US July Wheat & S/D Updates

Wheat supplies were slightly higher, but Weather now rules

Market Analysis

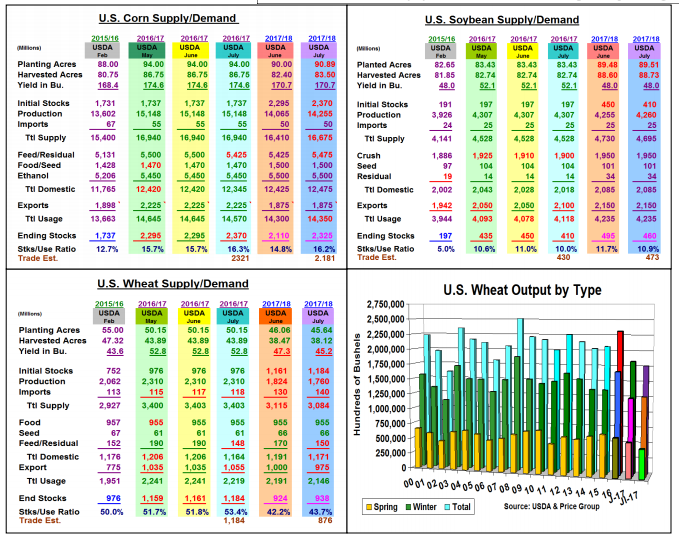

This month’s US supply/demand revisions generally followed the indications from June 30th quarterly stocks changes. Old-crop corn and wheat ending stocks were increased while old-crop soybean ending stocks were lowered. However, the USDA didn’t cut its spring wheat crop size as small as the trade ideas, which lead to a higher 2017/18 ending stock projection than forecast. Despite these curves from the USDA, the big change that impacted prices late in the session came from the US 8- 14 day weather model (GFS). It's mid-day forecast deescalated its hot temperatures in the 2nd week of its outlook for the Central US with this year’s high pressure ridge retreating westward. This mid-day model, however, has had a checkered past so caution is advised.

Looking at today’s S&D revisions, the USDA did reduce corn’s feed demand by 75 million bu. after last month’s higher quarterly stocks. However, no further changes in either ethanol or exports were made so these higher supplies provide more bushels for 2017/18 balance sheet along with 1.1 million more harvested acres (no US corn or bean yield changes this month). The USDA upped new-crop feed usage because of reduced small grain supplies, but stocks rose to 2.3 billion this month. In soybeans, this year’s strong export sales (145 million over its outlook) finally prompted a 40 million jump in old-crop demand (plus 50 export minus 10 crush) and reduced both old & new crop stocks below expectations.

This year’s N. Plains heat and dryness did reduce July’s spring wheat crop, but its drop wasn’t as sharp as the trade forecast. The other unexpected factor was the 19 million bu. rise in this month’s winter wheat crop as all three varieties were increased. Add in 23 million larger old-crop ending stocks because of lower feeding last spring and the USDA’s 2017/17 ending stocks didn’t decline, but rose by 14 million bu. this month.

What’s Ahead:

USDA’s latest grains and soybean supply/demand updates didn’t provide extremely negative new-crop stock levels vs. trade expectations. The latest wrinkle in the forecast could be positive for 2017 crops, but corn’s pollination will still likely stretch to August so this year’s US high pressure ridge remains highly dangerous to all crops. New-crop price rebounds to $4.10 and $10.35 levels still exists if the ridge returns.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more