USDA Trimmed Bean & Wheat Exports, But Upped Corn’s Ethanol

Market Analysis

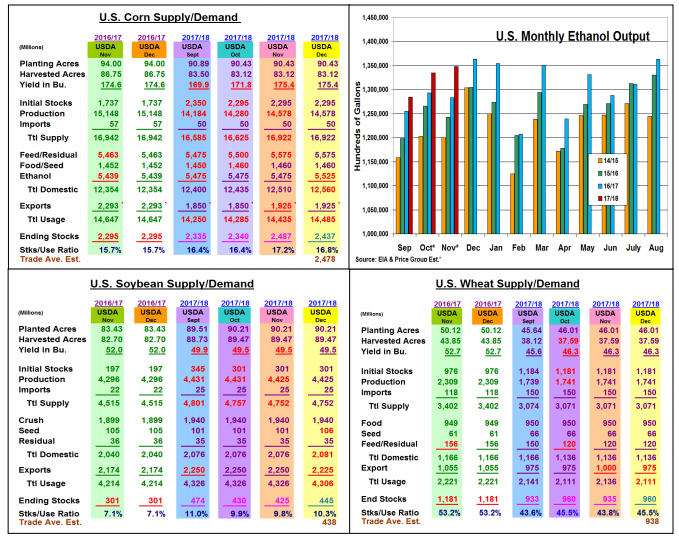

In a tip of the cap, the USDA sliced US soybeans and wheat exports on this month’s US supply/demand revisions in response to recent sluggish overseas sales. However, this past quarter’s record US ethanol output decreased US corn ending stocks when this industrial demand was upped 50 million bu. this month. These updates prompted some two-sided price action across the 3 major grain markets, but rain in Argentina’s weekend forecast and this year’s ending stocks remaining substantial weighed on prices late in the session.

In corn, this quarter’s 3.5% increase in ethanol output matches up with the USDA’s 50 million higher corn usage if US biofuel output stays the same as last year through next summer. Corn export sales are behind last year’s 360 million bu. higher yearly rate, but just a modest 80 million lower than seasonal pace to reach the USDA’s 1.925 billion outlook. This translates into no change in this overseas demand. Next month’s quarterly stocks will be used to adjust corn’s feed demand.

In soybeans, the recent higher EPA advanced biofuel levels for 2018 & 2019 did prompt the USDA to switch 500 million lbs of bean oil into biodiesel demand, but they shaved other industrial and exports leaving 2017/18 bean oil stocks and crush unchanged. With S. American dryness remaining a concern, soybean exports could pickup. This demand will be monitored closely since current exports are still being forecast larger than last year. With no changes in the USDA’s Argentine and Brazilian soy crops, only a modest 420,000 rise in world stocks occurred because of larger beginning stocks.

Last week’s higher Stats Canada wheat crop prompted the USDA to increase its world wheat output by 3 mmt. This change kept the USDA’s world stocks at a record 268 mmt and sliced 25 million bu. from US wheat’s export outlook because of stronger Canadian competition.

What’s Ahead

This year’s La Nina Pacific Ocean sea temperature pattern is likely to continue impacting Argentina and S. Brazil cropping areas with varying periods of dryness this growing season. With corn and wheat prices dipping to new seasonal lows, livestock operators, millers and grain users should be covering your grain needs through a combination of cash purchases or May hedges through March 2018.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more