GDX. Form late July, GDX has chopped modestly higher making higher closes and GDX/GLD ratio has made lower closes and a bearish divergence. Also notice that GDX has made higher lows as GDX/GLD ratio made lower lows and another bearish divergence. The Gold Commercials also increased their short position to 197K form the previous week of 159K, showing there increased bearish short term view for gold. When the Gold Commercials reach near 200K short and higher the market is usually near a short term high. A modest pull back for GDX and Gold is possible in the next couple of week. GDX has been choppy sideways since February and a break out of this choppiness could come in September. Still neutral for now.

Disclosure: None.

Disclaimer: Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance ...

more