US July Wheat & Supply/Demand Updates

Market Analysis

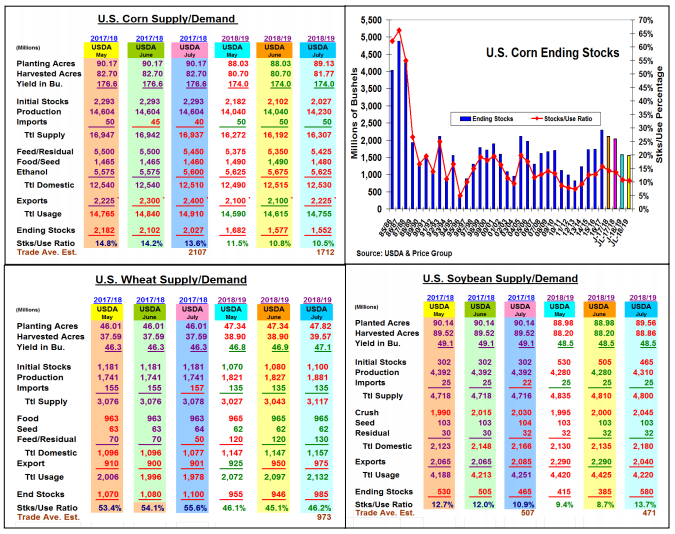

This month’s US grain demand and/or stocks levels for corn and wheat had positive outcomes while soybeans demand and stocks had a negative slant in their balance sheet revisions. As expected, all three major US crops had larger supplies because of this year’s higher June plantings, but the USDA didn’t up its corn or soybean yields as many traders feared. Tightening of both old crop corn and soybeans stocks was probably the biggest USDA surprise. Current seasonal strength in exports and domestic demand and no over-reacting to the trade war chatter were the reasons.

Looking at corn, the USDA upped ethanol’s old-crop usage by 25 million, but they sliced feed demand by 50 million because of last month’s quarterly stocks. With corn sales only 13 million below the current forecast, the USDA upped 2017/18’s exports by 100 million bu with 8 weeks left in the crop year. This 75 million lower stocks help counter corn’s 170 million larger 2018 crop, but the USDA’s 75 million increase in 2018/19 feed demand and 125 million jump in exports were the big reasons for corn’s 25 million dip in stocks vs. the trade’s 135 million higher expectations.

2018’s improved N. Plains growing conditions and 2.1 million larger spring/durum planted acres were the reasons for July’s 54 million larger US wheat supplies. Higher feed demand and exports trimmed this increase to a 39 million bu. rise to 985 million in US stocks. This month’s 8 mmt cut in foreign crops (AS, EU and FSU) resulting in 5.28 mmt drop in world stocks to 261 vs last year’s 273 mmt provided the strength to wheat prices.

Soybeans old-crop stocks were cut by 40 million because of strong seasonal export and processing paces. However, the USDA’s 250 million cut in US 2018/19 exports because of their 8 mmt drop in Chinese imports from 103 to 95 mmt curtailed any bean price enthusiasm

What’s Ahead:

The latest supply/demand updates provided a mixed grain and soybean outlook. However, given the sharp sell-off of prices and the normal US growing season weather concerns, livestock feeders and end users should cover your cash corn and meal needs till harvest now. Be prepared if weather or trade negotiations break out to purchase 50% of your fall feed supplies using futures/options.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more