View From The Hill: Review Of April 22, 2015

Commentary and Performance Summary

Wednesday’s trading was relatively flat on once again on weaker than average volume for equities (SPY, QQQ, IWM). While corporate earnings are surprising to the upside, revenues are failing to meet expectations.

As an asset class, volatility remains extremely oversold. I would not be surprised to see some sort of bounce before this week or early next week. However, if you’re a trader, you are probably hating this market since the VIX (VXX) has been more or less flatlining for the last 9 trading sessions.

Bonds have been relatively flat, but broke to the downside today as the Treasuries (TLT) took out a key support level. With the Bank of England indicating its next move will likely be a rate increase, especially if inflation gains a firmer foothold.

Regarding currencies, the U.S. Dollar (UUP) remains the strongest and best performer this year, but recent deceleration in its momentum suggests a potential inflection point whereby the Euro (FXE)and/or Yen (FXY) could overtake it in the near or mid-term future. The continual gains by the dollar are not sustainable and some sort of correction or adjustment is overdue.

In commodities, Gold (GLD) made a new 15-day low on higher volume and Oil (USO) bulls have encountered resistance during the last two trading sessions. Today’s EIA Petroleum Status report revealed a larger than expected build in crude oil inventories @ 5.3mm barrels for a new 80-year high at 490mm barrels.

Existing Home Sales in the U.S. were better than expected @ 5.19mm vs. 5.045mm and increased month-over-month by 6.1% and annually at 10.4%. Despite the positve news, the Homebuilders’ ETF (ITB) closed down -1.51% and broke support of its 50-day moving average. The Dow Jones Real Estate Index (IYR), a proxy for REITs and commercial real estate, closed in positive territory for its third consecutive day, albeit very modest gains.

April 22, 2015

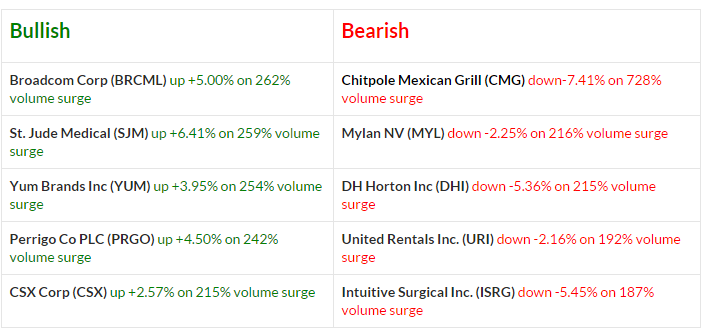

Stocks trading up or down on higher than average volume are as follows:

For Hillbent's full terms and conditions, please click here.