US Equity Sectors Review | 24 Oct 2014

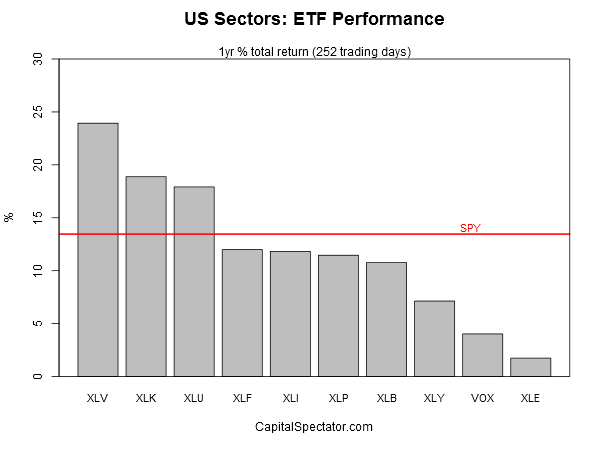

Healthcare is hot, energy is not. That’s the message in the trailing one-year total return data for ETFs that track the major sectors for the US equity market (see list below for tickers and links).

Measured by one-total performance, the Health Care Select Sector SPDR (XLV) is up nearly 24% through yesterday’s close (Oct. 23). That’s nearly twice the gain for the US stock market overall, based on the SPDR S&P 500 (SPY), which is ahead by 13.5% over the past 252 trading days (one year). By contrast, energy—the worst-performing equity sector—has been under pressure lately. Despite the selling, this battered corner is hanging on to a slight gain for the trailing 12-month period: Energy Select Sector SPDR ETF (XLE) is ahead by a slim 1.7% through Oct. 23.

The second-strongest equity sector is the Technology Select SPDR (XLK), which is up nearly 19% over the past year. Meantime, the telecom sector is the second-worst performer: Vanguard Telecom Services (VOX) has gained a relatively light 4.0% on a total-return basis over the past 12 months.

Here’s how the trailing one-year performance histories stack up when we index all the sector ETFs to 100 as of Oct. 24, 2013. Note the rebound across all the sectors in recent trading sessions in the wake of the recent selling wave.

Finally, let’s compare recent momentum for the sector ETFs by looking at current prices relative to trailing 50- and 200-day moving averages, as shown in the next chart below. For example, yesterday’s close for Health Care Select Sector SPDR (XLV) is 7.7% above its 200-day moving average (black square in upper left-hand corner). At the opposite end of the spectrum in the lower right-hand corner is Energy Select Sector SPDR ETF (XLE), which closed yesterday well below its 50- and 200-day moving averages.

Disclosure: None.