Upgrading Arcelor Mittal To Buy

For today's edition of our upgrade list, we used our website's advanced screening functions to search for upgrades to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Arcelor Mittal (MT) is our top-rated upgrade this week and it is a BUY. Autozone (AZO) and Shoe Carnival (SCVL) are our other BUY upgrades for the day. There were no STRONG BUY upgrades for the day, and the below three stocks are the only BUY upgrades for the day.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

|

MT |

ARCELOR MITTAL |

22.89 |

58.37% |

428.64% |

0.83% |

9.90% |

7.38 |

Basic Materials |

|

AZO |

AUTOZONE INC |

581.4 |

-25.67% |

-21.65% |

0.59% |

7.07% |

13.42 |

Retail-Wholesale |

|

SCVL |

SHOE CARNIVAL |

18.93 |

-19.45% |

-15.26% |

0.56% |

6.73% |

13.92 |

Retail-Wholesale |

ArcelorMittal is the world's leading steel and mining company. With a presence in more than 60 countries, it operates a balanced portfolio of cost competitive steel plants across both the developed and developing world. It is the leader in all the main sectors automotive, household appliances, packaging and construction. The company is also the world's fourth largest producer of iron ore, with a global portfolio of 16 operating units with mines in operation or development.

The company last reported earnings on May 12 and they had a nice beat. Earnings were $0.33/share vs estimates for $0.18. Profit more than doubled with a figure of $2.23 billion vs analysts expectations of $2.1 billion. That was a gain of ~140%.

The growth was widespread, across all markets, with especially good results for their European operations. At that time, the company CEO Lakshmi N. Mittal noted the following:

I am satisfied with the first quarter results, which reflect the anticipated positive momentum in the market and the progress we are making internally to make the business stronger. All parts of the business reported improved EBITDA as steel prices responded to higher raw material costs and strong volume growth saw steel shipments increase by 5.1% compared with the fourth quarter. Our mining segment benefitted from an increase in iron-ore shipped at market prices as well as the higher raw material price environment. Looking ahead, we expect market conditions to be broadly stable in the second quarter. While this is encouraging, the steel industry is still impacted by unfair imports in many of our key markets and we hope to see further progress in ensuring the necessary trade solutions.

Steel producers are benefiting from the improved global growth picture. BRIC nations are doing better than expected and thus there is an increased demand for steel in many areas of the world. In addition, there have been production cutbacks in China. Many nations reacted negatively to Chinese steel dumping and took action against that nation's exports.

Of course, not all is rosy. Some analysts are cutting back on steel demand estimates due to the cloudy picture in the US. Many had expected a big infrastructure program under the Trump administration. But now, due to the failure of the new president to demonstrate any ability to get legislation through the US Congress, that potential demand for steel may not materialize.

Keep in mind that the company just completed a reverse stock split, so some charts and price data you may see in your research will show a steep drop in share price last week.

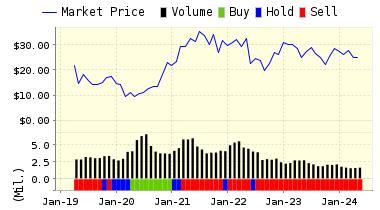

VALUENGINE RECOMMENDATION: ValuEngine updated its recommendation from HOLD to BUY for ARCELOR MITTAL on 2017-05-23. Based on the information we have gathered and our resulting research, we feel that ARCELOR MITTAL has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and P/E Ratio.

Below is today's data on ArcelorMittal (MT):

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

23.08 | 0.83% |

|

3-Month |

23.86 | 4.24% |

|

6-Month |

25.31 | 10.55% |

|

1-Year |

25.16 | 9.90% |

|

2-Year |

31.44 | 37.35% |

|

3-Year |

35.88 | 56.75% |

|

Valuation & Rankings |

|||

|

Valuation |

58.37% overvalued |

Valuation Rank |

|

|

1-M Forecast Return |

0.83% |

1-M Forecast Return Rank |

|

|

12-M Return |

428.64% |

Momentum Rank |

|

|

Sharpe Ratio |

-0.38 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

-15.97% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

41.56% |

Volatility Rank |

|

|

Expected EPS Growth |

-17.42% |

EPS Growth Rank |

|

|

Market Cap (billions) |

37.86 |

Size Rank |

|

|

Trailing P/E Ratio |

7.38 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

8.94 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

n/a |

PEG Ratio Rank |

|

|

Price/Sales |

0.64 |

Price/Sales Rank |

|

|

Market/Book |

1.42 |

Market/Book Rank |

|

|

Beta |

2.22 |

Beta Rank |

|

|

Alpha |

0.01 |

Alpha Rank |

|

Disclaimer: ValuEngine.com is an independent research ...

more