USD: The Consensus Trade Is Questioned Amid ‘Jerky’ FX Moves

Trump’s presidency is off to a rocky start, at least with the US dollar. The greenback is selling off across the board. What’s next?

Here is their view, courtesy of eFXnews:

The first hundred days of the Trump Presidency has started. He is likely to adopt pro-growth and dollar-supportive policies, while he may repeat his resistance to a stable currency. Actions usually speak louder than words, but at the start of the presidency, policy intentions can be expressed loudest of all

My short trip to Asia over the past week and a half has confirmed that the euro has no friends, though it also shows that the bullish dollar consensus is easily questioned. I’m still more struck by the fact that we seemed ‘bearish’ on the dollar only a few weeks ago for believing the peak would come in 1H17, by the start of this week, we were questioned for considering that the peak isn’t already behind us.

FX market confidence levels are low; trading patterns, whether in GBP/USD or USD/JPY and EUR/USD (let alone anything more exotic), can best be described as ‘jerky.’

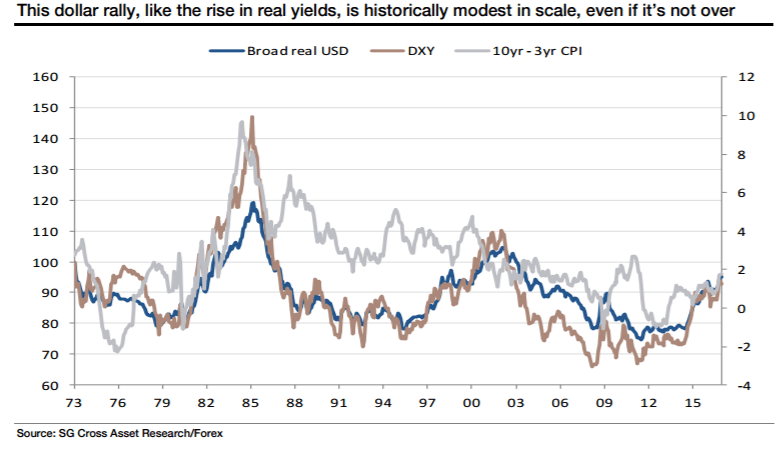

But the Trump presidency is about to start, and if his program is pro-growth, it will likely be pro-dollar for now, which would lead to a further 5-10% rise in USD during his first 100 days.