USD/CAD Snaps Back On Hawkish Yellen; Bearish Series At Risk

(Click on image to enlarge)

|

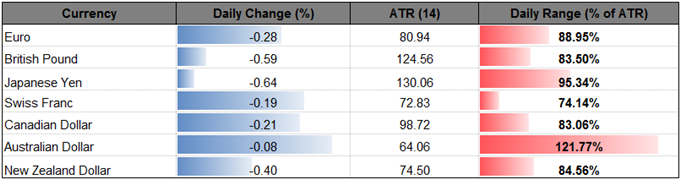

Currency |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

USD/CAD |

1.3099 |

1.3107 |

1.3025 |

28 |

82 |

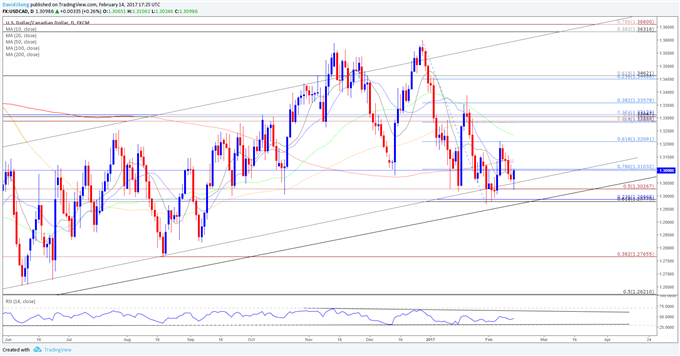

USD/CAD Daily

(Click on image to enlarge)

Chart - Created Using Trading View

- USD/CAD snapped back from a low of 1.3025 as Fed Chair Janet Yellen warned it ‘would be unwise’ to further delay the normalization cycle at the Humphrey-Hawkins Testimony and argued a further adjustment would be needed as long as the economy stays on it current course; may see the dollar-loonie stage a larger recovery over the coming days as it appears to be responding to channel support, while the Relative Strength Index (RSI) largely retaining the bullish formation carried over from 2014.

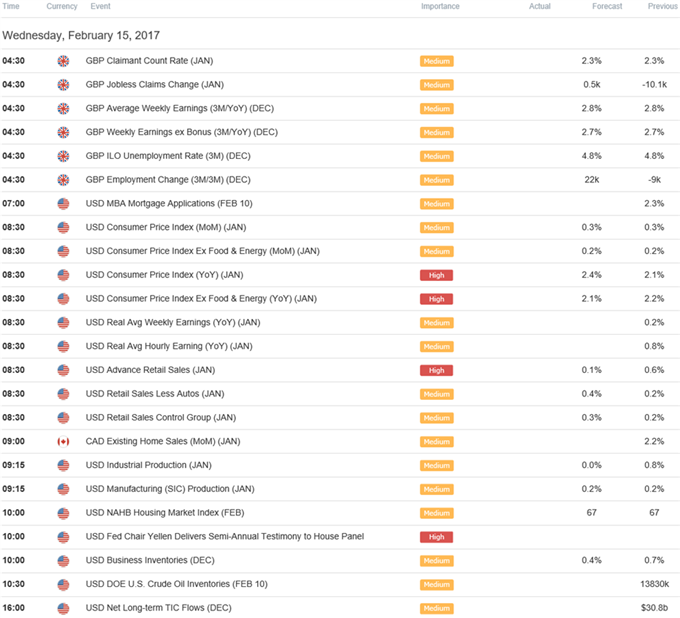

- The U.S. Consumer Price Index (CPI) on tap for Wednesday morning may heighten the appeal of the greenback as the headline reading for inflation is expected to advance an annualized 2.4% following a 2.1% expansion in December, but a slowdown in the core rate of inflation may generate a mixed market reaction and tame interest rate expectations as Fed Fund Futures continue to price a greater than 80% probability the Federal Open Market Committee (FOMC) will retain the current policy at the next quarterly meeting in March.

- With the FOMC still widely anticipated to raise the benchmark interest rate in June, the broader outlook for USD/CAD remains constructive, with a close above 1.3100 (78.6% retracement) raising the risk for a move back towards the February high (1.3212) which lines up with the next topside area of interest coming in around 1.3210 (61.8% retracement).

|

Currency |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

GBP/USD |

1.2452 |

1.2548 |

1.2444 |

74 |

104 |

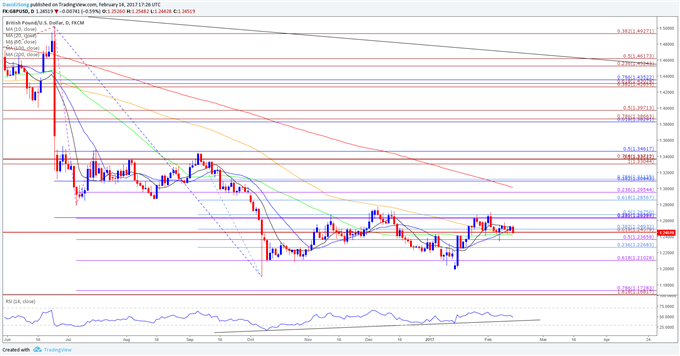

GBP/USD Daily

(Click on image to enlarge)

Chart - Created Using Trading View

- After outperforming its major counterparts to start the week, the British Pound struggles to hold its ground as the Consumer Price Index (CPI) fails to meet market expectations, with sterling at risk of facing additional headwinds over the next 24-hours of trading as U.K. Jobless Claims are projected to edge higher in January, while Average Hourly Earnings are anticipated to hold steady at an annualized 2.8% in December; may see GBP/USD continue to consolidate and track the late-2016 range especially ahead of the EU-Referendum deadline scheduled for the end of March.

- Signs of weaker-than-expected price growth may encourage the Bank of England (BoE) to preserve the highlight accommodative policy stance at the next interest rate decision on March 16, but a further depreciation in the British Pound exchange rate may push the central bank to gradually move away from its easing-cycle as officials warn ‘a consequence of weaker sterling is that the higher imported costs resulting from it will boost consumer prices and cause inflation to overshoot the 2% target.’

- Failure to clear the Fibonacci overlap around 1.2630 (23.6% retracement) to 1.2680 (50% retracement) raises the risk for a move back towards the lower end of the British Pound ‘flash crash’ range, with a break/close below 1.2370 (50% expansion) opening up the next downside target around 1.2270 (23.6% retracement).

(Click on image to enlarge)

Disclosure: See what live coverage is scheduled to cover key event risk for the FX and capital markets on the more

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!