US And S. American Weather May Stall Many S&D Changes This Month

Market Analysis

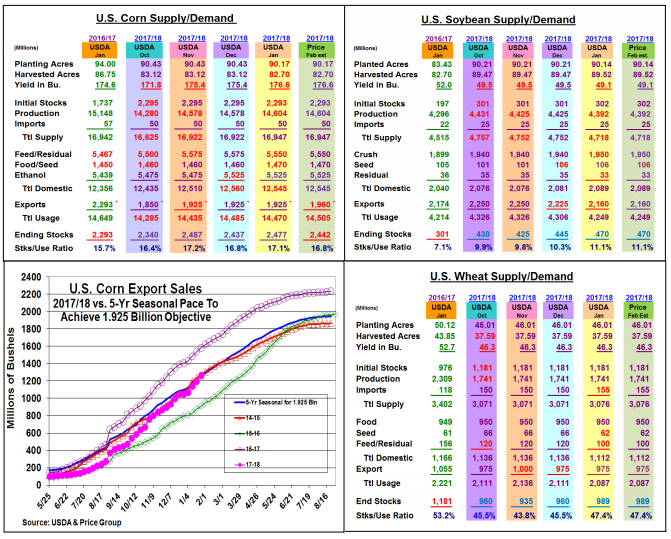

The upcoming World Production and US/World Supply/ Demand revisions will be released on February 8. Traditionally, the USDA doesn't make a lot of changes in their numbers on this report-after finalizing the US output data last month. Many times, the USDA's World Board has taken a wait-and-see approach in its US demand and S. Hemisphere crops updates. However, January’s Argentine weather may prompt some crop changes this month.

Heat and dryness in central Argentina has prompted their local exchanges to lower their corn crop estimates by 1 to 3 mmt vs. the USDA’s January level of 42 mmt. With the USDA’s latest attaché estimate at 40 mmt and recent weather impacting 35-40% of country’s first stage corn plantings, this level seems logical for the USDA’s current Argentine crop estimate. However, a large portion of Argentina’s recently completed 2nd stage corn seedings remains vulnerable to ongoing La Nina weather. Recent heavy rains in Mato Grasso, slowing their soybean harvest, may impact Brazil’s Safrina (2nd crop) corn output. However, no change is likely in Brazil’s crop (95 mmt) until next month when these northern plantings are better known. Given this year’s US export sales moving above its 5-year pace and Argentina’s weather issues, US corn exports could be upped 35 million bu. This may then slice stocks by a similar amount, but no other US corn demand changes are expected.

This year’s weather has also tilted the Argentine exchange bean estimates lower. However, it’s early in the growing season with the USDA not likely to slim much from its 56 mmt crop. Early harvest yields from Mato Grasso have Brazilians upping their crop ideas by 1-2 mmt from January’s 110 mmt level, but the current heavy rains are troublesome. Despite US sales being behind its pace to hit the current outlook, S. America’s weather uncertainties may limit any bean export change this month.

What’s Ahead

Weather in the Southern US Plains and S. America remain the market’s focus during the upcoming month. The upcoming USDA update may not have a lot of data changes, but smaller S. AM crops will likely mean more export demand north of the Equator later this year. However, moving cash needs on March corn ($3.68-$3.73) and March soybean ($9.95-$10.15) seasonal strength seems appropriate.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more