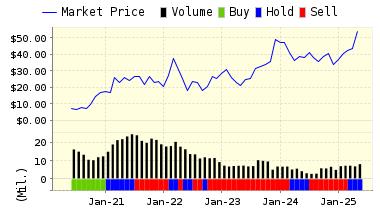

US Steel Jumps 23% Despite Layoffs

United States Steel (X) manufactures and sells a variety of steel mill products, coke and taconite pellets. Primary steel operations are the Gary (Indiana) Works, the Fairfield (Alabama) Works near Birmingham, the Mon Valley Works ( which includes the Edgar Thomson steelmaking and Irvin finishing operations) on the Monongahela River near Pittsburgh, and U. S. Steel Kosice in the Slovak Republic.

United States Steel is currently leading our ValuEngine Market Neutral portfolio for the latest rebalance period with a gain of 23%. However, the company is nowhere near the levels we saw just last Summer. This is a paradoxical case where bad news for company workers is often looked at positively by investors. US Steel started a round of lay offs recently by idling its Lorain, Ohio plant as well as cutting workers in Pittsburgh and elsewhere. These layoffs, called "temporary" by the firm, came about as competition from South Korea and failing energy prices lowered demand for its tubular steel products. US Steel was riding the fracking and drilling boom in the US and off-shore.

Tubular Steel from Lorain, Ohio

ValuEngine continues its BUY recommendation on United States Steel for 2015-04-15. Based on the information we have gathered and our resulting research, we feel that United States Steel has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE P/E Ratio and Price Sales Ratio.

Below is today's data on X:

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

27.60 | 1.01% |

|

3-Month |

27.98 | 2.39% |

|

6-Month |

28.83 | 5.48% |

|

1-Year |

30.63 | 12.07% |

|

2-Year |

27.05 | -1.02% |

|

3-Year |

26.99 | -1.25% |

|

Valuation & Rankings |

|||

|

Valuation |

1.50% undervalued |

Valuation Rank |

|

|

1-M Forecast Return |

1.01% |

1-M Forecast Return Rank |

|

|

12-M Return |

0.85% |

Momentum Rank |

|

|

Sharpe Ratio |

-0.45 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

-19.14% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

42.71% |

Volatility Rank |

|

|

Expected EPS Growth |

-71.62% |

EPS Growth Rank |

|

|

Market Cap (billions) |

3.98 |

Size Rank |

|

|

Trailing P/E Ratio |

6.25 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

22.04 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

n/a |

PEG Ratio Rank |

|

|

Price/Sales |

0.23 |

Price/Sales Rank |

|

|

Market/Book |

1.11 |

Market/Book Rank |

|

|

Beta |

1.72 |

Beta Rank |

|

|

Alpha |

-0.29 |

Alpha Rank |

|

Disclosure: None

As a bonus, we are offering a FREE DOWNLOAD of one of our Stock Reports. Read our Complete Detailed Valuation Report on United States Steel more