U.S. Oil Production Sets New Modern Record Last Week

EIA Report

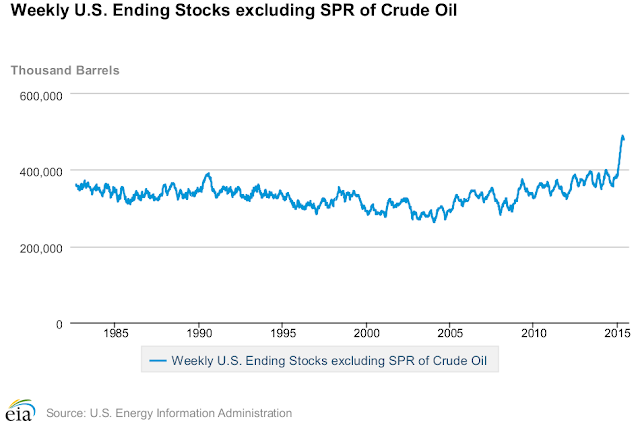

I looked over the weekly Petroleum Inventory Report put out by the EIA, and the biggest takeaway by far was that US Oil Production set a new modern era high at 9.566 Million Barrels per day. The last high in US Production occurred in March, and it appeared that the US Production numbers were getting slightly weaker, and maybe the top in US Production was in. But this past week Production really ramped back up with a blowout number, and if it wasn`t for a week in which imports were unusually low for the week, there would have been another huge build in Oil Inventories for the week.

Energy Storage Hubs

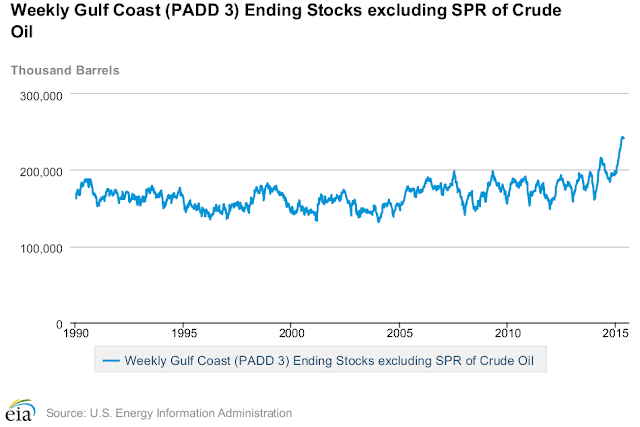

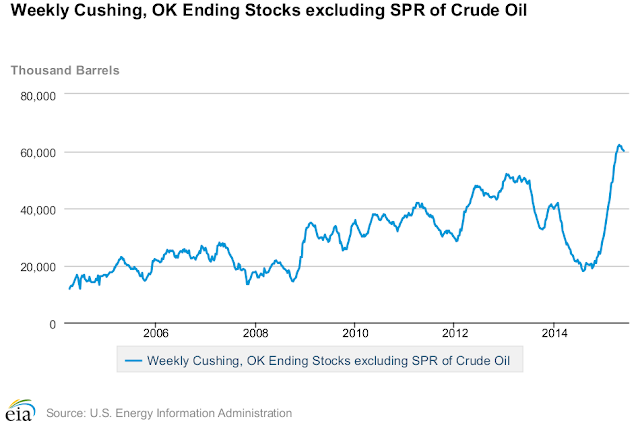

Refineries were operating near full capacity on the week cranking out a utilization rate just shy of 94%, which also helped avoid another weekly inventory build in oil supplies. However, Cushing Oklahoma and the Gulf Coast Region barely budged in reducing the oil inventory surplus at those two crucial storage hubs. Cushing Oklahoma still has 60 Million Barrels stuck in storage facilities, while the Gulf Coast has 242 Million Barrels awaiting refinery for end use.

Shale Industry

However, the noteworthy takeaway is that despite a large reduction in drilling rigs, and the lower prices of the last year US Oil Production is still going up, and not tapering off at all! So much for the Saudi and OPEC strategy of putting a dent in US Oil Production by not cutting production and hoping to gain market share for their oil by putting the Shale Industry out of business.

Annual Comparison

For example, a year ago US Oil Production was 8.472 Million Barrels per day, and now after a market share price war between OPEC and the US Producers, the US is producing a record level of Production, a new modern era record since the EIA began tracking this data in 1983 at 9.566 Million Barrels per day. This is an increase of over 1 Million Barrels per day in US Oil Production in a year`s time, and considering the decline in drilling rigs, this speaks volumes about the increased efficiencies taking place in a lower price and cost environment.

Market Reaction

The oil keeps coming out of the ground at record levels, and throw in OPEC`s record output, and it doesn`t bode well for oil prices the second half of the year once the summer driving season ends and we start the building season all over again in oil inventories! We really are at risk of both the Cushing and Gulf Coast storage hubs reaching their storage limits over the next year, and it will be interesting how the oil market deals with this reality.

All of the content on EconMatters is provided without assurance or warranty of any kind. The opinions expressed here are personal views only, and no warranty of fitness for any particular use, ...

more