US Dollar: Bearish Reversal Pattern Could Bring Weakness

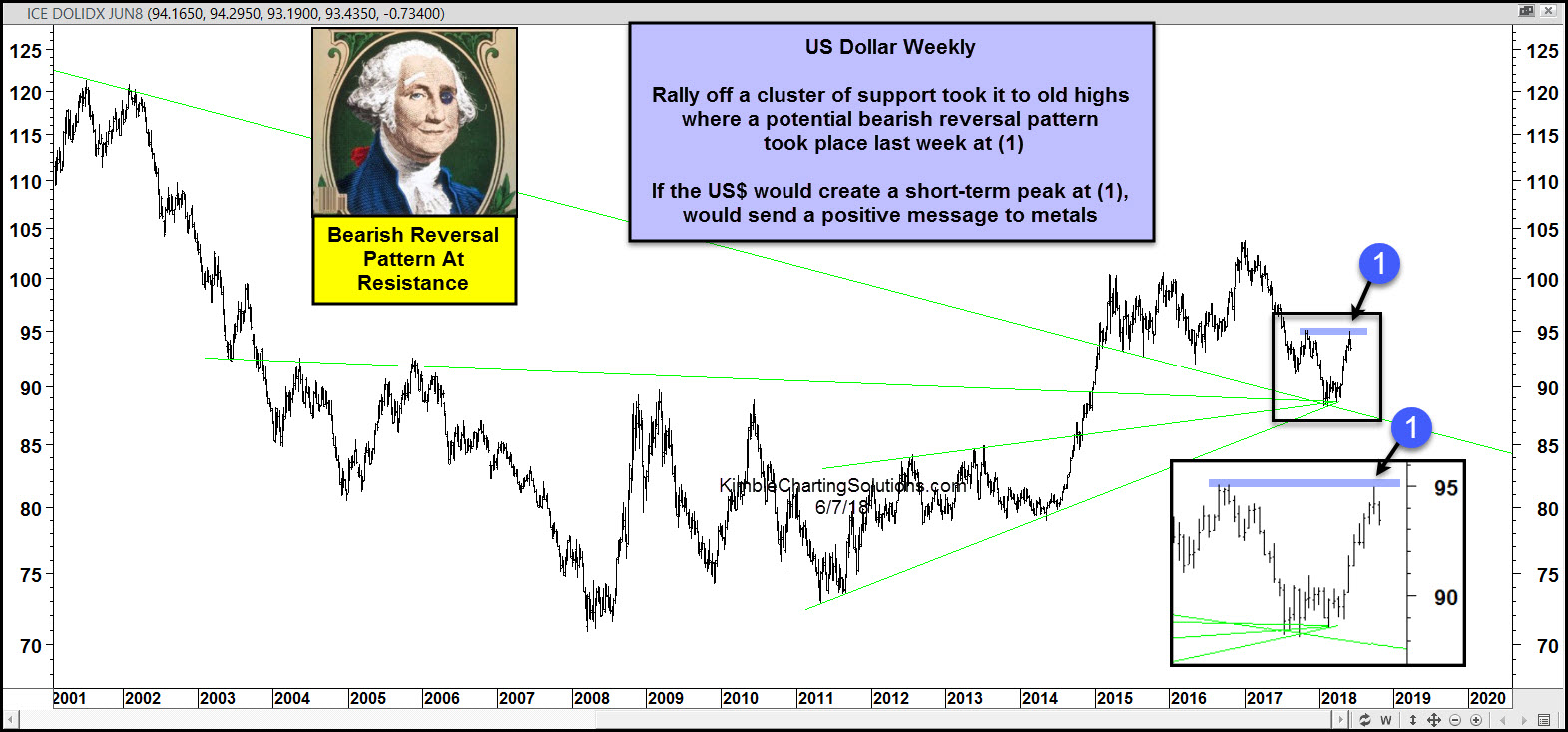

Several weeks back, we highlighted why the US Dollar might be due for a rally… and how this could slow the rise in precious metals prices. The greenback was deeply oversold and testing a confluence of price support.

That support can be seen in today’s updated chart as well (see green lines).

Sure enough, the Dollar put together a multi-week bounce that carried it up to the November 2017 highs before stalling out last week. That rally coincided with a pullback in precious metals prices.

Bearish Reversal Pattern?

The November 2017 highs proved to be stiff resistance for the buck – the Dollar literally stopped on a dime and reversed lower. Will this reversal mark another important “turn”?

If the US Dollar creates a short-term peak at point (1), it would send a positive message to precious metals. Stay tuned!

US Dollar “Weekly” Chart

(Click on image to enlarge)

Sign up for Chris's Kimble Charting Solutions' email alerts--click here.