US Dollar Strength Persists As Euro, Sterling Beset By Headline Risk

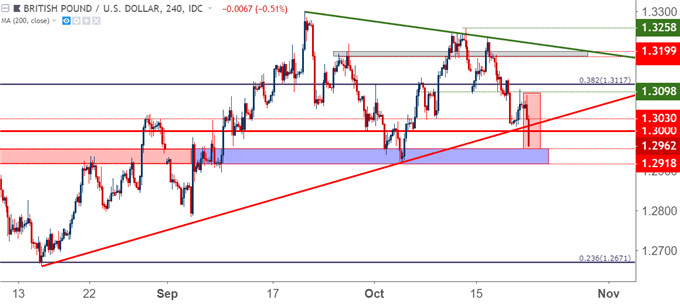

GBP/USD DIVES BELOW 1.3000 AS MESSY WEEK AHEAD FOR PM MAY

Brexit dynamics continues to push volatility in the British Pound, and as we open what appears to be a challenging weak for Prime Minister, Theresa May, GBP/USD is testing below the key psychological level of 1.3000. As was discussed by my colleague Nick Cawley a little earlier this morning, PM May could be headed towards a no-confidence vote, as her Chequers plan continues to divide parliament without providing much promise for a compromised solution.

This sets up British Pound price action to be in a fairly volatile position for this week, as this volatility can work in both directions and this isn’t the first time that markets have seen the threat of a no-confidence vote surround PM Theresa May. Something similar happened a month ago when Ms. May’s plan was initially rejected, creating a 375 pip sell-off in GBP/USD. Prices recovered in the aftermath, but now that fears around Hard Brexit or No-Deal Brexit are being coupled with the potential for volatility at the top ranks for the UK government, sellers have come back with force.

GBP/USD FOUR-HOUR PRICE CHART: BEARISH TEST BELOW 1.3000 SUPPORT

Chart prepared by James Stanley

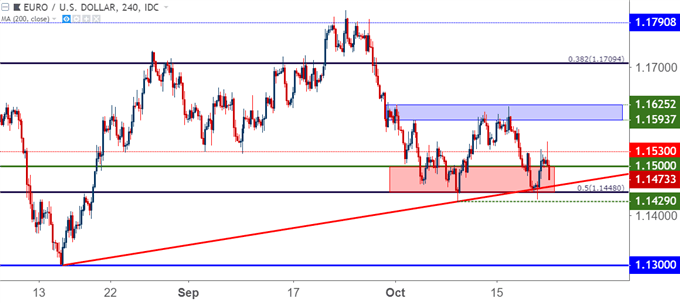

EUR/USD TESTING 1.1500 AS BIG SUPPORT ZONE REMAINS

This was a focus market in the Thursday webinar, as EUR/USD was setting up a potential bear trap. While the backdrop at the time appeared primed for bearish continuation, prices were finding a bit of support around a stubborn zone that had continued to elicit buyers into the market. And sure enough, after a false breakout around Friday’s European open, prices solidified and continued to push higher into last week’s close. But, as another fresh week has opened, bears have gotten back to work, and prices are now re-testing the 1.1500 level on the chart. The big question is whether sellers will find the ammunition to push the pair lower, and that will likely be determined by continued discussions between Brussels and Rome.

EUR/USD FOUR-HOUR PRICE CHART

Chart prepared by James Stanley

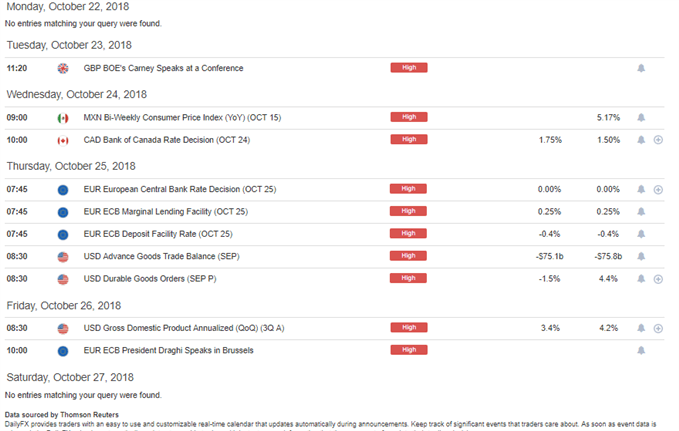

ECB HIGHLIGHTS THIS WEEK’S CALENDAR

Also relevant to the Euro is the highlight of this week’s economic calendar, as the European Central Bank is set for a rate decision and accompanying press conference on Thursday. This will be the first such meeting after the bank began tapering bond purchases earlier in the month, and market participants will be looking for clues as to the ECB’s strategy for managing the various scenarios circling around Italy at the moment.

Another rate decision on the calendar for this week will likely bring more action out of the representative Central Bank, as the Bank of Canada is expected to hike rates by 25 basis points at their Wednesday meeting; and the week closes with US GDP for Q3, set to be released at 8:30 AM on Friday morning.

DAILYFX ECONOMIC CALENDAR: ECB, BOC RATE DECISIONS HIGHLIGHT THIS WEEK’S MACRO CALENDAR

Chart prepared by James Stanley

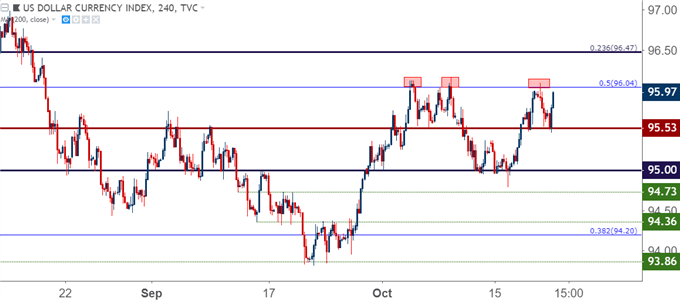

US DOLLAR BOUNCES FROM 95.53

Last week saw a really strong US Dollar as risk themes took over in both the Euro and the British Pound. After testing below key support of 95.00 in the early portion of last week, bulls took over to push right back up to resistance at 96.04. The 96.04 level is the 50% marker of the 2017-2018 bearish trend in the Dollar, and this level gave two different iterations of resistance earlier in October when it helped to cap the Greenback’s advance.

This level helped to cap last week’s bullish run in the Greenback, and that softening from resistance continued into this week’s open, until DXY ran into support at the 95.53 level.

The big question around the Dollar for this week is whether bulls can finally push through Q4/October resistance at 96.04. Given the dynamics of recent, this theme appears to be coupled with continued difficulty in Europe and/or the UK. If markets do pose extension of risk themes around the scenario surrounding the ECB or PM Theresa May, fresh highs Q4 highs in the US Dollar become a more likely possibility.

US DOLLAR FOUR-HOUR PRICE CHART: FOURTH TIME THE CHARM FOR USD AT 96.04?

Chart prepared by James Stanley

US EQUITY FUTURES HOLDING SUPPORT AHEAD OF THIS WEEK’S OPEN

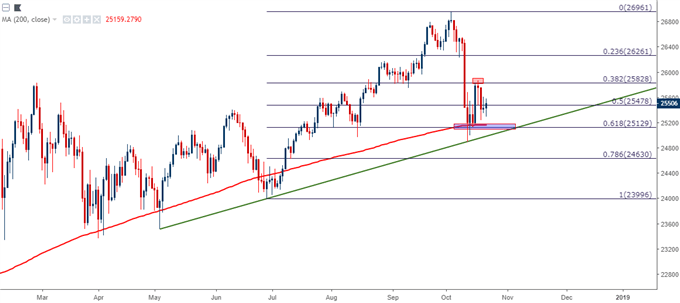

The bigger item across global markets so far in Q4 has been a return of weakness in stocks after what had become a very strong Q3. With equities having retraced rather aggressively in Q1, the second quarter saw a slow return of strength and that strength really ran loudly through Q3. In the first week of Q4, however, a different theme began to emerge and that hit fever pitch two weeks ago as US stocks gave back a large portion of those prior Q3 gains.

Last week was marked by equities attempting to regain footing, and this can be evidenced by the build of higher-low support in the Dow Jones as looked at below:

DOW JONES DAILY PRICE CHART

Chart prepared by James Stanley

This was a central theme in this week’s Technical Forecast for global equities, looking for strength to return in the US and, perhaps even Japan as European stocks and, to a lesser degree, British Stocks held the potential for deeper sell-offs. So far for this week, strength in equities has remained through Asian and European opens, and the Nikkei setup below illustrates this well after last week’s support test at a key trend-line. This trend-line had helped to produce the ascending triangle that was investigated just ahead of the September breakout, and a hold of this higher-low support keeps the door open for bullish approaches.

NIKKEI WEEKLY PRICE CHART: HOLDING TREND-LINE SUPPORT AFTER BREAKOUT RETRACEMENT

Chart prepared by James Stanley

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more