U.S. Housing Starts Have Rebounded, But Tariffs Are A Deterrent To New Construction

“According to the National Association of Home Builders, tariffs on lumber from Canada have added nearly $9,000 to the price of an average new single-family home since January 2017. In May, even before the new tariffs took hold, prices for construction materials were up by 5.9% from a year ago – the fastest pace of the recovery.” (TD Economics, U.S. Housing Starts and Permits, June 19, 2018)

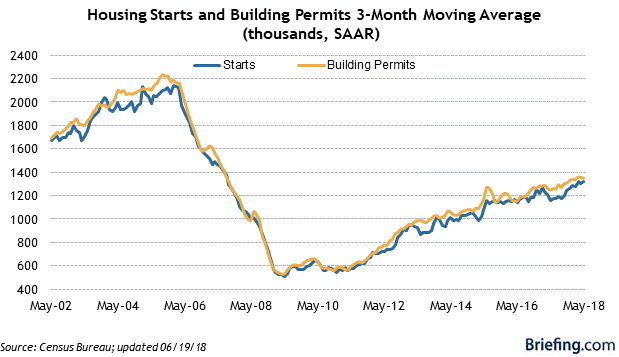

The home builder’s outlook for new construction has suddenly become less rosy. Although U.S. housing starts rebounded strongly in May, the fact that new construction permits declined is discouraging, particularly since construction costs are increasing rapidly.

Housing starts rose 5% in May reaching a seasonally adjusted annual rate of 1.350 million units, and building permits declined 4.6% to 1.301 million units. Both single and multi-unit starts increased in May following declines in the previous month.

The May decline in building permits (4.6%), represented the second consecutive month when fewer permits issued for both single and multi-family housing segments.

Unfortunately, tariffs on steel imports and escalating trade tensions pose potentially severe headwinds to U.S. home construction.

According to the National Association of Home Builders, tariffs on lumber from Canada have added nearly $9,000 to the price of an average new single-family home since January 2017.

Moreover, the threat of a trade war with Canada has taken a toll on the confidence of U.S. homebuilders. The National Association of Home Builders/Wells Fargo builder sentiment index released declined to 68 in June. A reading of 70 in May temporarily snapped a four-month slide in the index.

Builders are increasingly concerned that tariffs placed on Canadian lumber and other imported products are hurting housing affordability.

Disclosure: None.

The real threat is the bubbles caused by Chinese investment buying will pop as they stop buying or sell their investments as trade tensions rise. It is already starting to happen.

It's already starting to happen? Where is your proof of that?

Your comment is interesting. A sudden halt of Chinese investments in real estate around the world would have a negative impact in the US, even a bigger negative for Canada. But, don't under estimate the importance of tarif induced costs on housing construction.

I agree that is another effect. Housing prices are already going soft in Southern California and summer isn't even over.