US Ethanol And DDG Update

Strong plant margins & overseas demand keeps ethanol rolling

Market Analysis

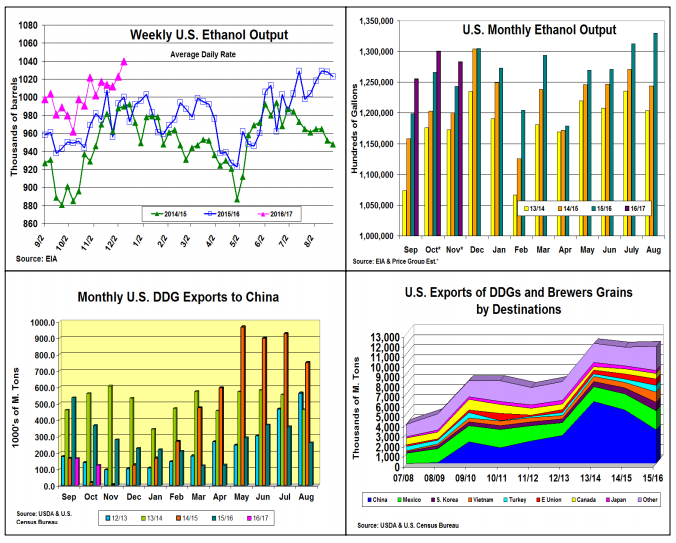

With last week’s US ethanol production at an all-time high of 1.04 million average daily barrels of output (305.8 million gallons) from 200 operating biorefineries across 29 states, corn demand from this hefty domestic industry remains strong. For the 39th consecutive month since September 2013, US ethanol output has produced a higher yearly amount of bio-fuel than the same month the previous year. During last year’s corn crop season, US total output of fuel ethanol was 15.15 billion gallons from September to August. With this year’s first quarter production level likely to be a record 3.838 billion gallons based upon EIA monthly and weekly data, this year’s first quarter industrial ethanol demand for corn is projected at 1.34 billion bu. or 2.7% higher than 2015’s fall quarter. With corn produced ethanol holding a price advantage vs. higher priced sugar ethanol keeping our exports very competitive in the world and our current domestic ethanol processing margins in their top 25% of their 20 year range, this fall’s trend of higher corn demand for ethanol should continue for most 2016/17 crop year.

China’s declared war against US exports of DDGs to their country in the fall of 2015. They jumped their domestic import tariffs sharply and they encouraged a drop in their internal corn price by dropping their support price and expanding China’ domestic corn processing industry with subsidies to encourage higher usage of their domestic crop and reduced their large stocks. This strategy reduced US DDG exports to China by 37% during last year’ crop season. However, last year’s overall US export of DDGs actually rose by 1% as other Asian countries (S. Korea, Vietnam, Japan, Philippines and other) along with Turkey expanded their import of DDGs. Mexico and Canada also remain strong utilizers of DDGs in their feed rations. Overall, the handy size of DDGs in containers and its inexpensive price as protein make it a winner.

What’s Ahead

Given this year’s strong first quarter US ethanol production and our current price advantage in the world biofuels markets vs. sugar based ethanol, this output trend should continue threw the upcoming 2016/17 crop year. This could prompt the USDA to up its yearly outlook for this domestic demand by 25- 30 million bu. in next month’s corn balance sheet revisions.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more