US Inflation’s Slow, Steady Rebound Looks Set To Continue

Thursday’s report on consumer inflation for June is expected to show that the recent firming trend will roll on. Analysts are looking for the year-over-year rate in headline prices to tick up to the fastest pace in over six years. It’s easy to overstate the rebound in pricing pressure, which appears dramatic after flirting with a mild degree of deflation as recently as 2015. But the rise from a low base still leaves inflation at a moderate rate relative to history. Nonetheless, the numbers clearly show that reflation is in progress — a trend that will increasingly ratchet up pressure on the Federal Reserve to tighten monetary policy.

Short of a new recession, or at least a dramatic slowdown in economic activity (neither of which appears imminent), it’s reasonable to assume that the reflationary regime underway will persist for the foreseeable future. Economists are projecting that annual increase in the consumer price index (CPI) for June will edge higher for a fifth straight month. Econoday.com’s consensus forecast for Thursday’s release (July 12) sees the unadjusted headline measure of CPI inching up to a 2.9% year-over-year gain, the most since February 2012. That’s still moderate, although the key takeaway is that the revival of inflation to just under 3% marks a conspicuous change from 2015, when headline inflation was essentially flat.

The more reliable core measure of CPI, which strips out food and energy, is rising at a softer pace — up 2.2% for the year through May. But the larger point is that reflation is alive and kicking in this corner too.

Recent surveys align with the firming up of inflation to a roughly 3% pace at the headline level. The New York Fed on Monday, for instance, released its monthly poll of consumers on prices and found that “median inflation expectations at both the one-year and three-year horizons were unchanged for the third straight month, at 3.0%.”

Wage growth has been subdued in recent years, but on this front too there are signs that a mild upward bias prevails. Average hourly wages for US workers are still advancing below the headline inflation rate, but it’s notable that a solid if mild upward trend remains in force. Notably, the 2.7% annual increase in wages in June is just a hair below the fastest pace in nine years.

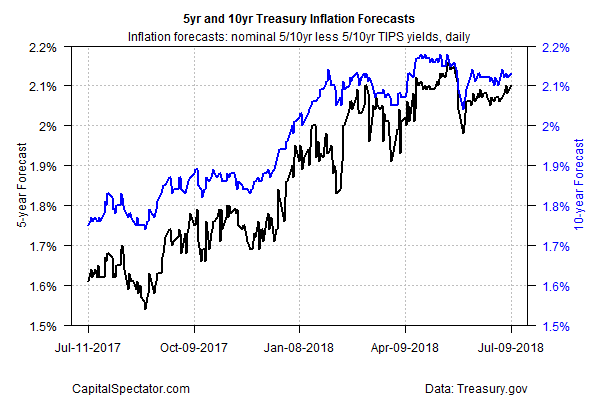

The Treasury market’s implied inflation forecast is currently pricing in a softer regime of pricing pressure, but here too the main point is the rebound in recent months. The yield spread on the 5-year nominal Treasury less its inflation-indexed counterpart, for example, has jumped from roughly 1.6% a year ago to 2.1% at yesterday’s close (July 9).

The revival in inflation has convinced the crowd that another rate hike by the Federal Reserve is on the near-term horizon. Although the central bank is expected to stand pat at next month’s policy meeting, Fed funds futures are currently pricing in an 85% probability that the target rate will be lifted another 25 basis points to a 2.0%-to-2.25% range at the September FOMC meeting, based on CME data.

The key challenge for the Fed in the months ahead is convincing the markets that the central bank can end inflation’s upward trend. Letting inflation run above the central bank’s 2.0% target has been tolerated as a form of monetary payback after a long stretch of unusually low and sometimes negative inflation. But that era has passed and inflation’s pace has normalized. The Fed’s patience for embracing its so-called symmetric inflation goal – permitting price changes to increase above and below its target – may be nearing an end. At some point, and perhaps soon, the policy goal may shift to emphasize that the Fed can enforce a ceiling on the inflation’s upper range.

The key factor is less about inflation’s pace in any given month vs. the trend. On the latter front, it’s clear that the reflation trend has a moderate degree of momentum. If this continues, the Fed will at some point will be compelled to adopt a more aggressive policy to slow if not reverse the upward pricing bias.

How soon might a more hawkish Fed stance emerge? The answer, as always, depends on the incoming data. All the more reason to pay close attention to Thursday’s CPI release. Given recent history, a hotter-than-expected inflation report would speak volumes about what’s in store for monetary policy for the rest of the year and 2019.

Disclosure: None.