US Dollar Start Week On Softer Footing After Retail Sales

The US Dollar (via the DXY Index) is starting down at back-to-back losses for the first time in nearly two weeks as investors continue to digest recent developments along the trade war front. A lack of escalation between China and the US in recent days has helped buoy risk-appetite, with the Japanese Yen, Gold, and the US Dollar - all safe havens - selling off over the past week-plus.

The greenback's push lower today has been aided by the June US Retail Sales report, which came in right at expectations at +0.5% (m/m). While still in positive territory, it is a material slowdown from recent months and suggests that Q2'18 growth estimates may be a bit too rich at present time.

It's worth noting that the Atlanta Fed will release an update to its Q2'18 GDPNow forecast later on this morning. A small dip in the projected rate of growth (currently +3.9%) should be anticipated, although the impact to the US Dollar will likely be limited as September rate hike expectations are unlikely be significantly moved.

Elsewhere, the pullback by the US Dollar is most apparent with respect to the British Pound and the Euro, neither of which have any significant data on the calendar for today. Realistically, there is only one release this week that will impact either the British Pound or the Euro - Wednesday's June UK CPI report - otherwise, attention will be on speeches made by various policymakers (and again, focus is on the UK, not the Eurozone).

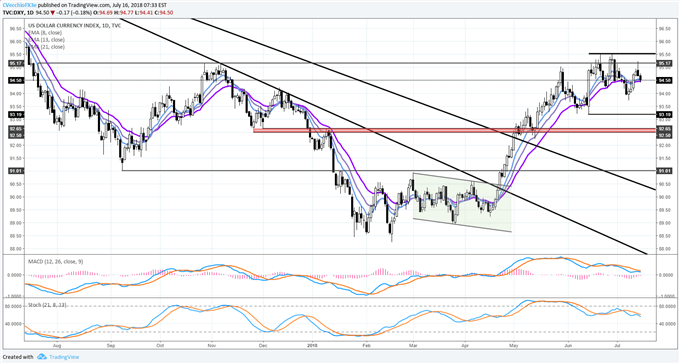

DXY Index Price Chart: Daily Timeframe (July 2017 to July 2018)

The past two days have been challenging for the greenback, and now the US Dollar's (via DXY Index) technical posture has started erode after failing to secure a fully bullish momentum profile. Price has started to undercut the daily 8-EMA in its envelope, and both daily MACD and Slow Stochastics are trending lower after failing to issue 'buy' signals in bullish territory last week.

Given the balance of risks right now - the good being a hawkish Fed looking to raise rates twice more this year, the bad being the US-China trade war - it seems that sideways trading for the US Dollar may result over the next few weeks. Only a move through the June 21 bearish daily key reversal and June 27 to 29 evening doji star candle cluster highs at 95.53 will truly reinvigorate US Dollar bulls; a break below 93.19, the June 14 bullish outside engulfing bar low, would fully jumpstart the downtrend.

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more